In recent weeks, the popularity of a trading app called SwipeStox has been on the rise across app stores - both on iOS and Android. The latest version of the social trading app which is aiming to redefine how traders look at the process of selecting their next position is here and it seems to have gained brokerage backing.

With the rise of the App Store and Google Play, the new applications that have been coming up with innovative features has been unending. When it comes to social trading platforms however, the trade has been fairly straightforward - a list of traders to copy, decent prices, follow and go…

SwipeStox and the company behind it, Naga Group, have been aiming to change the status quo, backed by a key foreign exchange industry figure, the founder of Varengold Bank Yasin Qureshi. After years in the tightly regulated banking industry, he decided to apply his knowhow to delivering new products to the financial industry by establishing a startup focused on blending technology with finance.

With strict banking regulations being somewhat prohibitive for the heavyweights of the financial industry to be big innovators, the Naga Group is aiming to change the way clients are interacting with financial products.

In the case of SwipeStox, the aim is to make trading more accessible and user friendly for clients.

Swipe Left, Swipe Right

The swiping gesture when using a smartphone has become somewhat of an intuitive move for most users of mobile technology these days. This is why a dating app, called Tinder has become somewhat of a quick phenomenon amongst youngsters.

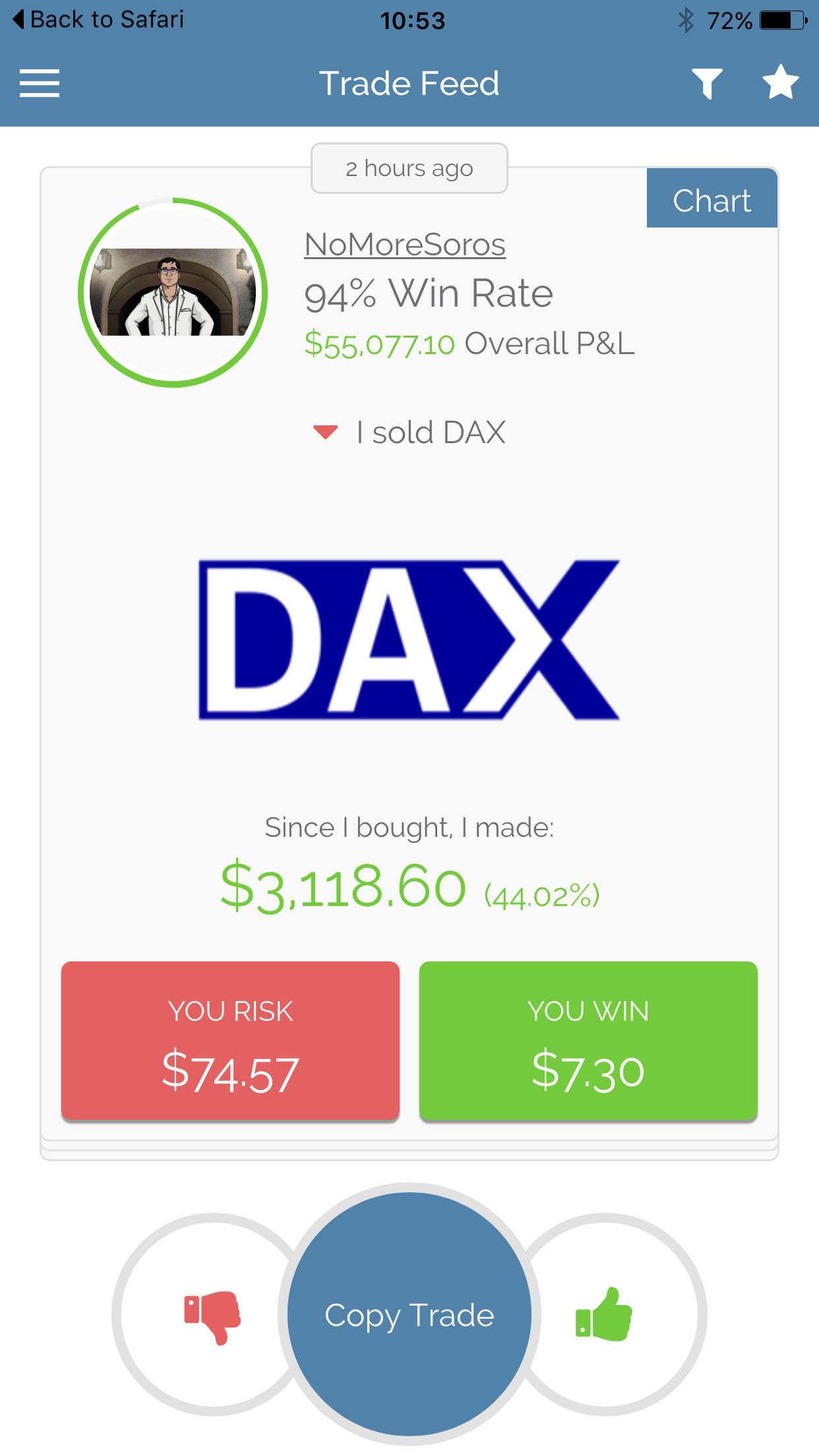

While swiping left and right on Tinder when seeing a photo of a prospective match can get you a date (provided that you do possess adequate courting skills), SwipeStox can get a trader into a… well, a trade. The big difference between the dating and trading app is that you are much more likely to find a good match on SwipeStox, because of the performance rating of the trader whose trade you are looking at.

While many traders will have a high percentage of winning trades, it is worth exploring how long have they been trading and whether or not they somehow ended up having a lucky streak.

Following the right type of traders is crucial

Once a user registers, a flow of trades storms in and swiping left or right would determine whether the user likes the idea of having a similar trade or not. By clicking on the center button named “copy trade” the user opens a position with the options to customize the size of the trade.

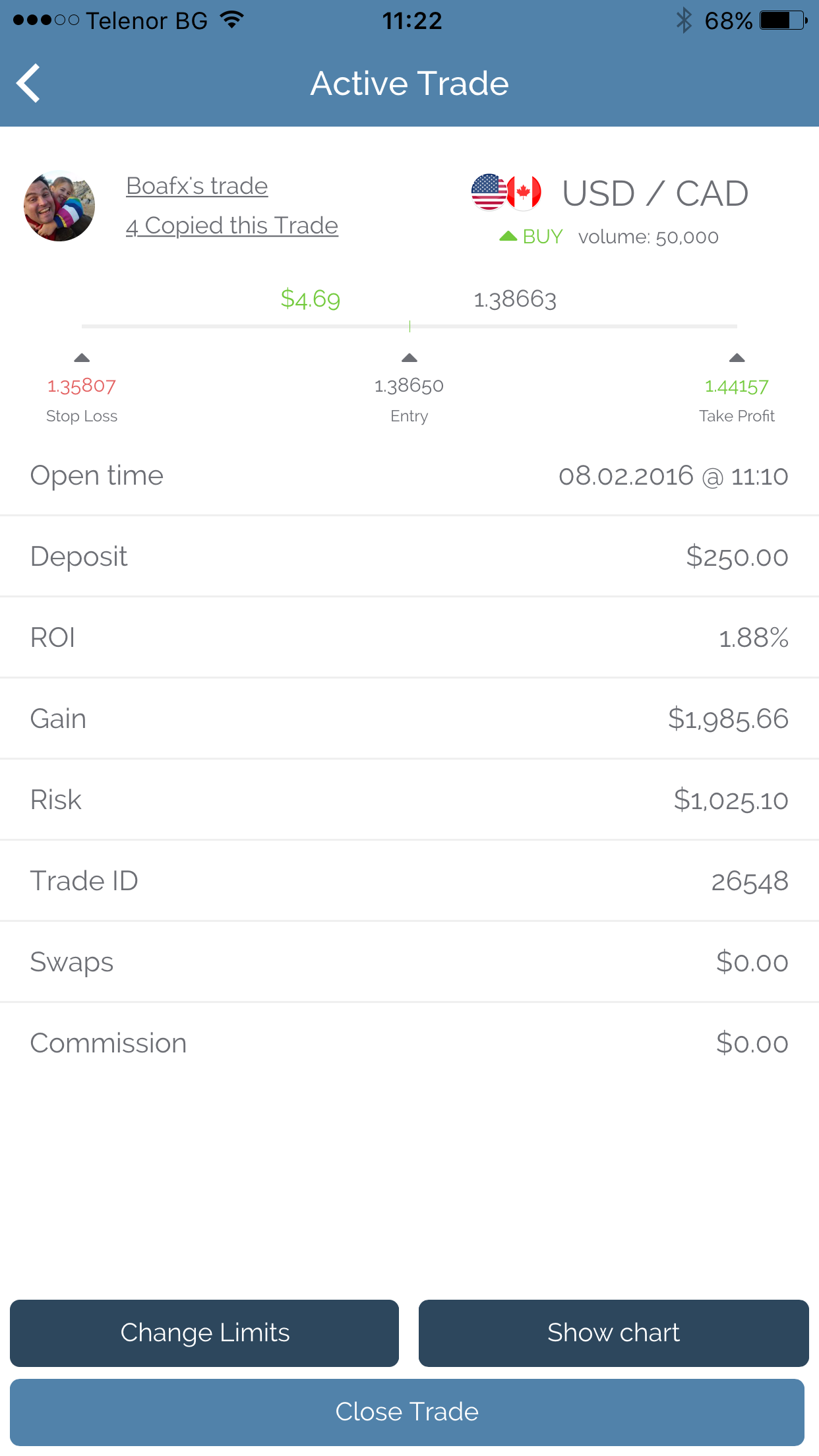

Crucially a risk and reward ratio are displayed before one can enter the trade. This functionality of the app can be particularly useful for novice traders, that are yet to get acquainted with the concept. For advanced traders, the stop and limit orders, hence the above mentioned risk reward ratio can be changed after the trade is active.

An active trade on display

A New Breed of Social Trading Platform

SwipeStox is undoubtedly a much more entertaining way to look at social trading today. With the myriad of trades that are flowing in, users can also access a leaderboard that displays the best traders for all time, for the month, week or even on a daily basis.

But the experience doesn’t end here. Every trader can open positions at his/her discretion and get copied. Moreover, cash rewards when a trade is copied are flowing into the account balance of the user. While currently the platform is available only in demo mode with no real money involved, some brokers like One Financial Markets have committed to the product.

With the ever-growing popularity of marketing sentiment based trading indicators, SwipeStox is also here with a real time look at the traders' positioning.

Market sentiment amongst the trading community can be a factor when taking an investment decision

Entertaining financial apps are the future for generating revenues at brokerages, especially when it comes to social trading. While not a large number of traders are able to get into the market and start trading, the universe of social trading as a niche product may yet prove that not all actual traders need to know about the markets in order to profit from Forex and CFDs trading.

With a range of currency pairs and CFD contracts on indices, commodities and stocks, SwipeStox may be a solid pillar in the social trading space. With its focus on a mobile experience it is already one step ahead of the competition in terms of user engagement, which could lead to higher trading volumes for brokerages. That said, the application is yet to prove itself as a place where traders can find reliable signals.

In the end it is all about the community of traders- should the solid clients of a brokerage get into the space and be rewarded adequately, the product may well take off and reinvigorate interest in social trading.

Social Trading Gateway

Looking at the industry's perspective on this new application, SwipeStox is more than relevant. The app is much more than another competing technological product to look at. For brokers which are not offering social trading, it can be a gateway to provide the service to its clients. Naga Group is offering access to the trading platform to every broker that is willing to make use of it.

With a number of social trading solutions on the market, the addition of a mobile player to the fray is providing new opportunities for traders and brokers alike. The main advantage of SwipeStox is its intuitive and easy to use simple trading interface, where traders can see easily how much are they risking and what are the prospective gains for per trade.

With a number of solutions on the market, SwipeStox may boost a cycle of innovation in the social trading space, which can be a boost to trading volumes for a number of brokers which have not dedicate efforts to developing products in this area.