It hasn’t been that long since TradingView introduced an upgrade of its proprietary Trading Platform , and the data-driven social network has done it again. The company has just informed its users that it has added a new exchange to its stock screener which expands the product suite to cover a total of seventeen exchanges across eleven countries, according to a TradingView update.

The latest batch of changes allows market participants to garner information and screening stocks from Switzerland’s principal exchange, the SIX Swiss Exchange.

[gptAdvertisement]

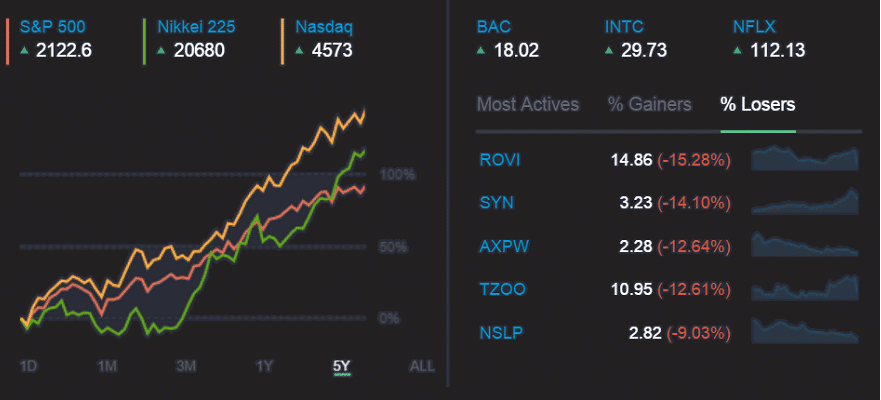

According to the web based charting provider, registered users will have access to the SIX data delayed by 15 minutes but with an option to upgrade their subscription to include real-time data. In addition, users will be able to scan the Swiss Market with its Stock Screener and also have access to hotlists such as top gainers, losers, most active and more.

TradingView’s coverage list now includes the following exchanges:

- AMEX – American Stock Exchange

- NASDAQ – NASDAQ Stock Market

- NYSE – New York Stock Exchange

- OTC – OTC Markets

- CME Group (GLOBEX, CBOT, COMEX, NYMEX) Futuresk

- MOEX – Moscow Exchange

- LSE – London Stock Exchange (UK and International Companies)

- BSE – Bombay Stock Exchange

- NSE – National Stock Exchange of India

- ASX – Australian Securities Exchange

- NZX – New Zealand Exchange

- BME – Bolsa de Madrid

- Bovespa – Sao Paulo Stock Exchange

- BM&F – Brazilian Futures Exchange

- NAG – Nagoya Stock Exchange

- Argentina BCBA – Bolsa de Comercio de Buenos Aires

- IST – Istanbul Stock Exchange

A chart-based offering

TradingView is a data-driven investor community which offers a comprehensive charting tool. The company’s approach differs from other social trading networks because it is chart based with an emphasis on visuals to support investing and provides communal space to view and share trading ideas.

TradingView also has a web-store where users can purchase access to third-party tools. Also recently notable for TradingView is how it has been able to deliver access to a multitude of brokerages to its charting solutions through a new partnership with Tradeable.

TradingView’s charting solution has gained a lot of popularity in recent years due to the smooth HTML5 charts that encompass a number of asset classes. Finance Magnates reported about the company last month when GAIN Capital started providing the tool to its clients. Prior to GAIN, TradingView has already been delivering its services to customers of FXCM and OANDA.