Riding the wave of its successful foray into fractional shares, the Polish-based brokerage XTB is setting its sights on a new frontier: passive investments based on global exchange-traded funds (ETFs). Initially tested in Romania with promising results, the service will debut in Portugal and Slovakia today (Monday). Omar Arnaout, the CEO of the publicly-listed fintech, has revealed plans to roll out the offering to additional European markets later in the year.

XTB Introduces 'Investment Plans', Recurring Payments in Line

After implementing fractional shares in European markets this spring, which were warmly received by retail investors, XTB has presented another product innovation called 'Investment Plans'. Finance Magnates reported a few months ago that XTB is preparing to launch savings products in 2023, reaching a wider audience than contracts for difference (CFD), with which the broker was originally associated.

From the information we exclusively received, it appears that the new offer is launching this month. Just a few hours after the publication of this article, it will officially be presented in Slovakia and Portugal. The choice of these countries is not accidental.

As Arnaout digs deeper into his company's internal data, in Romania, three out of five XTB clients invested their funds in ETFs during 2022. In Slovakia, the popularity of these funds is also growing, and a year ago, every third retail investor used them. As for Portugal, only 19% of clients were interested in ETFs in 2021, now it is almost 50%.

"The rationale behind choosing the initial countries is simple – we selected those markets where XTB clients invest in ETFs most frequently. Overall, we plan to offer Investment Plans on all our European markets and our technology team is working hard to make it happen this year," Arnaout commented exclusively for Finance Magnates.

As the CEO admitted, the new product is an opportunity to reach a new group of potential clients. Moreover, XTB wants to develop its functionality and add the option of recurring payments later this year.

"Thanks to this enhancement, investors will be able to automate their payments . This will make the product even more intuitive, hassle-free, and suitable for long-term capital allocation," XTB's CEO added.

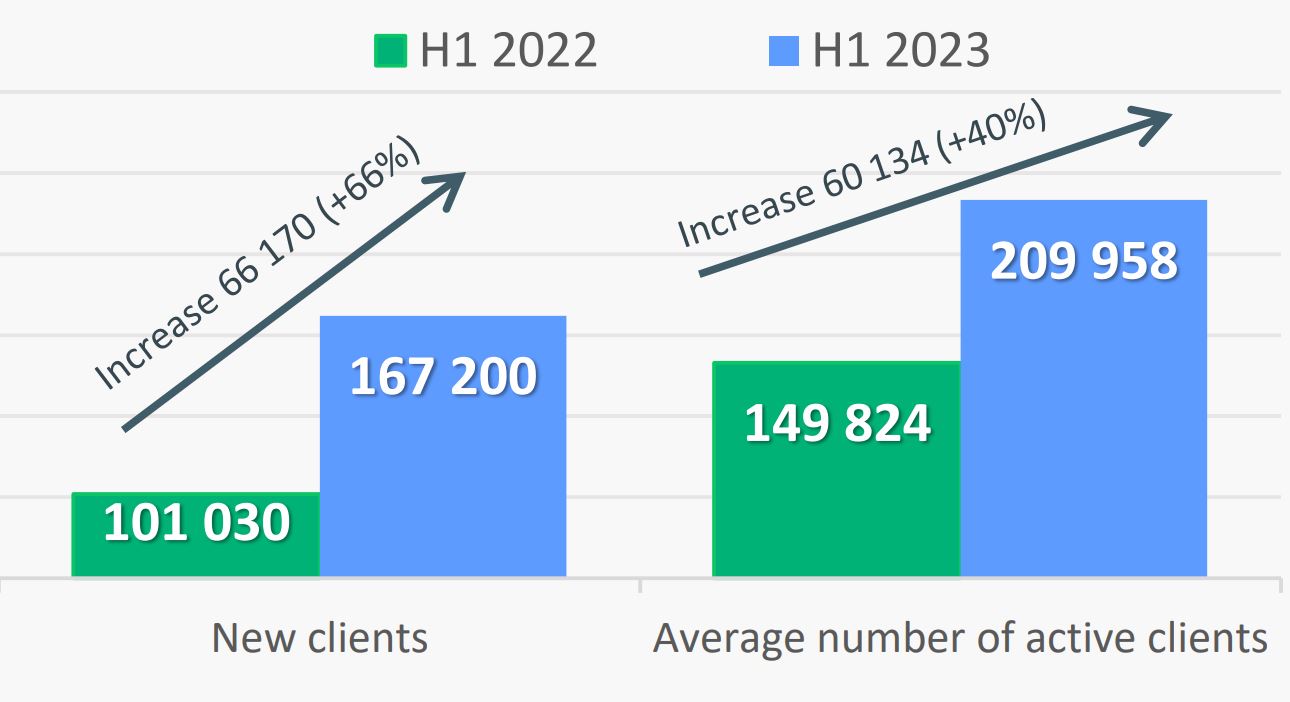

To maintain high momentum in acquiring new clients and retaining existing ones, XTB is constantly looking for new solutions. In the first half of 2023, the company managed to acquire a record number of clients (167,000), which is 65.5% more than the previous year. The total base of active clients has grown to almost 210,000.

What's Inside XTB's ETF Initiative?

Starting with as little as EUR 15, XTB clients can create up to 10 distinct portfolios, each containing a maximum of nine exchange-traded funds. The platform currently offers a selection of over 300 ETFs.

Investment Plans simplify the decision-making process by offering tailored suggestions. These suggestions are based on various factors such as the type of ETF, its asset composition, geographical focus, Morningstar ratings, and the plan's performance history over the past five years. The full list of available instruments can be found on the broker's Romanian website.

Within the XTB app, investors have the freedom to specify the exact amount they wish to invest. The system then automatically allocates these funds based on the investor's individual risk tolerance and chosen investment timeframe. Additionally, these Investment Plans are designed to be flexible; they can be opened or closed at any given moment, allowing investors to actively manage and re-allocate their funds as their financial goals evolve.

"Investment Plans are suited to cater to the needs of investors looking for ways to invest their funds but they don't want to spend too much time doing so. As this passive product streamlines the process of building an investment portfolio," Arnaout explained.

Romania as XTB's Testing Ground

When XTB introduced fractional shares to its offering in the first part of this year, it started with the Romanian market. It was later introduced to the Czech Republic, Portugal, and Slovakia, and finally to Poland, Spain, and a few other countries. The company's spokesperson confirmed to Finance Magnates that Investment Plans were initially implemented in the Romanian market, making it a testing ground for fintech solutions before implementing them in more developed markets.

This seemed like a natural move in the case of passive investing based on ETFs. Internal XTB data shows that out of all of the clients in Europe, ETFs are most popular in Romania.

"XTB's Romanian-language site promoting its Investment Plans offering." Automatically translated into English by Google Translate. Source: XTB

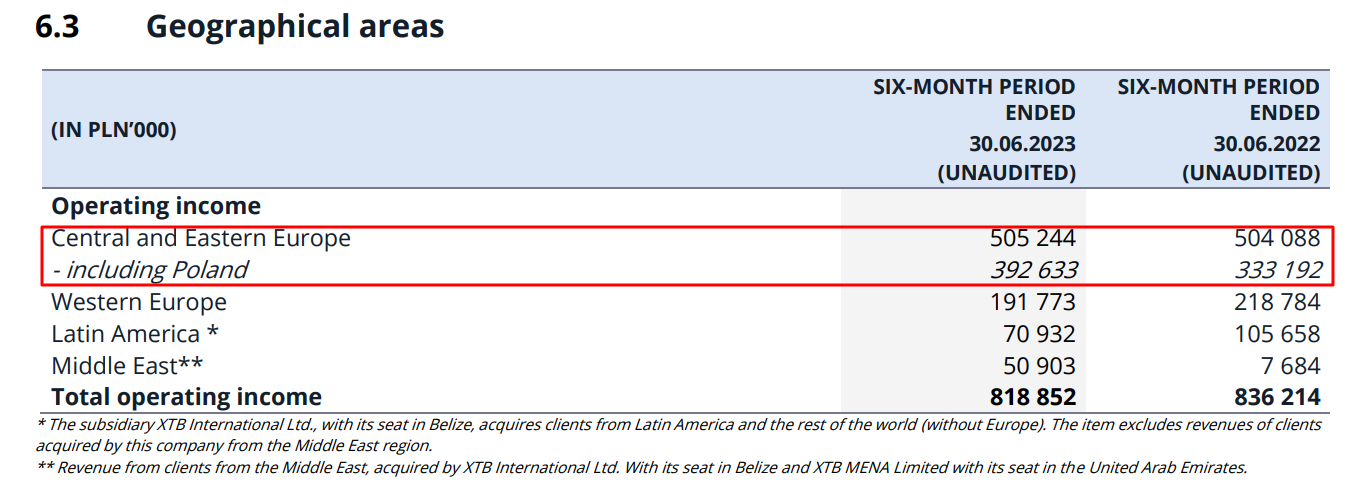

Unfortunately, the broker does not disclose what percentage of its revenue comes from individual countries in Central and Eastern Europe (CEE), it only provided aggregate results that focused on Poland. According to the latest report, operational revenue in the CEE region (including Romania) exceeded PLN 505 million. Excluding Poland, the revenue in the CEE was PLN 173 million, which is almost the same as in the entirety of Western Europe (PLN 191 million).

Finally, we asked Arnaout if he is not afraid that ETFs in Europe are still a fledgling product, especially compared to the United States. He believes they may dominate the market within a few years and repeat the history of fractional shares. The ETFs initially gained popularity in the United States and then spread to the rest of the world.

"The rise in popularity of ETFs in Europe is only a matter of time. Of course, the US market sets the trends for financial markets worldwide. This was the case, for instance, with fractional shares, which first appeared there and then conquered the whole world," Arnaout concluded.