We’ve been talking about the Tradable trading platform since the first day I arrived at Forex Magnates, and now it’s just about ready to finally go live. We had a chance to demo the platform, courtesy of TradeNext which we mentioned last month is among the first company’s launching the platform.

First off, I have to say that I was getting skeptical with the platform. Early reports were that it would launch last summer. The company did finally go public with it last November in anticipation of the Forex Magnates London Summit where Founder Jannick Malling presented the platform at the new product pitch. Therefore, with delays occurring, started to feel like it would never get released. That being said, after subsequently playing around with several other products that I felt were released too early and were filled with bugs, maybe the late launch isn’t such a big deal. But, skeptism aside, this is very cool product.

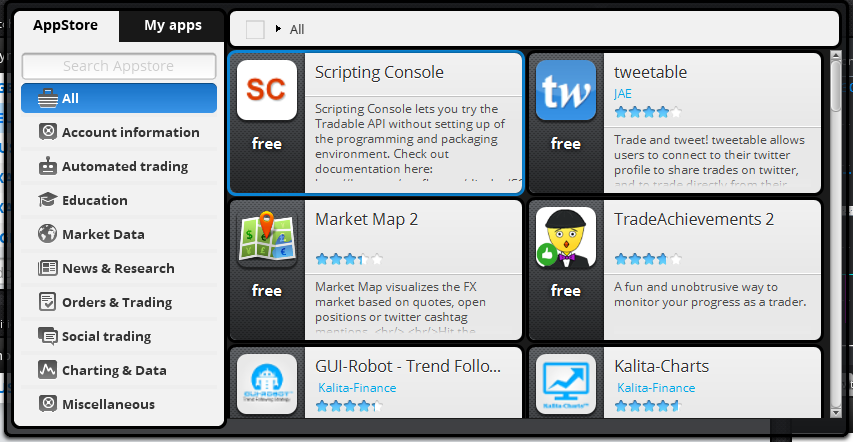

At this point, Tradable is available as a downloadable platform. As written about in the past, Tradable is an app based platform. Therefore, to use the product, you add the apps you want to run. This replaces opening windows. It’s more or less the same thing, but each app runs as a separate product. Preinstalled apps include the order entry, charts, watch list, P&L, and account apps. To add additional apps you open the app store. For a newly released platform, Tradable followed on its promise and did a good job of acquiring third party developers to create apps for the product, as the app store is filled with available offerings. As you can see below, apps are available for a bunch of different categories, and there are plenty of free products as well, with the remaining ones being for sale.

Tradabe App Store

Every app can be demoed for a period of time between 5-90 days. After purchasing an app, they appear in the ‘My Apps’ section where they can be added to the platform. As a downloadable platform, one of the advantages is that each app can run on a separate window and therefore can be separated from the platform.

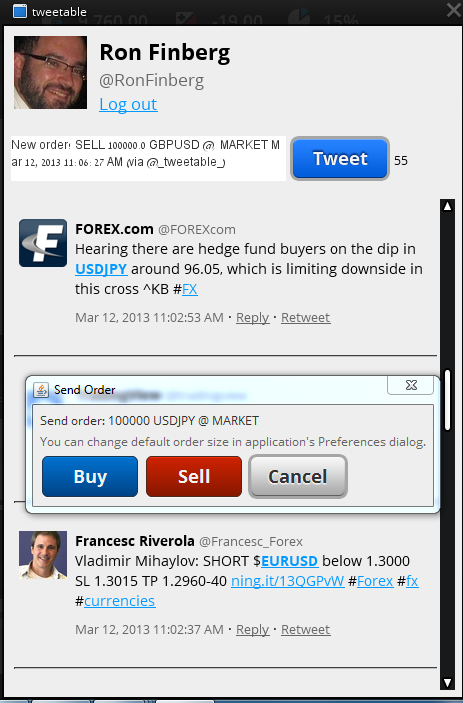

Among the apps that I tried out, my favorite was the Twitter app. It embedded my Twitter stream on the platform and allowed me to click on any symbol that was mentioned and automatically open an order window. If a mobile Tradable version does get launched, this app would be a natural addition to be included.

Tweetable App (app worked better than the USDJPY call)

In terms of performance, trades were opened and closed quickly. I was operating a demo, so over time we’ll have to see how the platform performs in live trading conditions. Where I experienced delays was in the app store as products would take a few seconds to load which led to lots of over clicking in the beginning. Also, as an app based system, one of the lacking features is inter-connectivity Therefore, I couldn’t just click or drag a symbol from the instrument and see a new chart being populated. For traders used to connecting several charts of different time frames and having them sync when changing instruments, manually entering symbols to multiple apps is annoying. (I have to assume this will become a requested feature and an app will be created to link different programs)

Another area that I found lacking was in terms of app documentation. Several apps I tried provided user information within the product. Others I had to find info about them from the app store, while others had scant details. For example, we wrote about Knowsis in 2012 and their social sentiment product. The company was one of initial group of firms that developed an app for Tradable. However, I found little information on what I should be looking for with their sentiment numbers and cases of when to trade based on them. (Update: to be clear, Knowsis does provide a long description in both its website and in the App store page-my issue was that within the apps themselves, they aren't always very intuitive and there is rarely a ? icon that links back to relative info)

Other limitations of the product include the lack of mobile or web-based connectivity. As a downloadable product, users are limited to only trading from them their computers. Also, when operating algos, the automating trading seizes to work when the platform is closed.

Developers

Speaking to several developers who created apps for Tradable, they had positive opinions about the process. As the third party eco-system is the heart of the platform, the Tradable’s success very much rides on them launching new products for the system. On the other hand, developers will only be coding for the platform if the financial incentives are there. Initial apps have been created by firms that are viewing Tradable as one of several destinations to launch their products. As many of these firms had products in development prior to working with Tradable, the downside risk of creating a compatible app is limited.

Conclusion

There is a lot of potential here. Tradable is going out of its way to provide power to the developers. The ease of creating products for the platform as opposed to needing to perform tweaks to be MT4 compatible is a draw for these firms.

The question now depends on whether the product takes off to trigger further involvement from developers. My own opinion is that it will see strong demand from brokers. The product fills a need in the market where it looks a little gamey, but has higher end performance potential. As such, just like we have seen a proliferation of new binary options brokers launching with turn-key platforms, a similar situation could occur with Tradable.

However, there are some worries that need to be addressed for the platform to become a success. First, when operating an app, if a user has a problem, the destination for answers is the app developer. As such, will developers who are tech focused be able to handle dealing with the plethora of support questions? If not, brokers that will want to promote Tradable heavily will need to become experts with not just the platform but also the apps to provide their clients support.

Secondly, broker control is a big question. Tradable was launched with funding from CFH Group. The company operates a large white label business. When speaking to Tradable CEO Jannick Malling in the past, he explained that the platform will be offered as a white label solution or with a broker’s own Liquidity . As such, brokers that control their platform’s settings will want to see similar abilities with Tradable. Third, the platform needs a mobile or web based version. Theoretically, a developer partner could create an app for this. Last, apps need to keep being launched. This matter will most likely get a boost from the brokers. To promote the platform, it would be expected that brokers will offer customers free credit to purchase apps as well as additional free apps for trading specific volume thresholds. Such incentives would go to the bottom lines of the developers and lead to increased innovation.

Previous New Product Spotlights:

Building a new startup, or looking to try out new products? Check out our New Products & Startup Portal, don't forget to sign up for the Beta Testing Program