Prop trading operations have remained marketing-centric. Then the question comes: how much does a prop firm need as its starting marketing budget? What is the break-even time? And does it even make sense to go for the big markets, or is it better to tap emerging markets?

The United States is a mature and established market for prop trading, while Latin America is seeing rapid growth. However, when it comes to these two markets, or others, the initial marketing budget break-even point can vary widely.

Although organic channels like YouTube gained the trust of prop traders, Google and Meta ads remain the two most used marketing channels globally. Prop firms also utilise other platforms for marketing, depending on the country; some companies even run campaigns on Reddit and native ad platforms like Taboola/Outbrain.

The US Is Lucrative, but Comes at a Cost

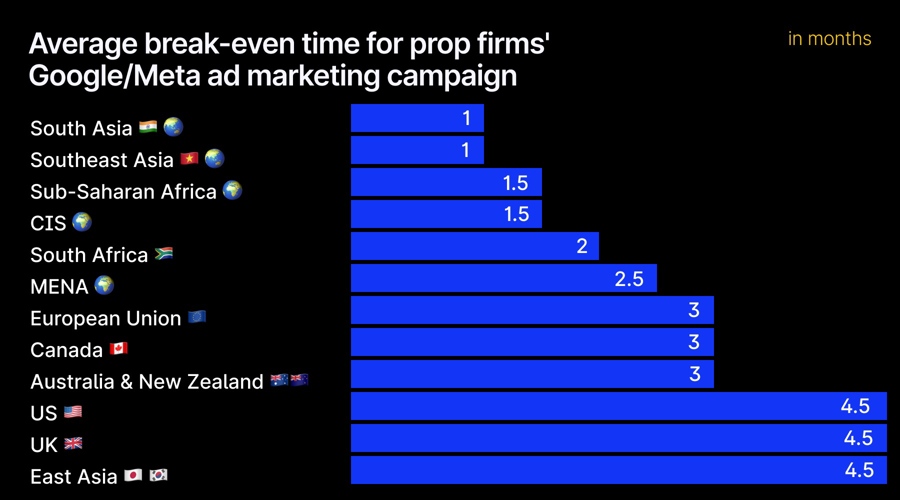

In the US, prop firms have to wait between three and six months to see any return on their initial marketing budget on Google and Meta ads, according to Stanislav Galandzovskyi, a user acquisition and growth consultant to prop firms, who provided these data to FinanceMagnates.com.

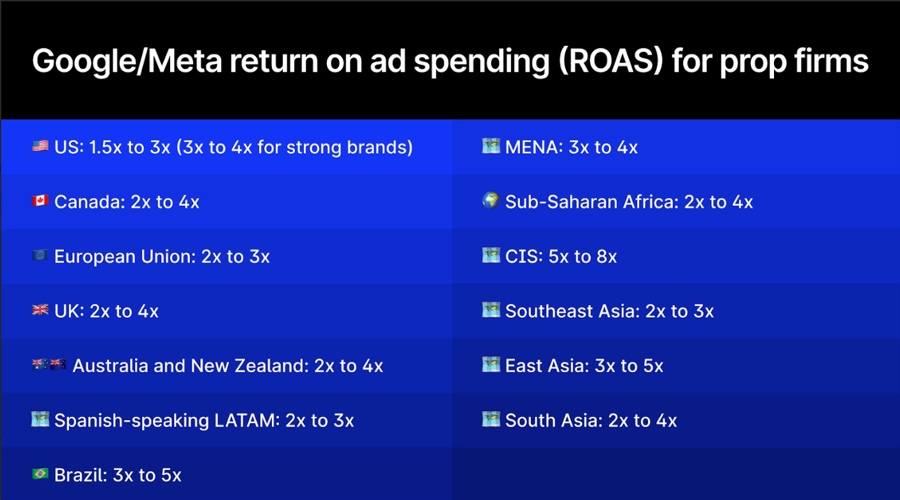

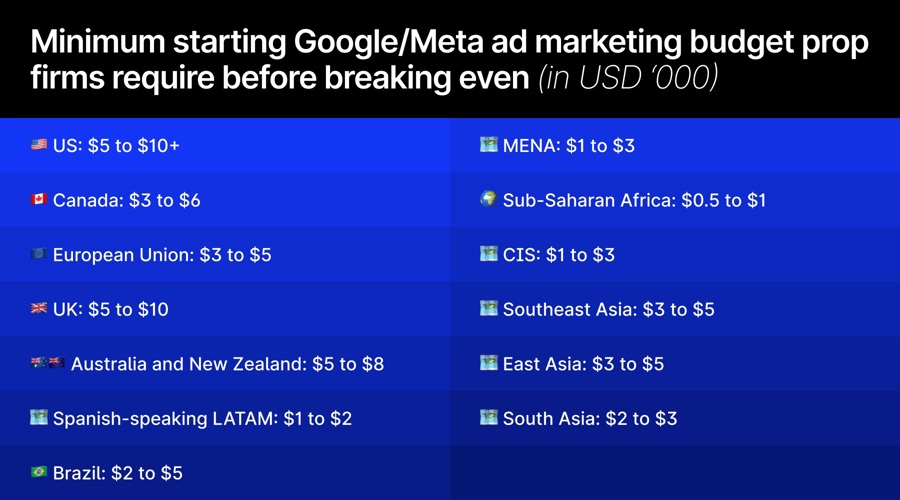

The initial budget requirement is also higher – between $5,000 and more than $10,000 – but prop firms can expect up to a three times return on ad spending (ROAS). For strong brands, the ROAS can be up to four times.

The high budget requirement is associated with the lucrativeness and competitiveness of prop firms in the US. The market is now captured by futures prop firms like Topstep, My Funded Futures and others.

Although the contracts for differences (CFDs) prop firms offering services there received a massive hit in early 2024 due to the unannounced MetaQuotes crackdown, most of them have reentered the market. FTMO, The5ers and FundedNext are only a few names to reenter the US last year.

- Topstep Faces Prop Traders' Wrath due to Repeated Outages, CEO Sets January Deadline for a Fix

- Prop Firm FundingTicks Faces Massive Backlash after “Retroactive Rule Change”

- Retail Trading & Prop Firms in 2025: Five Defining Trends - And One Prediction for 2026

In neighbouring Canada, prop firms can become profitable within 2–4 months of initiating their ad campaigns. With a minimum ad budget requirement between $3,000 and $6,000, the peak ROAS can touch 4x.

Entering Latam Is Cheaper, but Is It Worth?

Spanish-speaking Latin American markets, on the other hand, remain among the most efficient globally. An ROAS can be achieved in 1 or 2 months. The ad budget requirement there is also lower: $1,000 to $2,000 per country is enough to generate optimisation-ready data and produce a positive ROAS.

At peak levels, customer acquisition cost (CAC) can range between $30 and $40.

Firms also utilise local trading YouTube channels, as well as WhatsApp and Telegram communities, to promote their products.

For Brazil, a Portuguese-speaking country, a ROAS can also be achieved in 1–2 months; however, the initial budget requirement is slightly higher, ranging from $2,000 to $5,000. In the long term, working ROAS can reach up to five times, and at peak levels, it may even reach ten times.

An earlier study also shows that South America is one of the leading regions in terms of active prop traders. Colombia leads all countries by participation, with almost 15 per cent of prop firms’ clients, followed by the United States and Brazil.

Read more: ATFX Converted Over 10% Prop Traders to Brokerage in South America

When it comes to the core European countries, including Germany, France, Spain and Italy, a positive ROAS occurs between two and four months, and slightly faster in lower-competition markets. Companies targeting the western parts of the continent can expect a working ROAS of between two and three times, while campaigns in the southern and eastern parts can perform better. In saturated markets, peak performance can reach about four times.

Meanwhile, in the UK, a noticeable positive ROAS may appear only after three to six months, reflecting a highly competitive and regulation-constrained environment. The peak ROAS there can go above four times. Two other notable English-speaking markets are Australia and New Zealand, where prop companies can break even in two to four months.

Is India Attractive from a Marketing Budget Perspective?

India is another major market for prop firms. It is the largest market for several major players, including The5ers. Although FTMO did not accept India-based clients for a period, it entered the market last year. FinanceMagnates.com also previously reported that prop firms entered the Indian market without using the terms “forex” and “contracts for differences.”

Beyond India, other South Asian markets include Pakistan and Bangladesh. Prop campaigns can break even in those countries, often immediately or within the first month. Working ROAS also remains stable between two and four times, while the peak potential can reach twelve times.

Another challenging yet profitable market for prop firms is East and Southeast Asia. These markets include emerging economies like Indonesia, Vietnam and the Philippines, along with developed ones like Japan, South Korea and Singapore.

The emerging markets there can turn a positive ROAS within a month, while it can take three to six months for optimisation in the developed ones. Southeast Asia’s working ROAS can go up to three times, while for Japan and South Korea, it can be as much as five times.

Many CFD brokers also target the Middle East and North Africa, as do prop firms. In countries like Morocco and Egypt, where the marketing budget requirement is lower, the break-even point occurs within one to three months; however, it takes closer to three months in the GCC.

In sub-Saharan markets such as Nigeria, Kenya, Ghana and South Africa, even a regional budget of $500 to $1,000 can generate a strong volume of leads. Break-even is usually reached within one to two months, although it takes slightly longer in South Africa.