KVB Kunlun, the Hong Kong-based broker, has published its full financial results for the first nine months of 2014, following on from their preliminary ‘hint’ late last month, as reported by Forex Magnates.

At the time, KVG’s statement said: “Based on a preliminary review by the Board of Directors on unaudited management accounts, the Group is expected to record a net profit for the 8 months ended 30 September, 2014, as compared to a net loss for the first 6 months ended 30 June, 2014.” Adding, “Such improvement was mainly due to the increase in leveraged foreign Exchange and other trading income earned from external customers during the three months period from July 1, 2014 to September 30, 2014.”

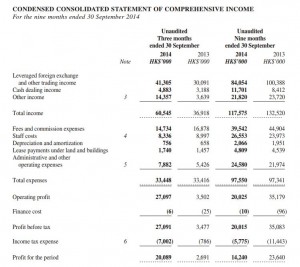

In actual figures published today, leveraged foreign exchange and other trading income in Q1-Q3 was HK$84,054,000 ($10.1 million) compared to HK$41,305,000 ($5.3 million) in Q3 alone. The figures do indeed indicate that the sharp revenue boost in Q3 helped KVB swing from a loss to a profit this year.

KVB Financial Results - Click to Enlarge

Overall, KVB reported a total profit of HK$20,089,000 ($2.6 million) in Q3 2014, bettering last year's performance (HK$2,691,000) over the same period by 650%. However, on a year-to-date basis, KVB reported a profit of HK$14,240,000 ($1.8 million) in the first nine months of 2014 (Q1-Q3) – a 37% year-on-year decrease.

Coincidentally, KVB reported a 37% quarterly year-on-year improvement in leveraged FX income, from HK$30,091,000 in 2013 to HK$41,305,000 in 2014. In terms of performance over the first three quarters in total, KVB suffered a 16% fall in Leverage FX income compared to 2013. The broker generated HK$100,388,000 of income in Q1-Q3 2013 but only managed HK$84,054,000 in 2014.