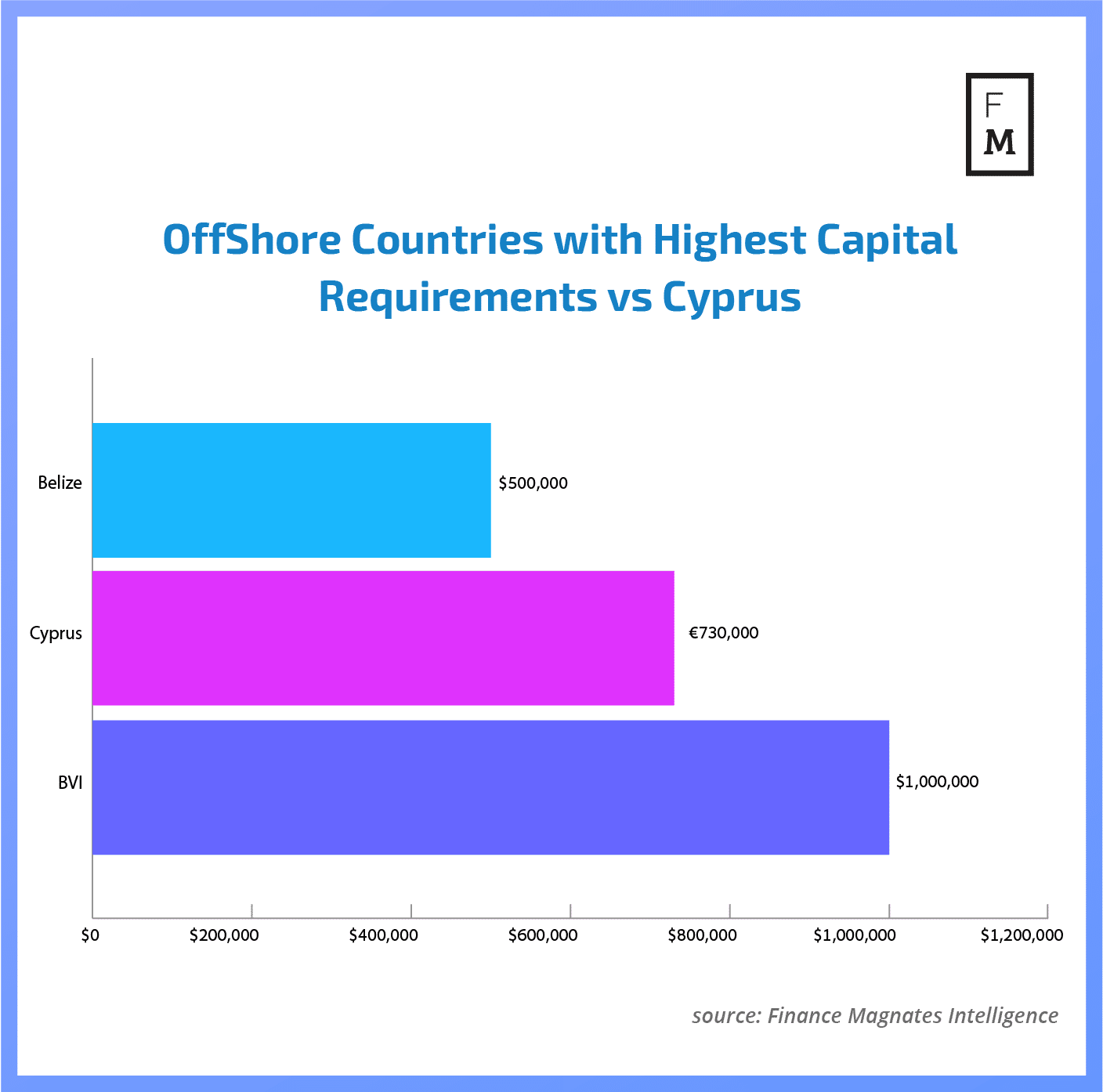

For the last two years, we have been witnessing growing regulatory requirements in Europe and, more recently, in Australia as well. Many brokers have decided to open or use existing regulated offshore branches to offer an alternative to clients. Recent changes in Bahamian regulations show that even in safe havens, the business and regulatory environment is inevitably changing. Is this a new trend that will affect the whole FX/CFD industry?

Recent propositions for Bahamian regulations bring important questions to the table. Firstly, everybody would like to know if other offshore jurisdictions will follow the same approach. Secondly, it is not clear yet what the rationale is behind the decision of the Bahamian regulator.

Some Jurisdictions Lack Benefits for Traders?

At first, it may look as though the Bahamas may want to become a more reputable destination for brokers. Since these countries have started to accept FX/CFD brokers and dealers with open arms, the reputation following them has not been very positive. Offshore destinations at best have always been linked to tax avoidance strategies rather than regulatory requirements. In other words, those companies that did not want to pay taxes (or pay much lower taxes) chose offshore destinations. But, there have always been many negative opinions about doing business in such places, especially with consistent accusations of Money Laundering .

"Some jurisdictions were highly popular in the past, but now they've become what we call in our law firm the 'Plan B' jurisdictions – Barbados, Bermuda, Bahamas, and Belize. These serve as a nice place to register the business, but lack a real benefit to the traders or the brokers," told Finance Magnates Tal Itzhak Ron, Chairman, and CEO, Tal Ron, Drihem & Co., Law Firm

With growing regulatory pressure all over the globe, owning a license in offshore destinations seems to be inevitable today. Although no one can be sure in which regions we will see further restrictions next.

To get the full article and the bigger-picture on the regulatory trends for off-shore destinations, get our latest Quarterly Intelligence Report.