Sterling trading has been erratic all day long with rapid swings defining a 250 pips range during the London trading session in cable, with EUR/GBP swinging within 200 points. The Bank of England has announced that the so called 'flash crash', which is a term to describe abrupt market moves for no apparent reason, is under investigation.

Chart of British Pound flash crash (purple) and other active futures. Red line is Euro/LB contract pic.twitter.com/z7pLrilBxu

— Eric Scott Hunsader (@nanexllc) October 7, 2016

So far the speculation has been that the move in sterling has been caused by thin Liquidity conditions (and thin they were!), a ‘fat finger’ trade, exacerbated by algorithmic trading, a perfectly sound fundamental move and others…

Nanex LLC's CEO Eric Scott Hunsader states on his twitter account a rather interesting graph with some unique points:

Closer look at Pound Sterling's drop last night -- not caused by a traditional fat finger $6B_F pic.twitter.com/mq5YOfqzZ7

— Eric Scott Hunsader (@nanexllc) October 7, 2016

Quotes across different brokerages varied widely with the lowest bid price in GBP/USD trading hitting between below 1.1200 up towards above 1.2000. This 800 pips difference is unprecedented (outside of our all-time favorite post-SNB ‘Black Swan ’) and to asses the market impact Finance Magnates has accumulated some information from brokers.

Cable Bottoms out From below 1.1000 to above 1.2000

According to one of the industry's key figures in London Eddie Tofpik, fills on cable have been ranging wildly with some being quoted below 1.1000.

Looking at different brokers and trading venues, across a multitude of real money broking accounts which the author of this article holds with multiple brokers, the lowest points vary.

At Admiral Markets, the lowest level is printed at 1.1900.

After enquiring about the firm’s standing on the matter, a company spokesperson stated: “Currency pairs with the pound sterling (GBP) have experienced extreme levels of volatility. Admiral Markets Group AS with its regulated investment firms will continue providing services to its clients as usual. All currency pairs with GBP are available for trading as usual, with no changes to trading terms.”

In a statement distributed to clients the firm said: "Although we wee that several liquidity providers will have to justify their fills and market making efforts during the period of extreme volatility, we would like to assure you that Admiral Markets will continue providing its services to its clients as usual."

the market is over reacting to the Brexit wherein institutions and brokers are over-trading the Cable

Saxo Bank’s traders have seen a print as low as 1.1500, which is in line with quotes from Reuters. Commenting on the abrupt overnight move, the Head of Markets of the company Claus Nielsen stated: “Our systems have performed well and without any disruptions despite the extreme but short term volatility in sterling and low liquidity in early Asia trading hours.”

“Activity has been high but overall our clients’ exposure in sterling is low. Like other market participants we are monitoring the events closely especially in light of US payrolls and earnings data,” he explained.

Charts on LMAX Exchange are showing that the multilateral trading facility (MTF) has handled the order flow briskly, with the lowest bid standing above the 1.2000 level. The company's spokesperson was not immediately available for a comment.

The CEO of social trading provider eToro, Yoni Assia. stated to Finance Magnates: "In light of last night’s events where a 6% ‘flash-crash’ drop in GBP would have caused many traders significant issues, we’re pleased to confirm that overall sentiment on eToro is overwhelmingly positive as many traders were safeguarded from hitting lower stop-losses as our risk management processes kicked in."

OANDA’s trading platform printed a low around 1.1650. Finance Magnates has reached out for a comment, however at the time of publication the company has not issued an official statement.

FxPro has executed the lowest bids in GBP/USD at 1.20203 for MT4 and 1.20125 for cTrader. Commenting on the abrupt moves overnight, the company’s Chief PR Officer, Vasily Sukhotin stated: “We had no problems with execution, everything worked seamlessly.”

Elaborating on a question about margin requirements, he said: “There is no change so far, but we continue to monitor the situation, and are prepared to take necessary steps to protect our clients as and when the need arises.”

FXCM is on the wires with a statement which says that the firm weathered the storm in a solid manner. The lowest print on a real money account with the brokerage is just above 1.1915.

“FXCM's systems and operations functioned without material adversity during the GBP Flash Crash. FXCM's risk committee will continue to closely monitor market movements,” an official announcement elaborated.

MEX Group’s CEO Naser Taher elaborated on the recent move stating: “The move was a knee jerk reaction wherein the price of the GBPUSD went from 1.26143 to 1.20260, some 600 pips, in the space of 2 minutes.”

“In my view the market is over reacting to the Brexit wherein institutions and brokers are over-trading the Cable causing unnecessary volatility which is likely to be detrimental to market confidence. We are pleased to announce that due to our advanced risk management technology and sound financials, today’s events relating to Sterling has had no impact on the MultiBank Exchange Group.”

A Call for Investigation

The Bank of England has announced that it is going to investigate the reasons for the abrupt move, aiming to establish what has been the trigger that caused such a sharp move across the board.

Naser Taher, Chairman of Multibank Exchange Group, Photo: LinkedIn

MultiBank Exchange’s CEO Naser Taher has been vocal about the investigation by financial markets supervisory authorities on the matter.

“The crash has led to panic and confusion among investors and traders. Such unfortunate incidents are rather detrimental to the forex market because it is our aim that investors believe in the stability and transparency of the market. A number of reasons where given for such a crash but it not really clear how this happened.”

“I strongly call for an immediate inquiry and investigation to be undertaken by a panel of leading central banks to report to the public the reason for the crash. This is likely restore confidence in the forex market by investors,” he elaborated.

Where Does Sterling Go From Here?

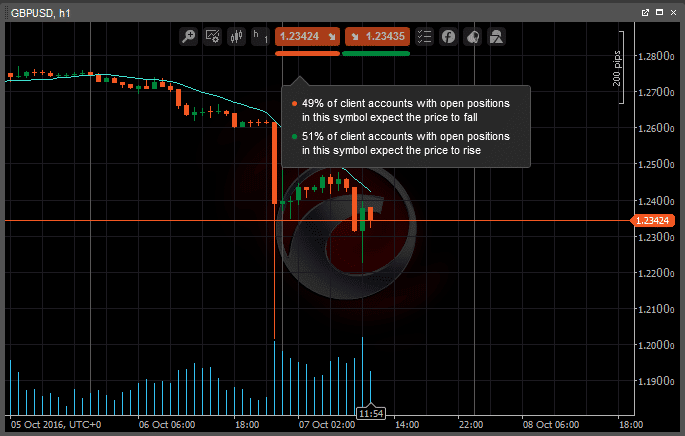

With the dramatic decline which was witnessed overnight, the next big move in sterling is quite a popular question, and apparently traders are equally split in their opinion.

Commenting to Finance Magnates, the Head of Business Development of cTrader James Glyde stated: “As most of Europe was getting a good nights sleep, in preparation for the most anticipated trading event of the month, they remained oblivious to a 600 Pip opportunity which lasted just a couple of minutes, which went on to create a very messy 1 minute chart and a perfect day of scalping.”

Traders are split on which way cable is going, Source: cTrader

“As NFP was approaching at 12:00 UTC, the market remained undecided as data collected from all open GBPUSD positions from all cTrader users across all brokers shows a near 50/50 split of long vs. short positions.”