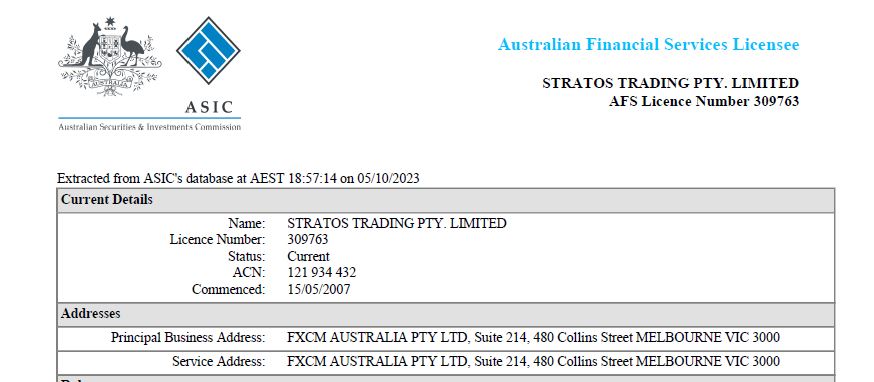

FXCM Australia Renamed to Stratos Trading

A few weeks after the UK's and Cypriot branches of FXCM rebranded to Stratos Markets Limited and Stratos Europe Ltd., the Australian subsidiary also changed its official name. According to the registry of companies authorized by ASIC, the company changed its name from FXCM Australia Pty. Ltd. to Stratos Trading Pty. Ltd.

All indications suggest that the change in the company serving as the broker's operator does not affect the rebranding of FXCM. At least for now. FXCM originated from the now-defunct Global Brokerage Inc., which declared bankruptcy in 2017. The company's roots date to 1999 in New York, a global financial hub.

ACY Securities Appoints Alchaar as Chief Economist

ACY Securities, a global multi-asset CFD broker, has welcomed Dr Nedal Alchaar as the Chief Economist for their MENA team. Dr Alchaar is a renowned figure in finance, economics, and academia, with a rich background that includes serving as the Minister of Economy and Trade in Syria.

He has also been an adjunct professor at George Washington University and has received multiple accolades, including nominations for the Nobel Prize. ACY Securities believes that Dr Alchaar's expertise will significantly benefit their clients and keep the company at the forefront of industry innovation.

Colt Technology Identifies Growth Avenues in AI

Colt Technology Services has released a report highlighting new AI and digital infrastructure growth opportunities. The study surveyed 755 IT leaders and found that technologies like 5G, agile connectivity, and edge computing are considered essential for AI adoption.

The report also emphasized the increasing importance of On-Demand connectivity, with 89% of respondents planning to use or already using this feature. The study suggests that IT leaders are looking for diverse partners to expand their knowledge in these areas, presenting opportunities for SaaS providers, hardware vendors, and consultants.

CMCC Global Launches $100 Million Fund

The Hong Kong-based venture capital firm CMCC Global has successfully raised $100 million for its new Titan Fund to support early-stage blockchain startups in Asia. The fund attracted more than 30 investors, including significant names like Winklevoss Capital and Jebsen Capital.

Martin Baumann, the Co-Founder of CMCC Global, stated that the fund would focus heavily on Hong Kong-based companies. The Titan Fund is CMCC Global's fourth fund despite a challenging funding environment in the crypto sector.

SIX Digital Exchange Collaborates with Invest Direct for Private Markets

SDX, the world's first fully regulated digital asset financial market infrastructure by SIX, has entered discussions with Invest Direct, a Geneva-based startup specializing in independent company assessments and investor matchmaking. The collaboration aims to enhance transparency and standardization in SDX's private equity offerings. Invest Direct's team, led by Frank Levy, will assist private companies throughout their funding process, providing independent assessments and connecting them with professional investors.

Cboe Global Markets Announces September 2023 Trading Volume

Cboe Global Markets, a leading derivatives and securities exchange network, has released its trading volume statistics for September 2023. The report covers various segments, including options, futures, and equities. Notably, the average daily trading volume (ADV) for index options witnessed an increase of 14.3% compared to September 2022.

However, US equities on exchange experienced a decline of 16.2% in matched shares. The company also provided insights into its third-quarter performance, highlighting new volume records in its proprietary product suite.

FlexTrade Partners with Axioma for Portfolio Optimization

FlexTrade, a trading solutions provider, has partnered with Axioma to integrate its Portfolio Optimizer into FlexONE, FlexTrade's order and execution management system. The integration aims to automate portfolio rebalancing based on various criteria like risk tolerance and investment constraints.

Jose Cortez, the VP of Buy-Side Sales at FlexTrade, stated that the partnership would offer clients a more efficient workflow across trading, operations, and risk management, enhancing the role of trading desks in risk management and portfolio optimization.

Citigroup Outlines Upcoming Organizational Changes

According to a global memo sent to staff, Citigroup is undergoing its most significant reorganization in decades. The memo, written by Sara Wechter, the bank's Chief Human Resources Officer, indicates that roles will be reassessed, created, or eliminated to fit the new structure.

The changes are set to be announced in November. Employees whose roles are eliminated may be eligible for severance pay and can apply for other positions within the company.

Deutsche Bank Appoints New Head of Human Resources

Deutsche Bank has named Volker Steuer as its new Head of Human Resources. Steuer, who has been with the bank for over 30 years, will report to Rebecca Short, a Member of the Management Board and the Group's Chief Operating Officer.

The appointment is part of Deutsche Bank's ongoing transformation, and Steuer aims to focus on evolving the workforce to meet changing client expectations and market conditions.

FCA's Regulatory Action against Christopher Vincent Summers

The UK Financial Conduct Authority (FCA) has prohibited Christopher Vincent Summers from performing any regulated activities due to his criminal activities between 2014 and 2019. Summers was convicted of fraud and sentenced to six years in prison. The Authority stated that Summers' actions demonstrated a severe lack of honesty and integrity, making him unfit for any regulated activities.

Wirex Limited Revises E-Money Contract Terms

In a separate action, the FCA informed that Wirex Limited has committed to revising its e-money contract terms under the Consumer Rights Act 2015. The firm will remove three terms that were considered likely to be unfair to consumers.

These terms are related to the firm's liability in case of account suspension, limitations on compensation, and exclusion of commitments implied by law. The changes aim to provide clearer and fairer conditions for consumers, effective from January 1, 2024.