Octa-linked brand plans new broker launch

A company that has been using a shared brand with Octa is ending that arrangement and plans to roll out a new identity next month. The firm will launch an international trading brand, marking the end of its current brand‑sharing model.

A source close to the company told Finance Magnates that the firm has been developing the new brand for several months and is now fully focused on its launch and rollout.

CFD brokers eye Dubai via budget license

Meanwhile, Dubai’s appeal to CFD brokers shows no sign of slowing, with one or two obtaining licenses almost every week. However, despite two available pathways, most firms are opting for the easier and more affordable route.

- Weekly Recap – MFF Founder Breaks Silence: “We Were Blindsided”; Is the Retail-Institutional Gap Narrowing?

- Weekly Recap: Ripple-LMAX Pact Brings Stablecoins Closer to Mainstream; Will London’s IPOs Rebound?

- Market Wrap: Prop’s Rule Changes Spark Debate; Can Kraken–Deutsche Börse Pact Boost Crypto?

The majority have secured Category 5 licenses from the Capital Markets Authority, formerly known as the Securities & Commodities Authority. This lower-tier license has become increasingly popular as the CMA refines its rulebook and clarifies activity categories.

Dubai’s growing potential as a global hub for the retail trading industry will take center stage at the upcoming iFX Expo, where industry leaders and innovators will converge, alongside the debut of the Trading Festival.

US asset manager takes 5% IG stake

The UK brokerage space is drawing fresh institutional attention. Capital Group acquired a substantial 5% stake in IG Group, following a similar investment in London-listed broker Plus500 in June.

The position gave the asset manager roughly one-twentieth of IG’s voting share capital, based on the broker’s most recent total voting rights update. According to the RNS filing with the LSE on Monday, Capital Group’s total number of voting rights held in IG stood at 17,157,806.

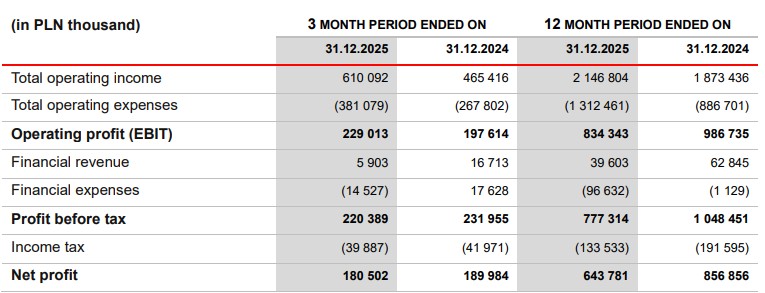

XTB profit falls despite gold rally

Interestingly, the rally in gold prices became a tailwind for some brokers. Polish-listed broker XTB posted a 24% decline in net profit for 2025 to PLN 643.8 million, as surging marketing and operating expenses outweighed record revenues driven by strong client acquisition and and specifically gold rally.

Preliminary results released Thursday show total operating income climbed 15% year-on-year to PLN 2,146.8 million, up from PLN 1,873.4 million in 2024. The expansion was fueled by a 70% jump in active clients to 1,189,422 and a 41.3% increase in CFD trading volume to 8,866,381 lots.

However, XTB’s results show a major shift in how clients are allocating capital, with stocks surpassing contracts for difference as the platform’s largest asset class by nominal value.

OANDA Japan cuts leverage amid silver surge

Elsewhere, volatile metals markets are forcing brokers to act defensively. OANDA Japan implemented sweeping restrictions on silver trading amid surging volatility in the precious metals market.

Effective this week, the broker has reduced maximum leverage on silver positions from 20:1 to 5:1 and slashed position limits by 75%, citing the need to strengthen risk controls. The broker also lowered maximum order sizes from 50,000 units (10 lots) to 25,000 units (5 lots) and cut maximum open positions from 100,000 units to 25,000 units, with these changes taking effect immediately.

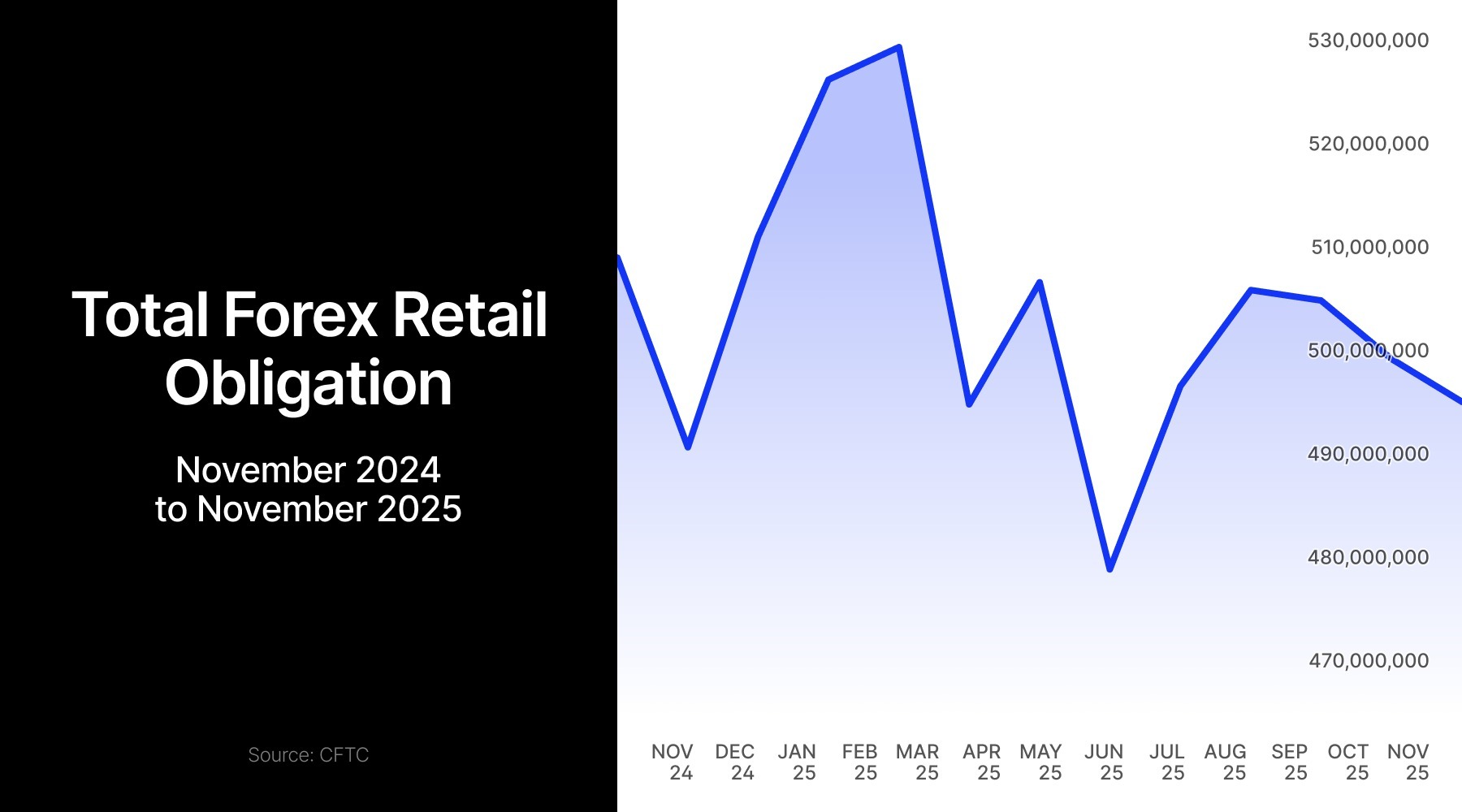

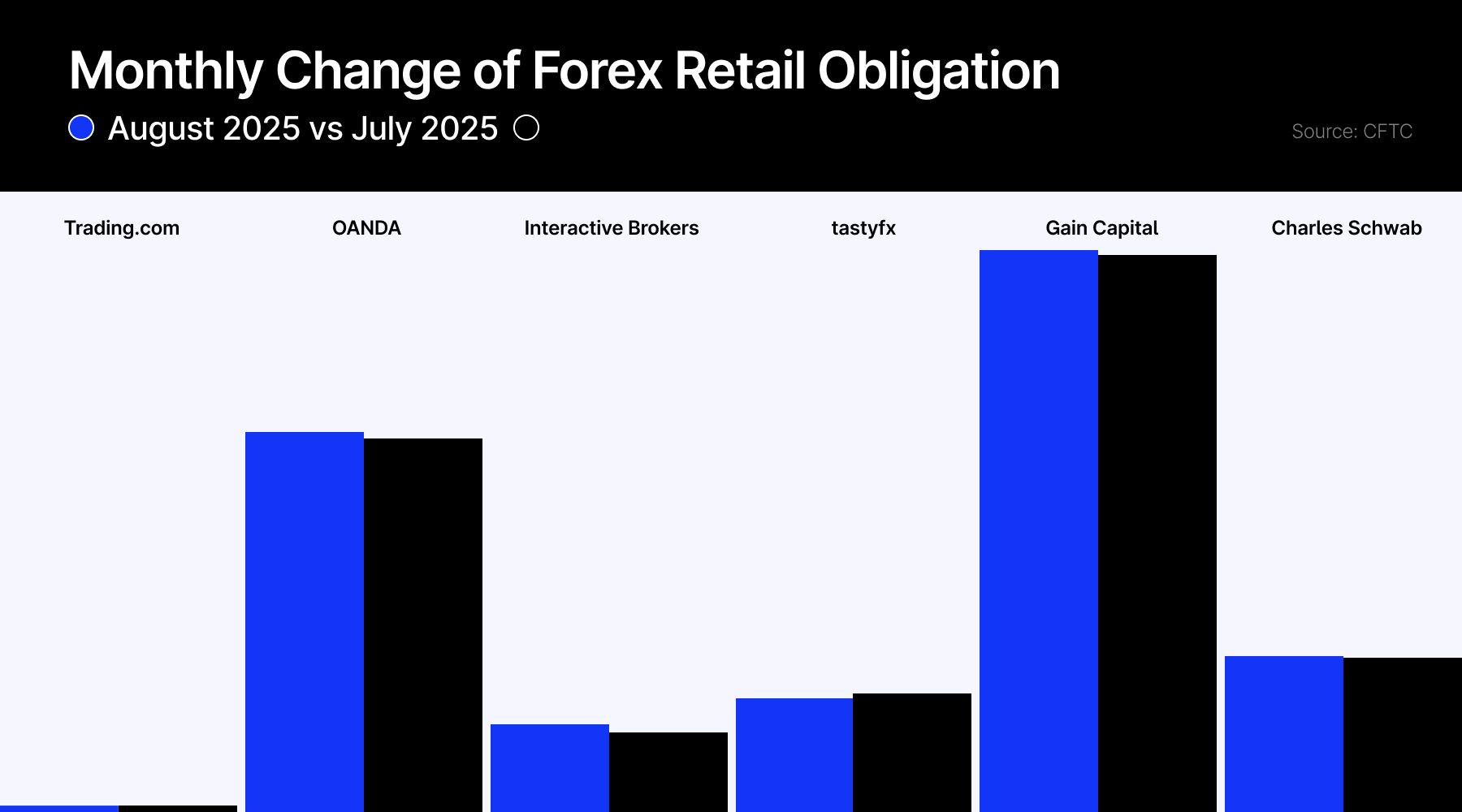

US forex deposits dip in November

Meanwhile, retail participation in US appears to be cooling. Forex deposits at major US platforms fell 0.8% in November 2025 to $495.7 million, down from $499.9 million in October, marking the industry's third straight monthly decline.

The downturn continued a losing streak that began in September and brought total client funds below the $500 million threshold for the first time in several months.

Are retail investors getting savvy?

Retail investors have often been viewed as less sophisticated participants in financial markets, but new data suggests that perception may be outdated.

According to a recent analysis by liquidity provider Winterflood Securities, retail traders demonstrated notable awareness and adaptability during key market events in 2025. The Winterflood report reviewed more than 97% of UK retail trade flow in equities and ETFs, covering nearly 26 million transactions with a total value of £228 billion.

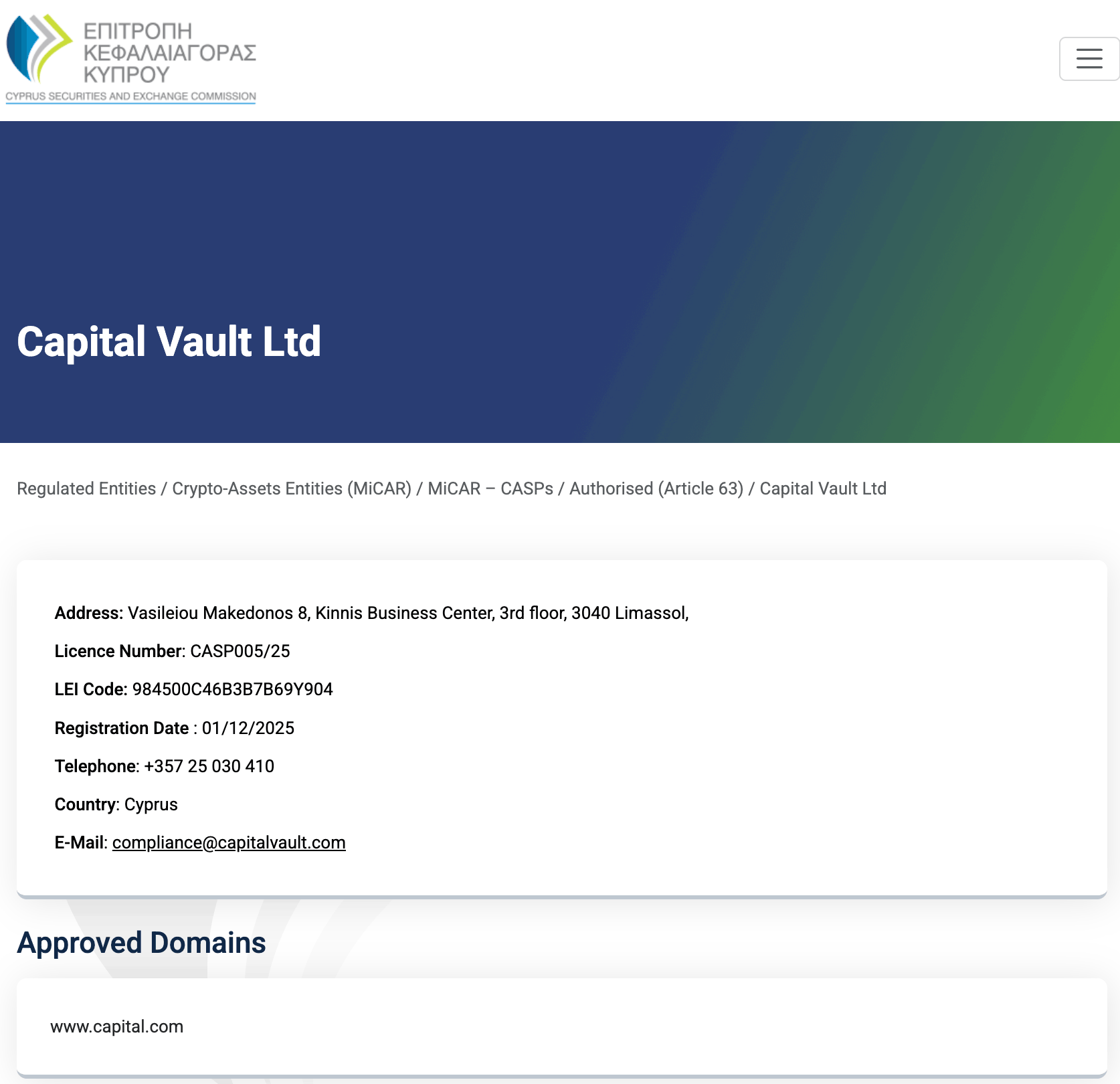

Capital.com secures MiCA license

Meanwhile, brokers are securing MiCA licenses. Capital.com appears to have secured a Markets in Crypto-Assets license from the Cyprus Securities and Exchange Commission, according to details found in the regulator’s public registry.

The brokerage joins eToro, Revolut, and two other firms that have also received the new pan-European crypto licence in Cyprus, signaling growing readiness among major fintech firms to operate under the upcoming EU crypto framework.

Asia drives growth for Singapore family offices

Banks and fund managers in Singapore are seizing the growing appetite among family offices for alternative investments, actively curating and presenting such opportunities to their clients.

The city-state’s family office landscape has evolved into two distinct segments: the pre-2019 “old money” cohort and the wave of “new money” that has arrived since.

Financial services firms generally regard the Monetary Authority of Singapore’s regulatory approach as strict yet fair, noting its practice of regularly engaging with both current and potential market participants.

Prop trading tech provider FPFX acquires BullRush

Finally, in the prop trading space, FPFX Tech, a provider of proprietary trading technology and infrastructure, completed the acquisition of BR Management Group LLC, the parent company of BullRush Entertainment.

BullRush runs a gamified trading platform centered on competitions, skill-based challenges, and active user participation. The acquisition follows FPFX Tech’s expansion moves last year, including a partnership with Acuity Trading.