It’s been more than three years since the first signs of trouble emerged for clients of one particular retail brokerage in Cyprus - IronFX. The company’s clients have been all over the news and social media in China, Europe and Latin America, demanding justice and a repayment of their withdrawals. In the meantime the Audit Office of the Republic of Cyprus has released its annual report, showing a massive client money hole. The company disputed the findings.

The case escalated into an investigation by the Cyprus Securities and Exchange Commission (CySEC ) that settled with IronFX and allowed the firm to continue operating. In the meantime clients from China and Europe have had to resort to legal proceedings to demand repayment of their funds.

[gptAdvertisement]

After the settlement, CySEC advised clients to direct their complaints to the Cyprus Financial Ombudsman Service, an institution which is yet to conclude its investigation of the brokerage.

As of today, a number of clients continue to contact Finance Magnates with their hopes dashed by European bureaucracy. The wealthier customers have resorted to pursuing legal cases against the brokerage using qualified lawyers from Cyprus to assist them in the recovery of funds.

Some online entities claim that they have successfully recovered money for clients, but there is no definitive way to prove whether these claims are legitimate. Others have resulted in failure and admissions of using multiple accounts to abuse the firm’s once generous bonus system.

Commenting to Finance Magnates on the matter, an IronFX spokesperson stated: “There is only one pending Court case in the Limassol District Court for a claim of approximately $600,000 by a single group of 165 Chinese Clients who have yet to present themselves at Court. 72 of these have already dropped the case and we strongly believe the remaining lack merit."

"The Company has a further 7 lawyer claims for purported pending withdrawals, none of which has gone to a Court trial yet. These claims represent a tiny fraction of the 1.1m accounts the Company has opened since its inception. The Company has a number of independent legal and expert opinions that strongly support its position and the validity of its T&Cs and therefore strongly believe that none of these fictitious claims will proceed to trial. No clients have managed to win compensation for their purported withdrawals by virtue of a successful Court order or winning any Court case,” the company's spokesperson concluded.

European Commission and Ombudsman Dragged into IronFX Case

The inconclusiveness of actions undertaken, and the lack of action on the part of CySEC and the Cyprus Financial Ombudsman Service, has resulted in a case brought to the European Ombudsman by a Hungarian client of IronFX regarding repayment of his funds. Additional complaints have been brought to the European Commission.

To the detriment of clients that have been looking to obtain assistance from European Authorities, all cases have been deemed appropriately addressed and the relevant institutions have been cleared of any wrongdoing.

ESMA states that it has adequately addressed the case, highlighting its recent actions targeting retail brokerages across the European Union. The supranational regulator has mandated tougher rules on Leverage and prohibited bonus practices by all companies in the industry.

As a result of the actions of few brokers, all brokers have been labelled as aggressively targeting clients. Industry insiders know that this is not the case, but the chief European bureaucrats don’t seem to be paying a lot of attention to this.

ESMA took 5 months to reply to the Hungarian client's complaint, and no action was taken to alleviate the client’s concerns. This has been criticized by the Ombudsman service.

The case also highlights that CySEC announced a settlement worth €335,000 against the company. The disputes between IronFX and its clients are still ongoing however.

High Leverage Advertising

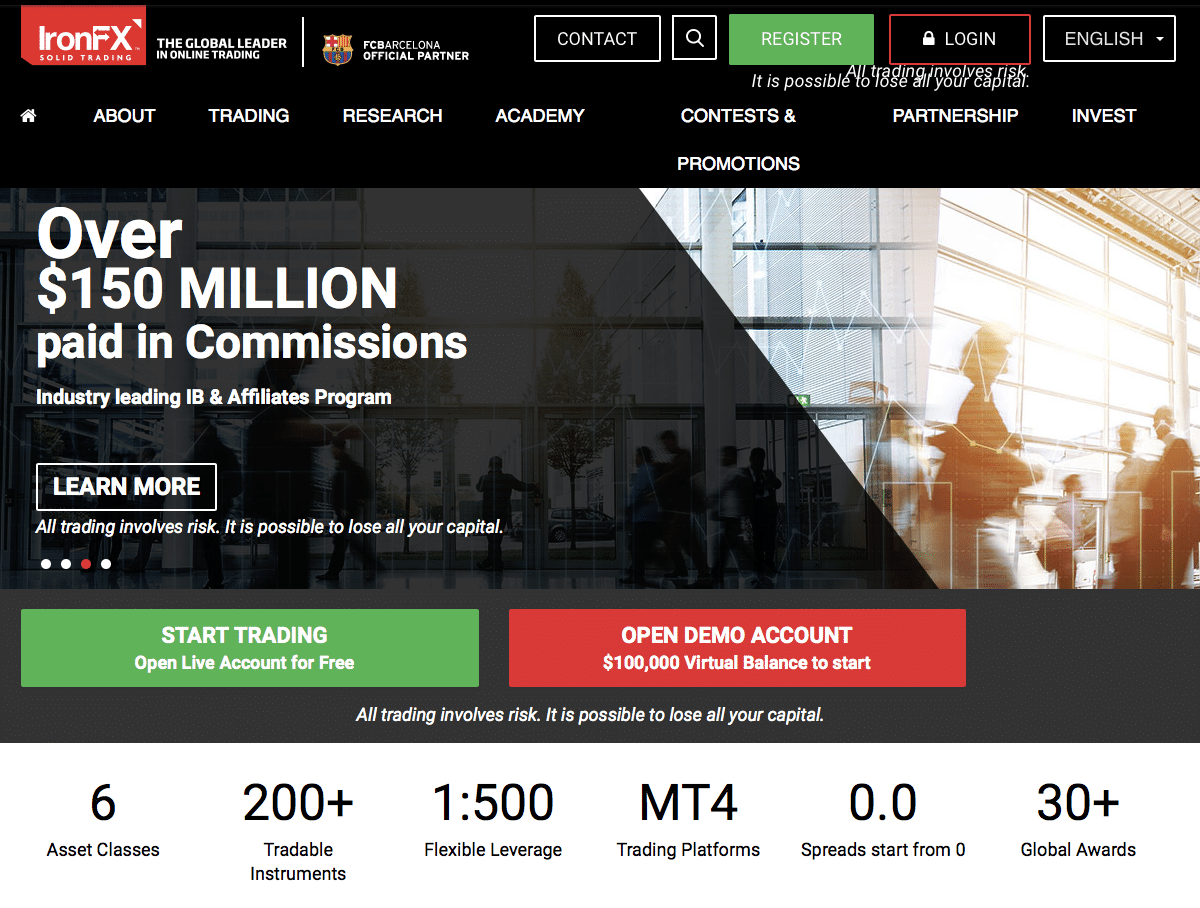

Before the publication of this article, a CySEC spokesperson was contacted by Finance Magnates. We asked why IronFX was still allowed to openly advertise on its website that it is offering up to 1:500 leverage.

A screenshot from the website of IronFX showing 1:500 leverage, before CySEC was contacted by FM.

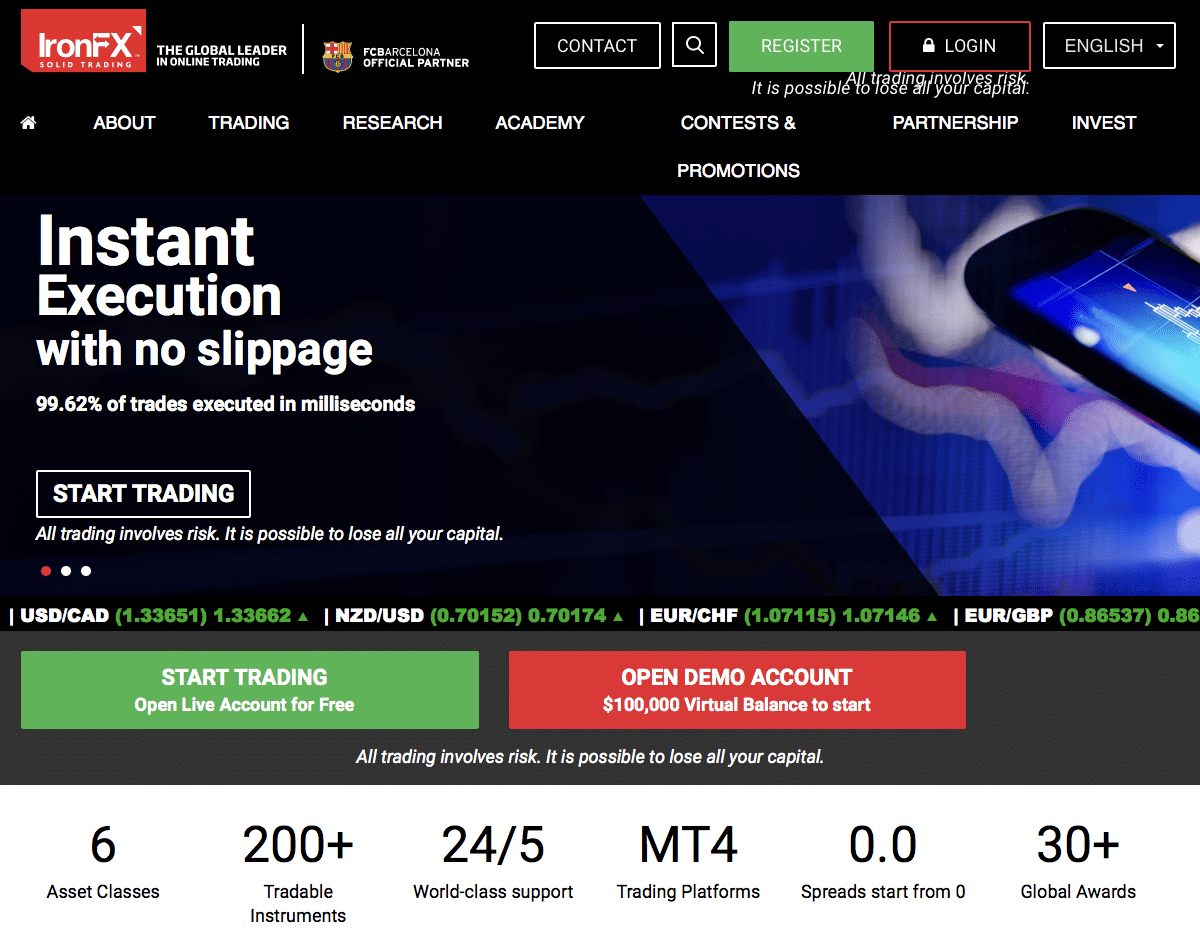

No official comment has been received on the matter, however at present the website of the broker has coincidentally substituted the highlighted high leverage position. IronFX is now instead highlighting its dedication to 24/5 customer support.

The website of IronFX is no longer advertising 1:500 leverage

This is the same customer support system which has been contacted over years by customers whose complaints have not been addressed. Finance Magnates has spoken to numerous customers of IronFX that assert that all of their withdrawal requests have been directed to compliance@ironfx.com. After emails were sent to the address, no appropriate reply was received by several clients.

European Bureaucracy is Not Helping End Clients

The main issue with the legal cases brought to European institutions against the brokerage continues to be that the institutions, whether Cypriot or EU (CySEC/the Cyprus Financial Ombudsman Service/ESMA/the European Ombudsman), have provided zero assistance to the clients.

Instead, ESMA has mandated that national regulators introduce additional measures for client protection. And yet the main question for the industry remains - what will Cypriot authorities do to actually enforce the existing regulations?

Numerous clients of the EU-regulated broker are at present unable to access their funds. In the meantime, CySEC issued a communique last year mandating that all withdrawals be completed within the same working day or on the working day following receipt of the request.

After more than two years, the situation has still not been resolved, and the firm constructed a presentation for an IPO that never materialized.