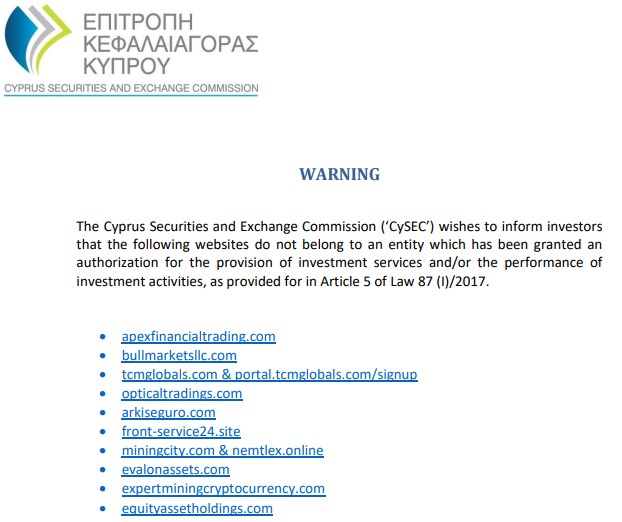

The Cyprus Securities and Exchange Commission (CySEC) has warned investors regarding several websites that are not authorized to provide investment services or perform investment activities under its regulations.

These platforms include apexfinancialtrading.com, bullmarketsllc.com, tcmglobals.com, opticaltradings.com, arkiseguro.com, front-service24.site, miningcity.com, nemtlex.online, evalonassets.com, and expertminingcryptocurrency.com. The regulator has advised investors to exercise caution and refrain from engaging with these entities.

CySEC Identifies Regulatory Breaches

CySEC flagged apexfinancialtrading.com and bullmarketsllc.com, which claim to offer investment services without the necessary regulatory approval.

Additionally, CySEC warned against tcmglobals.com and portal.tcmglobals.com/signup, opticaltradings.com, arkiseguro.com, front-service24.site, miningcity.com, nemtlex.online, evalonassets.com, and expertminingcryptocurrency.com, emphasizing that they lack the required authorization to conduct investment activities.

Last year, CySEC identified 12 websites that do not hold the necessary licenses to provide investment services in Cyprus. These platforms range from FX/CFD brokers to cryptocurrency companies. The regulator urged investors to exercise caution and verify the legitimacy of investment firms before conducting any transactions.

Risks of Dealing with Unregulated Firms

CySEC explained that trading with unregulated entities exposes investors to various risks, including mishandling funds and potential bankruptcy without compensation. Without proper oversight, traders are vulnerable to fraudulent activities and financial losses, the financial watchdog explained.

Last year, CySEC announced a significant move towards strengthening regulatory oversight within the financial sector. The regulator advertised a tender valued at €240,000, seeking experts to identify potential regulatory violations among Cypriot Investment Firms (CIFs).

The tender, titled "Provision of services by two experts to conduct investigations regarding potential violations of the current legislation by CIFs", underscored CySEC's commitment to comprehensive oversight.

Meanwhile, CySEC recently withdrew Brokereo's membership from the Investors Compensation Fund (ICF) following the revocation of its CIF license. Finance Magnates reported that the company voluntarily renounced its license at the end of the previous year.

CySEC confirmed the removal of Neo Premium Investments Ltd., which operated the retail trading brand Brokereo, from the ICF membership. This decision aligned with CySEC's earlier move to revoke Brokereo's CIF license.