The Finance Magnates London Summit 2025 moves into its second and final day today, with industry participants returning for another full schedule of panels and discussions.

Building on the themes covered on day one, today’s sessions continue to focus on market structure, trading technology, payments, regulation, and the growing role of brokers, liquidity providers, and fintech firms in a shifting global environment.

Join IG, CMC, and Robinhood in London’s leading trading industry event!

- “We Have Entered an Era Where Data Is Abundant, Accessible, and Tailored,” FMLS:25

- Finance Magnates London Summit is Returning for its 13th Year!

- Crypto and NFTs Are "Male Dominated Industry": Strategies for Effective Marketing

Day one of FMLS:25 featured a wide range of panel discussions covering macro uncertainty, liquidity conditions, trading platforms, payments infrastructure, stablecoins, prop trading, corporate culture, sponsorship strategy, and the growing role of AI and automation across financial services.

Executives examined market structure under geopolitical pressure, evolving broker models, institutional expansion, and the technologies reshaping execution, security, and client engagement. Together, the sessions set the context for further debate as the summit continues into its second day.

Panel Debates the Role of Prop Trading in Retail Markets

A panel titled “DEBATE: Is Prop Trading Good for The Trading Industry?” features Jonathan Fine, Content Strategist at Ultimate Group; Drew Niv, Chief Strategy Officer at ATFX; and Brendan Callan, CEO of Tradu.

The session examines differing views on the role of prop trading in retail markets, focusing on value for traders, the sustainability of challenge fees and revenue-sharing models, and why some brokers adopt prop offerings while others avoid them.

The discussion centers on the structure and incentives behind funded trading models rather than specific products or integrations.

Session Reviews Infrastructure and Compliance for Neo-Bank Wealth Offerings

A panel titled “How Neo-Banks Go Wealth” examines how digital banks are expanding into investment and wealth products after establishing their core retail banking offerings. Speakers include Andy Russell, CEO of Project Arnaud at 11:FS; Mushegh Tovmasyan, Chairman of Zenus Bank; Rachel Przybylski, Chief Product Officer at SIGMA AI; and Stefan Lucas, Founding CEO of FinTech Armenia.

The discussion focuses on how neo-banks are adapting infrastructure, compliance, and user experience as they move into wealth services and blur the lines between retail banking and wealthtech.

Panel Discusses Consumer Habits, Competition, and Regulation in Finance Apps

A panel titled “The Leap to Everything App: Are Brokers There Yet?” features Laura McCracken, CEO and Advisory Board Member at Blackheath Advisors and The Payments Association; Slobodan Manojlovic, Vice President and Lead Software Engineer at JP Morgan Chase & Co.; Jordan Sinclair, President of Robinhood UK; Simon Pelletier, Head of Product at Yuh; and Gerald Perez, CEO – UK at Interactive Brokers.

The discussion examines how brokers are navigating the push toward super apps that combine investing, personal finance, and wallets, focusing on collaboration, evolving consumer habits, competitive pressures, and regulatory considerations.

Speakers Discuss Technology, Misconceptions, and Knowledge Gaps in Dealing

A panel titled “Art of the Dealer: Risk Management and Industry Education” features Elina Pedersen, Co-founder and CEO of Your Bourse; Lee Shmuel Goldfarb, Executive Sales Trader at B2Prime; Chariton Christou, Co-Founder and CEO of Boltzman Research; and Antonis Patinios, Dealing Analyst at TMGM.

The discussion explores the evolving dealing landscape, combining AI tools with human expertise, and highlights gaps in industry knowledge. Speakers provide insight into risk management technology, common misconceptions among non-dealers, and opportunities for education in the trading industry.

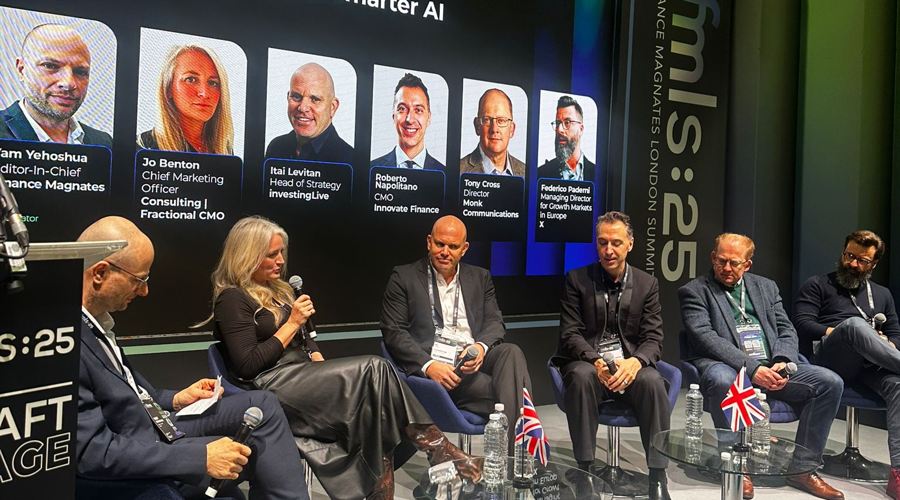

Speakers Examine Acquisition Costs, Audience Segments, and AI in Marketing

A panel titled “Marketing in 2026: Audiences, Costs, and Smarter AI” features Yam Yehoshua, Editor-In-Chief at Finance Magnates; Federico Paderni, Managing Director for Growth Markets in Europe at X; Roberto Napolitano, CMO at Innovate Finance; Jo Benton, Chief Marketing Officer at Consulting | Fractional CMO; Tony Cross, Director at Monk Communications; and Itai Levitan, Head of Strategy at investingLive.

The discussion covers marketing challenges for brokers in 2026, including acquisition costs, audience segmentation, balancing global consistency with local adaptation, and the practical use of AI and automation to optimize campaigns.

Panel Discusses Retail Investors and the UK Stock Market

A discussion titled “Mind The Gap: Can Retail Investors Save the UK Stock Market?” features Adam Button, Chief Currency Analyst at investingLive; Nicola Higgs, Partner at Latham & Watkins; Jack Crone, PR & Public Affairs Lead at IG; David Belle, Founder of Fink Money; and Dan Lane, Investment Content Lead at Robinhood UK.

The panel explores the role of retail investors in the UK market, examining regulatory reforms, government influence on savings behavior, and how brokers and fintechs can encourage investment while balancing flexibility and consumer protection.

Speakers Discuss Platform Dependency, Hybrid Models, and AI in Trading

A panel titled “Fail Better? Trading Tech to Tackle Industry Risks” features Stephen Miles, Chief Revenue Officer at FYNXT; John Morris, Co-Founder of FXBlue; Tom Higgins, Founder and CEO of Gold-i; Adam Saward, Managing Director at EC Markets; and Gil Ben Hur, Founder and CEO of 5% Group.

Day 1 at #fmls25 was 🔥

— EC Markets Global (@EcmarketsGlobal) November 26, 2025

Thanks to everyone who stopped by, grabbed a photo with the #PremierLeague

Trophy, and entered the signed #Liverpool FC jersey giveaway 🏆🎁

Day 2 → same energy, even bigger vibes at Booth 32⚡#FinanceMagnates #ECMarkets #TradeLikeaChampion pic.twitter.com/bvtWQ4TWwq

The discussion explores how brokers manage operational and technological risks, including platform dependency, hybrid build-and-buy models, and the impact of AI on execution, risk, and reporting. Speakers also examine which tools and features drive adoption and retention in trading infrastructure.

Our Group Deputy CEO, Christia Evagorou, took the stage at fmls:25 yesterday to moderate a discussion on the past, present and future of payments.

— payabl. (@payabl_eu) November 27, 2025

Joined by industry leaders from Visa, Weavr | Kindlee, Edenred Payment Solutions and Payments Solved, the panel explored how far… pic.twitter.com/dHwY0a2nll

Speakers Examine AI Tools, Compliance, and Client Usage in Trading

A panel titled “Secret Agent: Deploying AI for Traders at Scale” features Joe Craven, Global Head of Enterprise Solutions at TipRanks; David Dyke, Head of Engineering – Wealth at CMC Markets; Guy Hopkins, Founder and CEO of FairXchange; Ihar Marozau, Chief Architect at Capital.com; and Rebecca Healey, Founder of MindfulMarkets.AI.

The discussion focuses on how AI tools are deployed in retail trading, covering technical challenges, compliance, ethical considerations, and client behavior.

Speakers also explore the limits of AI in decision-making and the evolving role of advice, autonomy, and algorithms in financial services.

Panel Reviews Role of Educators and IBs in Regional Brokerage Growth

A panel titled “Educators, IBs, and Other Regional Growth Drivers” discusses how partners affect broker growth as acquisition costs increase. Speakers include Adam Button, Chief Currency Analyst at investingLive; Amar Ramith, CEO of TDMarkets; Brunno Huertas, Regional Manager for Latin America at Tickmill; and Paul Chalmers, CEO of UK Trading Academy.

The session examines the role of educators and IBs in shaping market access, trust, and user engagement, alongside regional regulation and performance-based partnership models.

Speakers Discuss Regulatory Arbitrage and Multi-Jurisdiction Risk

A panel titled “Negative Friction? Brokers between Tougher Demands & Regulatory Arbitration” brings together Ron Finberg, Executive Director at S&P Global Market Intelligence Cappitech; Matthew Smith, Group Chair and CEO of EC Markets; Chris Rowe, Director at Financial Technology Consultancy Services Limited; Aydin Bonabi, CEO of Surveill AI; Rav Saidha, Chair of the Retail Derivative Forum; and Christiana Vasiadou, CEO and Compliance Officer at Global Markets Group.

The discussion focuses on how increased scrutiny from regulators affects broker strategy, including the trade-offs between onshore compliance and offshore structures. Topics include regulatory timelines, setup costs across jurisdictions, multi-entity risk management, and the use of AI in compliance and client products.