The Financial Conduct Authority used data and technology to tackle unauthorized financial promotions, suspending or blocking over 1,600 websites and removing more than 50 apps from major platforms like Google Play and the App Store. The regulator’s latest annual report outlines these actions and other steps taken to address harm in the financial sector.

Rise in Financial Promotion Interventions

In 2024, the FCA intervened in almost 20,000 financial promotions, ensuring they were amended or withdrawn—a significant increase from fewer than 600 in 2021. It also cancelled the authorisations of over 1,500 firms, 20% more than in 2023 and more than triple the number in 2021.

“Our annual report shows how we’ve laid the strongest possible foundation from which to implement our new strategy,” said Ashley Alder, Chair of the FCA.

Targeting “Finfluencers” on Social Media

The regulator focused on social media enforcement, targeting unauthorised “finfluencers.” It interviewed 20 individuals under caution and issued 38 alerts regarding illegal promotions on social media platforms.

You may find it interesting at FinanceMagnates.com: FCA Extends Anti-Harassment Rules to 37,000 Financial Firms, Including CFD Brokers.

Actions Against Banks and Unauthorised Firms

To reduce harm, the FCA fined two banks a total of over £45.5 million for failures in sanctions controls and anti-money laundering monitoring. It also issued 2,240 alerts about unauthorised firms and individuals.

Nikhil Rathi, Chief Executive, noted the increased use of data and technology to identify and address risks, highlighting key achievements such as faster firm authorisations and changes to listing rules.

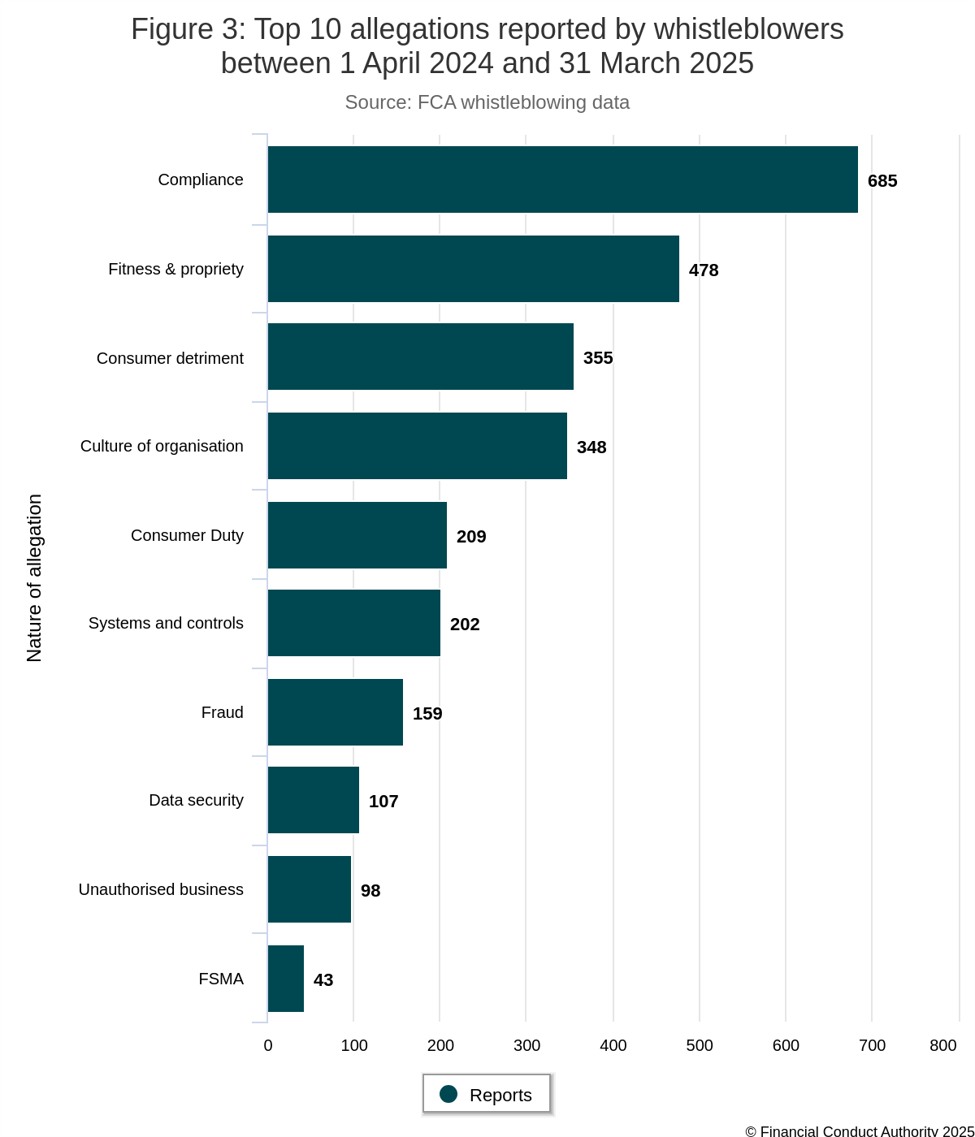

Whistleblowing Reports Inform FCA’s Supervisory Actions

In a separate update, the FCA received 1,131 whistleblowing reports between April 2024 and March 2025, containing 2,684 distinct allegations. These reports led to direct action in 908 cases, including reviews and enforcement steps.

A growing number of allegations were tied to the Consumer Duty, introduced in 2023, which has now replaced the “Treating Customers Fairly” category. The most common issues reported included compliance breaches, mis-selling, poor advice, and weak customer outcomes—highlighting the FCA’s increased reliance on whistleblowing to inform supervisory actions.