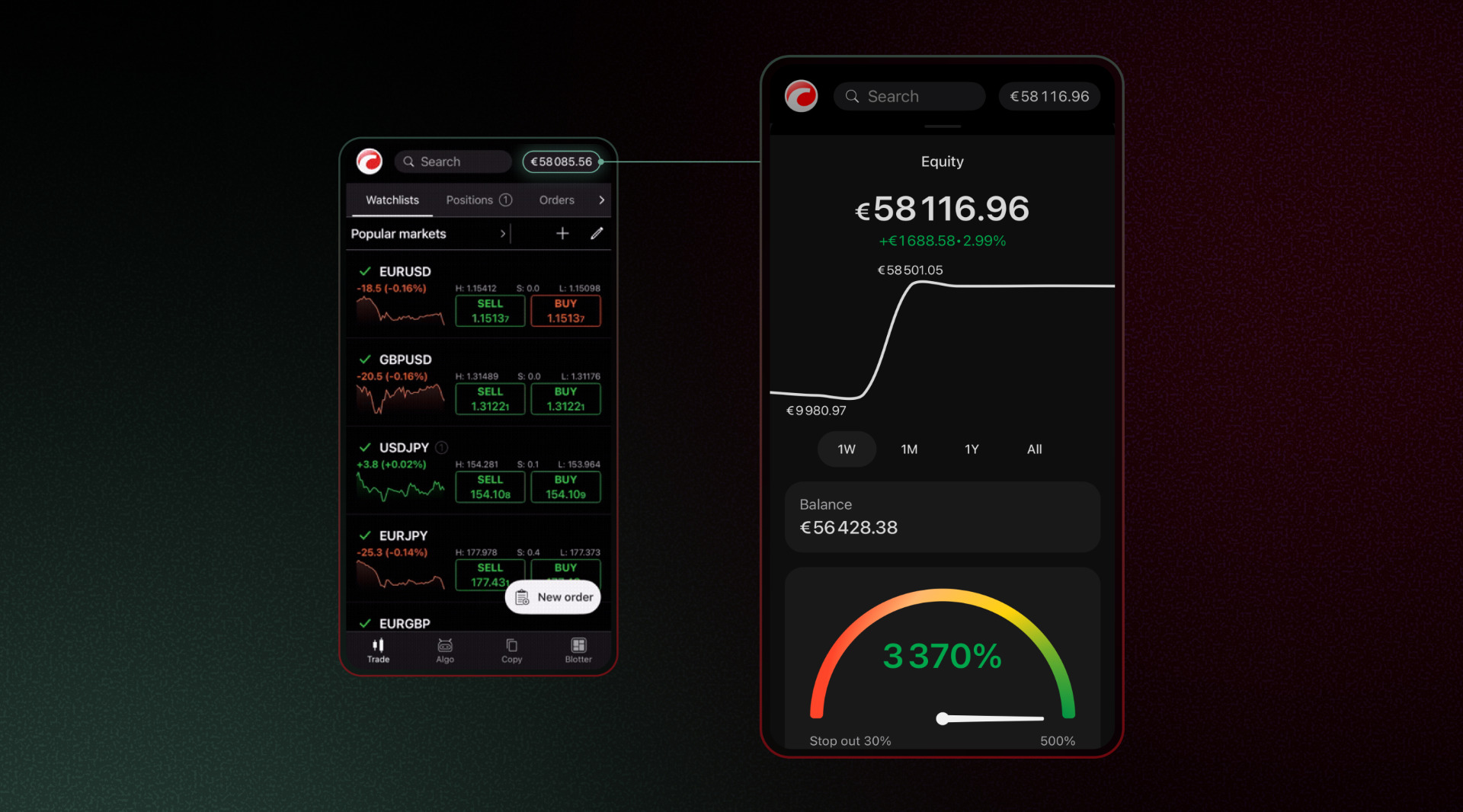

Spotware, the developer of the multi-asset trading platform cTrader, has released cTrader Mobile 5.6. The update introduces features aimed at improving transparency, usability, and visual clarity for traders.

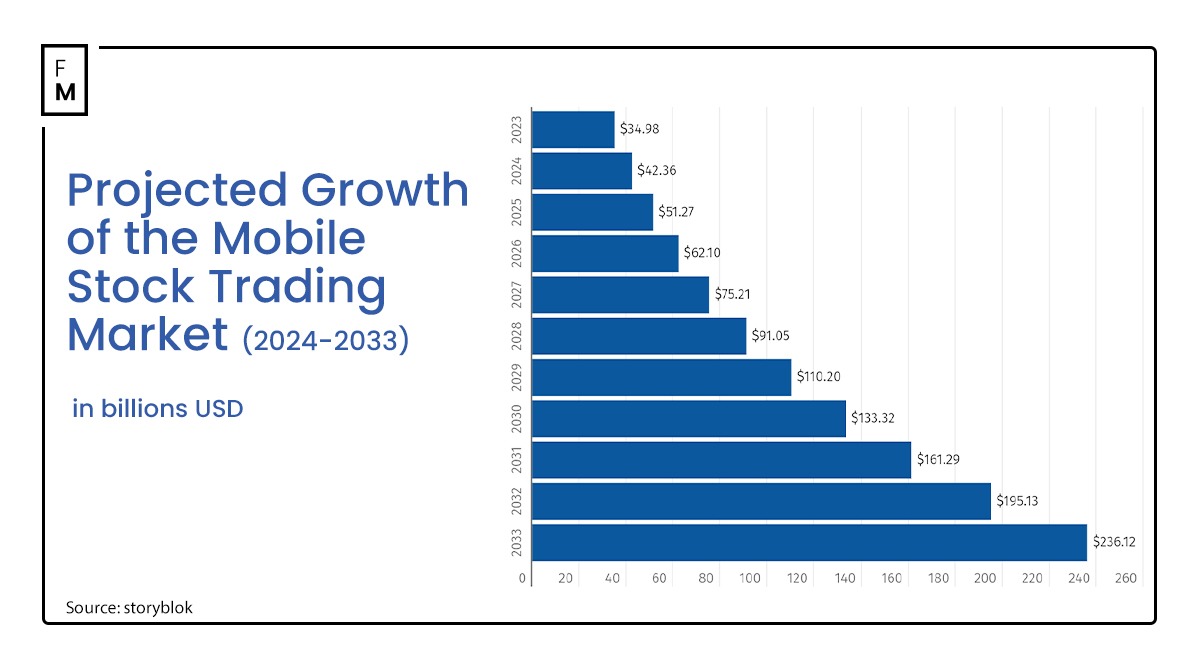

Mobile trading has accelerated since the COVID-19 pandemic, as investors seek accessible ways to participate in the retail stock market. Mobile apps allow users to trade anytime and anywhere, providing flexibility and faster access to opportunities. The market is projected to reach $42.36 billion in 2024 and exceed $133.32 billion by 2030, reflecting strong growth potential.

Equity Charts, Candle Countdown, Redesigned Landscape

The new version adds an equity chart to the account dashboard. The chart shows how trading activity, deposits, and withdrawals affect account equity over time. Users can select specific periods to review account performance.

- Retail Traders Gain Access to Forex, Metals, and Indices as Bitget’s TradFi Goes Live

- “Retail Traders Are Just Scratching the Surface of AI,” FMLS:25 Panel on Broker Growth

- Action against Retail Forex Fraud: Companies, Individuals to Pay $60M for Settlement

A candle countdown has been added to charts, indicating the time remaining before the current candle closes. Spotware said the feature supports more precise timing in trading strategies and was developed in response to user requests.

The landscape view has been redesigned to provide a larger chart area. Quick Trade and toolbar functions remain accessible in a single-row format, reducing interface clutter and improving readability.

Traders Approach Delivers “Practical Improvements”

Charts have also been refined with a transparent price axis and the removal of axis separators. Users can drag and resize charts with more flexibility.

Version 5.6 introduces live trading ribbons. These are in-app prompts that suggest account actions, such as opening or funding an account. Ribbons appear only when relevant and can be managed or disabled by brokers.

“With cTrader Mobile 5.6, we are strengthening the mobile experience in ways that matter across the trading ecosystem,” said Sergey Borisov, Product Manager for cTrader Mobile at Spotware. “Our Traders First approach turns feedback into practical improvements.”

Mobile Trading Surges Among CFD Brokers

The trend toward mobile trading extends beyond individual platforms. Nearly nine out of ten CFDs trades at Plus500 are now executed on mobile devices, representing 89 per cent of the broker’s H1 2025 OTC revenue.

This is well above the industry average of 55.5 per cent in Q2 2025. Plus500’s mobile share has grown steadily since 2018, rising from 73 per cent to over 82 per cent by 2023.

The broker attributes high mobile usage to its mobile-focused system design, consistent interface across devices, and mobile-centric marketing, though overall industry adoption remains lower.