Pepperstone Launches Spot Crypto Exchange

Pepperstone has launched a dedicated spot cryptocurrency exchange, initially for users in Australia. At launch, the platform lists Bitcoin, Ethereum, Solana, USDC, and USDT, all paired against the Australian dollar.

Trading carries a flat fee of 0.1%. CEO Tamas Szabo said the company built the exchange infrastructure in-house to maintain oversight of liquidity, execution, and security. Pepperstone will continue offering crypto CFDs separately.

- Capital Index UK Changes Name to Vantos Markets Following Tough Trading Year

- Financial Commission Approves Monstrade Giving Clients Mediation and €20K Coverage

- Retail Traders to Access a Single Platform as Trade Nation Brings TD365 Under Its Brand

The move follows Szabo’s announcement last November at AusCryptoCon, reflecting a broader trend: industry observers note that other CFD brokers, including IG Group and CMC Markets, are expanding into spot crypto services.

CFD Brokers Accelerate Shift to Crypto

Industry perticipants highlighted the operational challenges of creating a standalone crypto unit. They said, “execution quality, compliance oversight and operational resilience remain central as brokers and crypto exchanges increasingly converge in product scope and client expectations.”

Rising spot volumes and clearer regulations have supported the shift, as brokers weigh the trade-offs between in-house infrastructure and white-label solutions while managing custody, liquidity , and treasury responsibilities.

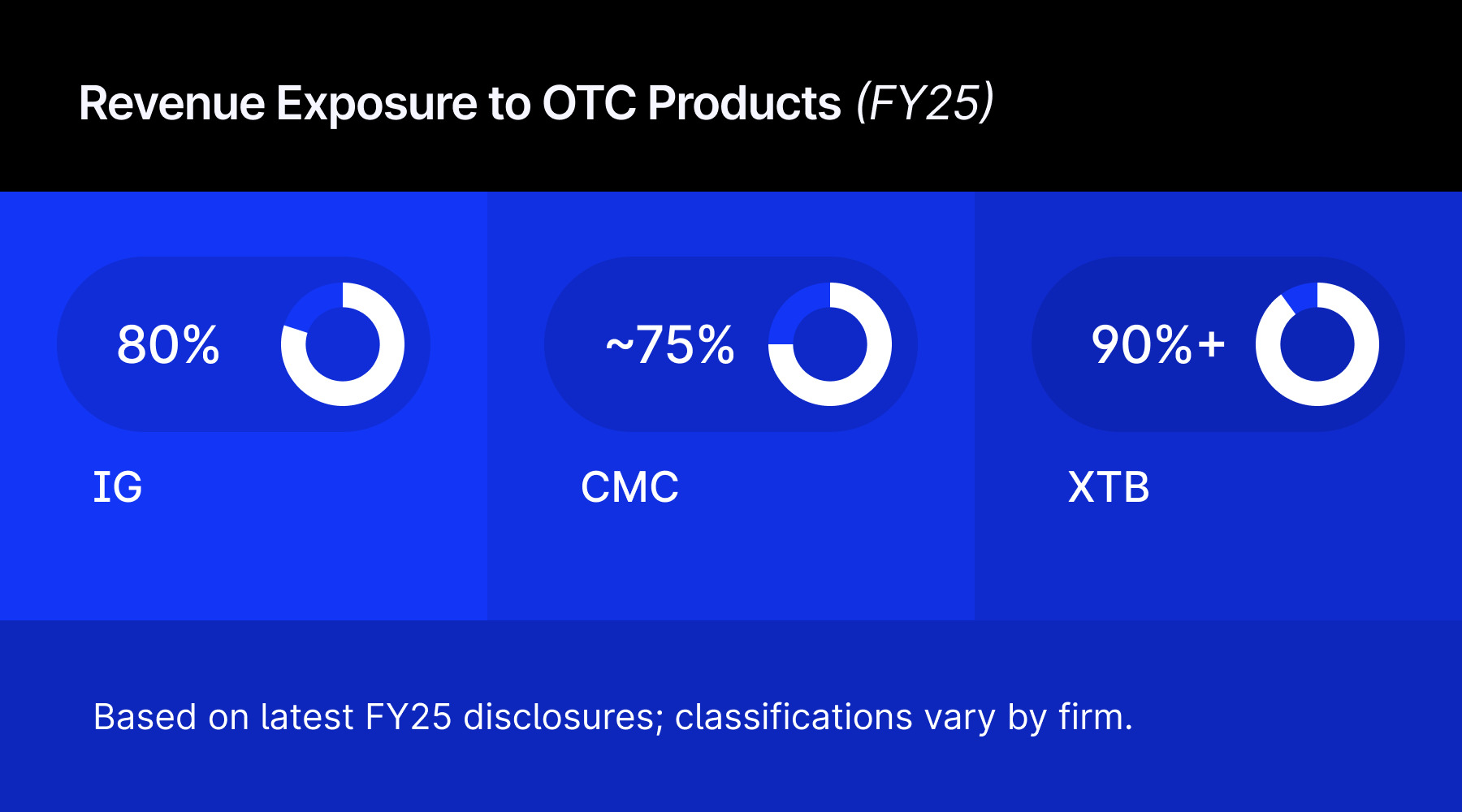

European CFD Brokers Shift to Listed Derivatives

A related trend can be seen in Europe, where CFD brokers are increasingly offering exchange-traded futures and options, according to a survey by Acuiti for CME Group.

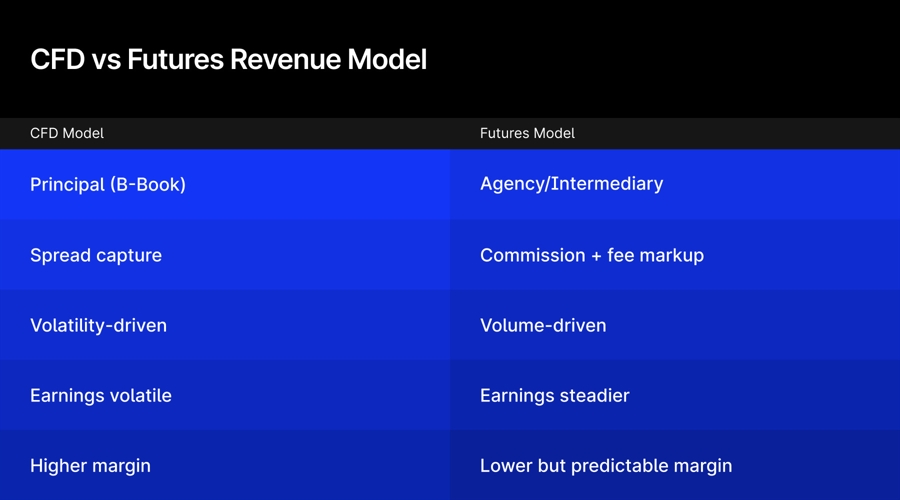

The shift comes amid tighter restrictions on high-leverage OTC products. Transitioning to listed derivatives changes revenue models, with less reliance on internal B-Book profits and greater dependence on commissions, financing, and ancillary services.

Margins per trade may decline, but listed products offer more predictable income and reduced regulatory risk. Data from IG Group indicate growing momentum in listed derivatives despite near-term profitability pressures and higher client education costs.

Plus500 Reports Higher Deposits Despite Fewer Clients

Financial metrics from Plus500 illustrate another dimension of broker performance. The firm reported FY2025 revenue of $792.4 million and EBITDA of $348.1 million. Active clients fell 5% to 242,440, while new customers dropped 11% to 104,902. However, the average deposit per active customer rose 124% to about $26,900.

Average revenue per user increased 8% to $3,268, and acquisition cost declined 13% to $1,267. Earnings per share rose 10% to $3.93. The company launched a $100 million share buyback and declared $87.5 million in dividends. Non-OTC revenue exceeded $100 million, reflecting growth in US futures and other exchange-traded segments.

NAGA Revenue Stable Amid Market Headwinds

Similarly, NAGA Group reported group revenue of EUR 62.4 million in 2025, slightly below the prior year. FX-adjusted revenue rose 3.5% to EUR 65.4 million. EBITDA fell to EUR 3.3 million from EUR 4.7 million FX-adjusted, with the company citing low market volatility and “structural headwinds” across the trading sector.

Client numbers surpassed 2.5 million, with over 180,000 funded accounts. Marketing spend increased 15.6% to support acquisitions, while average revenue per user rose 6.4% and withdrawals fell 21%. NAGA expects 2026 revenue of EUR 68–75 million and EBITDA of EUR 10–15 million, emphasizing an AI-first approach to operations.

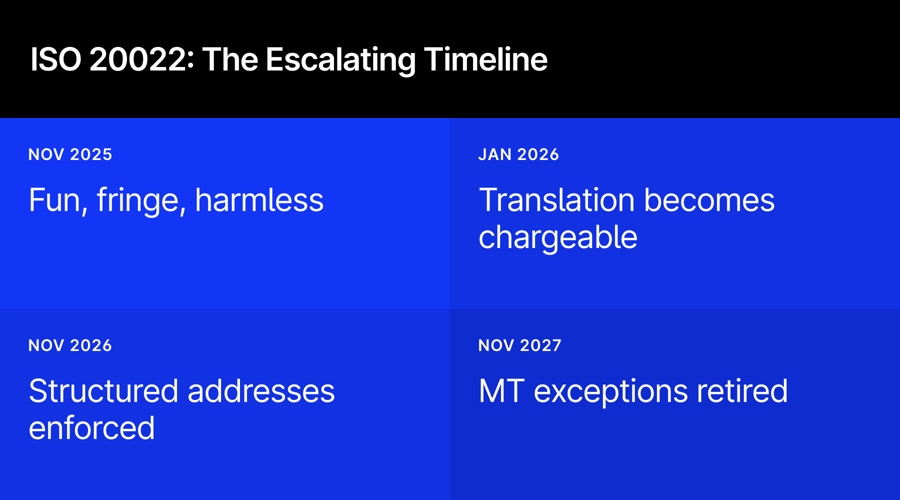

ISO 20022 Migration Highlights Operational Gaps

Operational shifts are not limited to brokers. The ISO 20022 migration, implemented by SWIFT on 22 November 2025, replaced legacy MT messages for cross-border payments. Adoption reached 97% on day one, though many firms rely on translation services rather than native processing, introducing new costs and operational risks.

The standard requires detailed beneficiary information, purpose codes, and remittance data. Brokers face workflow adjustments in client funding, including enhanced validation and back-office tasks. Meanwhile, crypto platforms can leverage ISO 20022 to integrate fiat rails with traditional banking systems.

Bithumb Accidentally Distributes Billions in Bitcoin

Operational risks were also highlighted in South Korea, where exchange Bithumb mistakenly credited customers with over $40 billion worth of Bitcoin. A 2,000 KRW marketing reward was distributed as BTC.

The exchange restricted affected accounts and recovered 99.7% within 24 hours. Bithumb said the incident was “not related to a hack” and pledged to improve verification systems and deploy AI to detect abnormal transactions. The error underscores ongoing concerns about platform integrity and operational controls.

FCA to Regulate UK BNPL Sector

Regulatory oversight continues to expand in adjacent financial sectors. The UK Financial Conduct Authority will regulate buy now, pay later (BNPL) services starting 15 July 2026. The rules aim to ensure credit is only extended to those able to repay.

BNPL firms active as of 15 July 2025 must apply for a temporary permission regime, while those that do not seek authorization must stop regulated BNPL activities. Pre-existing agreements remain exempt. The approach follows consultations and aligns with frameworks in other countries, including Australia.

iFX EXPO Dubai 2026 Opens

In events coverage, iFX EXPO Dubai 2026 exhibition began on 11 February at the Dubai World Trade Centre. The three-day event includes keynote speeches, panel discussions, workshops, and networking.

Participants include retail brokers, fintech firms, liquidity providers, and service companies. Sessions cover trading fundamentals, broker liquidity, AI in trading, stablecoins, digital assets, fintech leadership, risk management, and MENA regulation. Workshops provide practical guidance on trade execution, risk management, and portfolio strategies. The first day concluded with awards and networking events.

MENA Finance Leaders Discuss Markets and Technology

The final day of iFX EXPO highlighted financial discipline, wealth strategies, geopolitics, trading technology, operational risk, digital currencies, tokenization, and crypto trends. Speakers represented KojoForex, Markets.com, CEPR, TradingView, My Forex Funds, Galadari Accelerator, and Versus On Chain.

Key discussions included the UAE’s Digital Dirham, AI and algorithmic trading, bullion markets, and regional regulatory updates. Advanced workshops focused on trade execution, risk management, and portfolio development. Overall, the event emphasized sustainable wealth, resilience, and the integration of technology and digital assets in financial markets.