Monex Group today reported its monthly business metrics for April 2016, showing an overall increase over the previous month’s figures. Today’s release indicates a positive turn for the Japanese broker, which last month saw its financial metrics for Q4 2015 ending March 31, 2016 decrease QoQ over the previous quarter.

As of this month, Monex Group no longer reports Global Forex volumes following the transfer of OTC FX accounts offered by the FX companies of TradeStation Group, Inc. to OANDA Corporation and OANDA Australia Pty Ltd in March. As a result, Monex’s FX volumes are now comprised of only the OTC FX volume of Monex, Inc., the Japanese subsidiary of the broker.

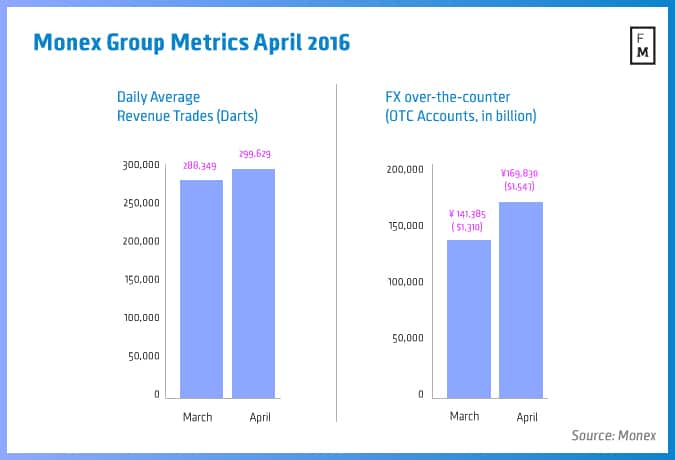

The Japanese broking giant, whose Daily Average Revenue Trades (DARTs) had been in decline since January, reported a figure of 299,629 DARTs compared with 288,349 during March 2016, representing an 3.8% increase MoM. The annual comparison, however, showed a 5.9% drop from the result of 318,116 recorded in April 2015.

There was a slight increase in accounts at Monex during April 2016, rising to 1,639,437 accounts from 1,635,172 accounts in March 2016, or 0.3% MoM. Looking at Monex’s FX business, the number of over-the-counter (OTC) FX accounts came in at 224,485 up from 223,365 accounts in March 2016 or 0.5% MoM.

In terms of its FX OTC business, Monex reported an average trade value per business day of ¥169,830 billion ($1,574 billion) compared with ¥141,385 billion ($1,310 billion) in March, representing an increase of 20.1% MoM.

TradeStation, meanwhile, saw DARTs fall to 110,929 in April compared with 112,769 in March, reflecting a 1.6% decrease MoM. In terms of account numbers, April figures were 61,819 in April compared with 61,348 in March, reflecting a 0.8% increase MoM.