oneZero Financial Systems has officially released to its clients the latest iteration of its Liquidity Hub, a software tool allowing retail brokers and prime of prime brokers to manage bridging, aggregation, orders, margins, back office operations, and their B2B relationships within a single platform.

The initial launch of oneZero’s Hub in 2015 ushered in a new era of retail connectivity, spearheading a change in how leading bridge providers in the industry are received in the over-the-counter (OTC) markets technology marketplace.

[gptAdvertisement]

Following suit, PrimeXM’s XCore technology and other solutions have nipped at the heels of legacy institutional connectivity providers such as Currenex, Integral, and Flex-Trade while simultaneously expanding the suite of capabilities available to retail brokers.

Over the past 18 to 24 months, with competition at an all-time high and broker profit margins dwindling in the face of constricting credit availability, consolidated technology solutions for retail and prime of prime brokers have become a major driver of cost savings.

OneZero’s technology suite has been at the forefront of this revolution, with an increasing presence in the institutional prime brokerage and prime of prime space, as well as with retail brokers.

The latest release of oneZero’s Hub technology addresses trends outlined by Andrew Ralich, CEO of oneZero Financial Systems, at the Finance Magnates Expo in Hong Kong in 2017. During the panel on connectivity solutions, Mr. Ralich highlighted the significant and growing demand for advanced API access and more flexible Institutional functionality in order to automate book management and other activities in the middle and back office.

New Features

In addition to the capabilities that have become synonymous with the oneZero brand (enterprise-quality MT4/MT5 connectivity, flexibility to connect to 60+ liquidity venues, etc.), oneZero has announced that the following additional features are now available to its entire base of clients:

Warehouse Profiling Controls – the Warehouse system has been a staple of oneZero’s offering for years, providing retail and B2B brokers with transparent, best execution practices on internalized trades. In the latest release, oneZero clients can build robust execution profiles for STP, warehouse, or mixed %-controlled flow which can be dynamically assigned on a per-client, per-symbol basis.

Full API Support – using oneZero’s industry-standard REST API, brokers can now automate any aspect of oneZero’s Hub environment in real-time, including client A/B Book switching, spread changes -- even LP failover and provisioning. This allows brokers to control the oneZero system directly from their own customized applications.

Externally-Facing SQL DB – the ARMS platform, which provides full trade lifecycle reporting for brokers, has always been a defining aspect of oneZero’s overall solution. Brokers looking to go above and beyond this web-based application can now access all client trade audit data, as well as ledger, position and quote data, directly from an externally facing SQL Database.

MT5 / Multi-Asset Expansion – following oneZero’s integration to MT5 / Interactive Brokers in 2016, an enormous amount of work has been done to improve and expand their multi-asset support for equities, futures and fixed income products in MT4 and MT5.

B2B Trade Portal – clients accessing liquidity via FIX API from a oneZero Hub-enabled prime of prime broker can now monitor their account status and hedge positions in real-time using oneZero’s trade portal. This is a major step towards brokers using the oneZero platform as a standalone solution to liquidity distribution for B2B and retail clients.

Full Back-Office Framework – brokers offering B2B liquidity via oneZero can now supply their clients with branded daily statements and a client portal with access to trade history, balances and reports. oneZero has also integrated its regulatory reporting interfaces so that EMIR, ASIC and custom reporting now works seamlessly across clients managed in traditional retail platforms (MT4/MT5) and those managed via oneZero’s margin engine.

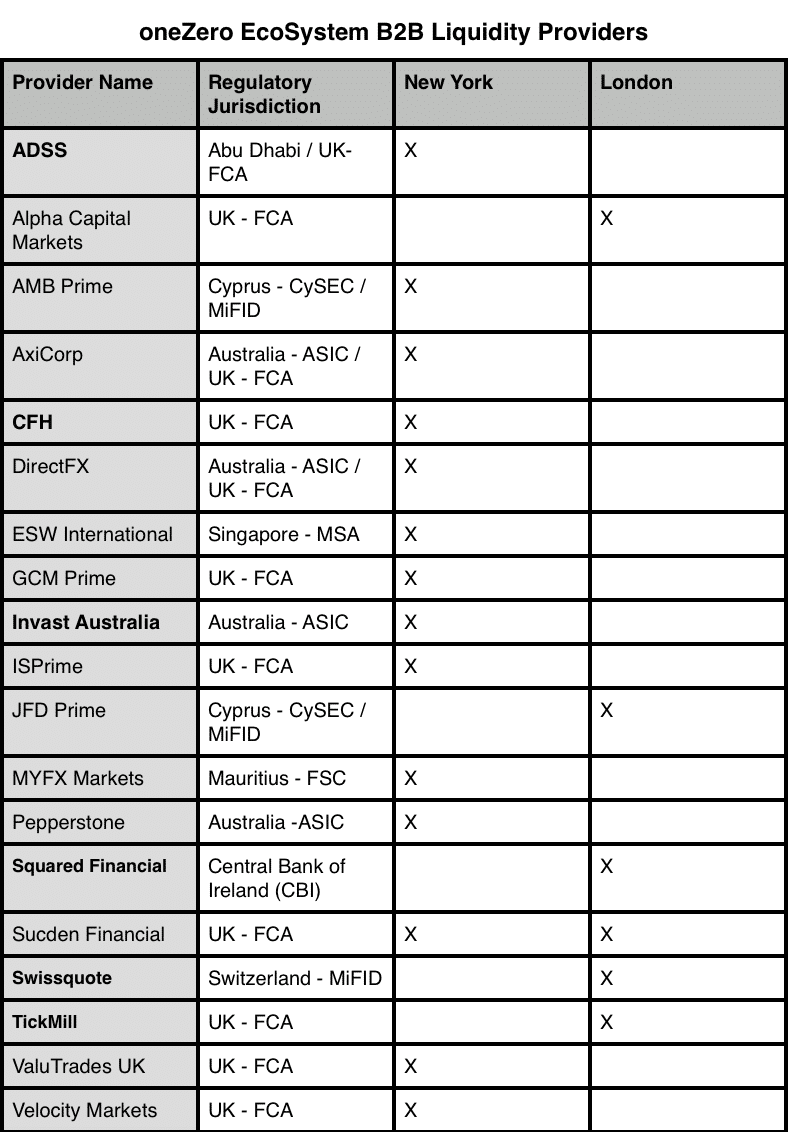

In addition to the functionality released in the latest instance of oneZero’s hub, clients of the company have also benefited from discounted access to 'EcoSystem' Liquidity Providers (previously announced by Finance Magnates in 2016).

oneZero EcoSystem B2B Liquidity Provider List as of 5/1/2017 (new additions in bold), Source: oneZero

This list of providers, many of which use oneZero as their exclusive platform for B2B distribution, has grown considerably since the initial release of oneZero’s Margin Engine. This growth is proof positive that prime of prime providers are increasingly taking on new technology that can provide both cost reductions and direct access to the strong retail client base behind the leading connectivity vendors.

From best-in-class technology advancements to a new office in Limassol, Cyprus, over the past year oneZero has continued their accelerated expansion within the OTC/FX Connectivity marketplace, making waves among brokers and technology providers alike. The oneZero team will be present at this year’s IFX Expo International and available to answer any questions about the latest update to their offering.