This article was written by Aayush Jindal, currency analyst at Titan FX.

The British pound declined to a new 31 year low versus the US dollar due to Brexit cementing its place, and it looks like the GBP/USD pair is positioned for more declines.

The FM London Summit is almost here. Register today!

No doubt, the Brexit impact is causing a lot of pair to British pound traders, and it may continue to put a lot of pressure until things settle down. This week we saw the sterling tumble and create a new 31-year low, surprising many traders.

I was always looking for more losses in GBP/USD. In an earlier post, I mentioned how the recent decline in the pair was a picture perfect combination of technical scenario and Brexit.

There were losses written all over the charts of GBP to USD, and the impact of the UK's exit from the EU may not heal soon. Many traders thought that 1.2800 was low formed. However, they were surprised when this week sellers stepped up the momentum, and pushed the pair below the stated level.

British pound and GBP/USD to face more selling pressure?

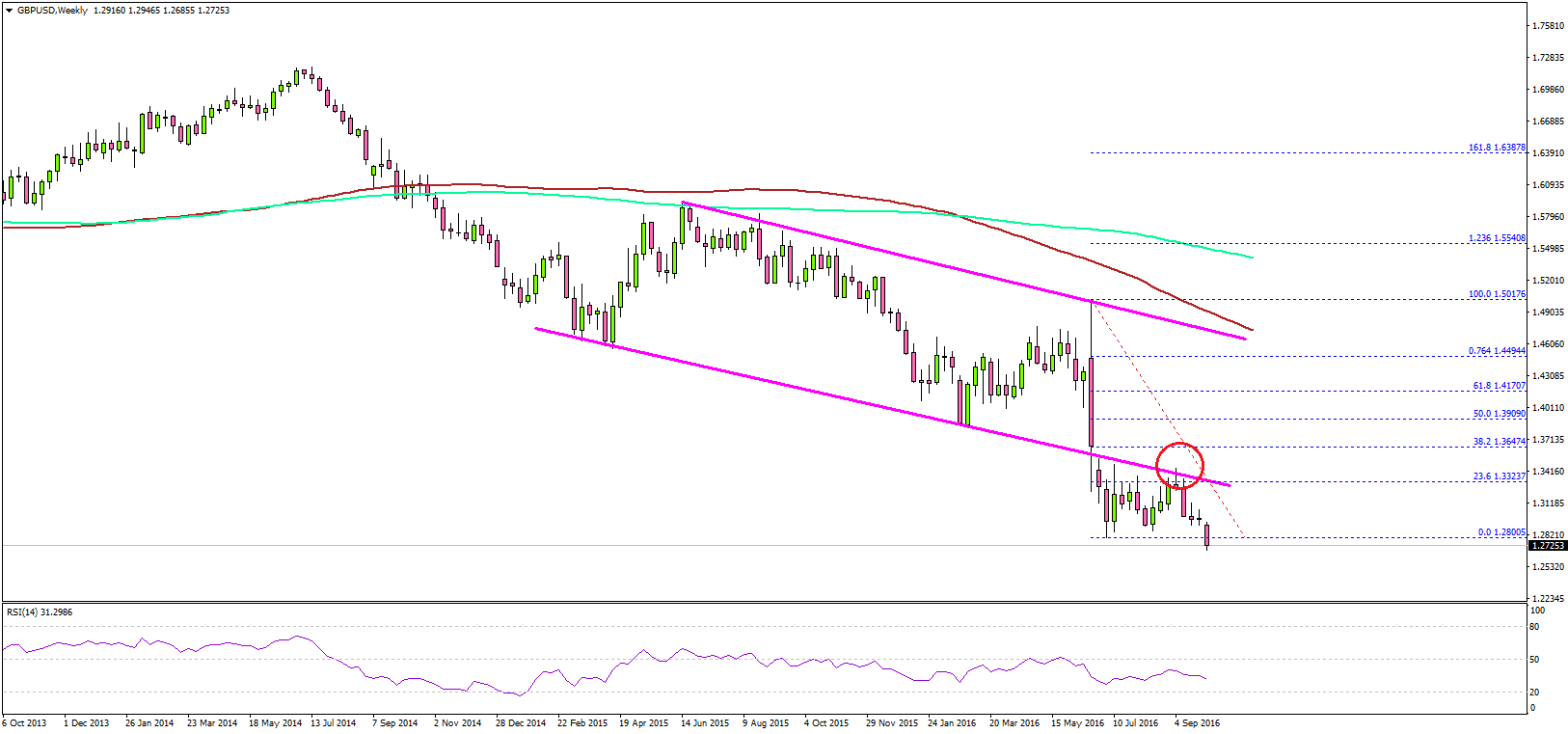

To analyze the British pound versus the US dollar and the recent decline, I would like to put focus back on the last post on the same subject. In that Brexit impact post, I highlighted a monstrous declining triangle pattern on the weekly chart.

I stated that the same broken lower triangle trend line may act as a resistance if the GBP/USD pair attempts to recover. Now, it did act as a hurdle, as can be seen from the updated weekly chart in this article.

Another point was that the 23.6% Fibonacci retracement level of the last drop from the 1.5017 high to 1.2800 low also acted as a perfect resistance. It prevented the upside move perfectly and ignited a downside move.

The weekly RSI also struggled to climb back above the 50 level, signaling further losses. Overall, more losses were written all over the chart. Going forward, the trend still remains bearish, and there are possibilities of more declines.

The next stop for British pound sellers may be around the 1.618 extension of the recent recovery from the 1.2796 low to 1.3430 high, which is at 1.2403. This is why I think the GBP/USD is heading towards 1.2500 in the near term.

Brexit Impact and EU Trade Deal

As mentioned, the Brexit is have a big impact and the recent talks in the UK for a transitional trade deal after Brexit is creating a stir.

There is still time for Britain to use the Article 50 clause to kick off cutting ties with the EU. In my view, as time moves, the British pound may continue to face pressure until things settle down.