Major US forex brokers posted mixed results in client deposit flows during May 2025, with some platforms gaining ground while others shed customer funds as the dollar rebounded from three-year lows.

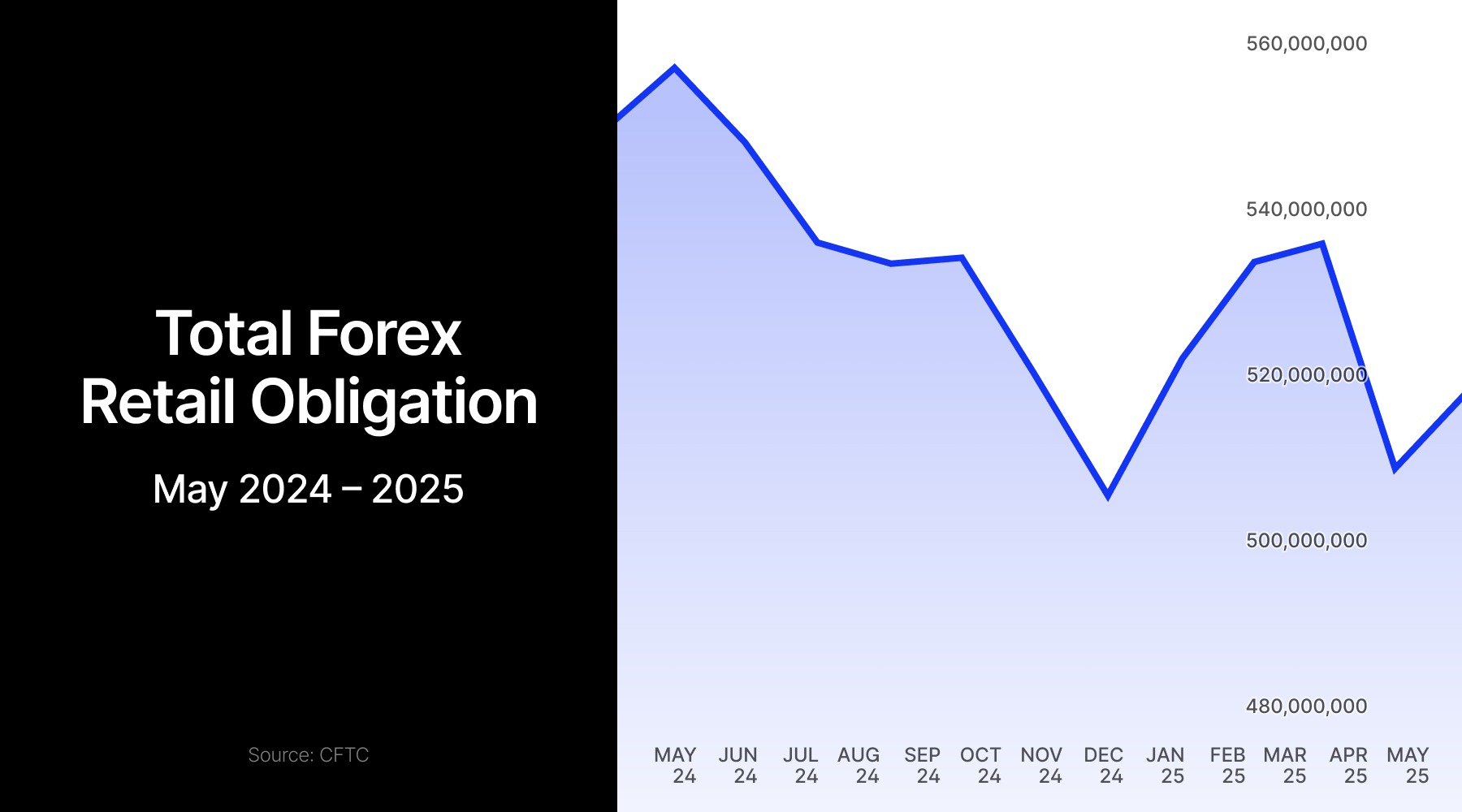

The industry average shows a modest month-over-month increase of about 2%, but a more noticeable 8% decline compared to the same period last year.

US Forex Brokers Deposits Jump in May 2025

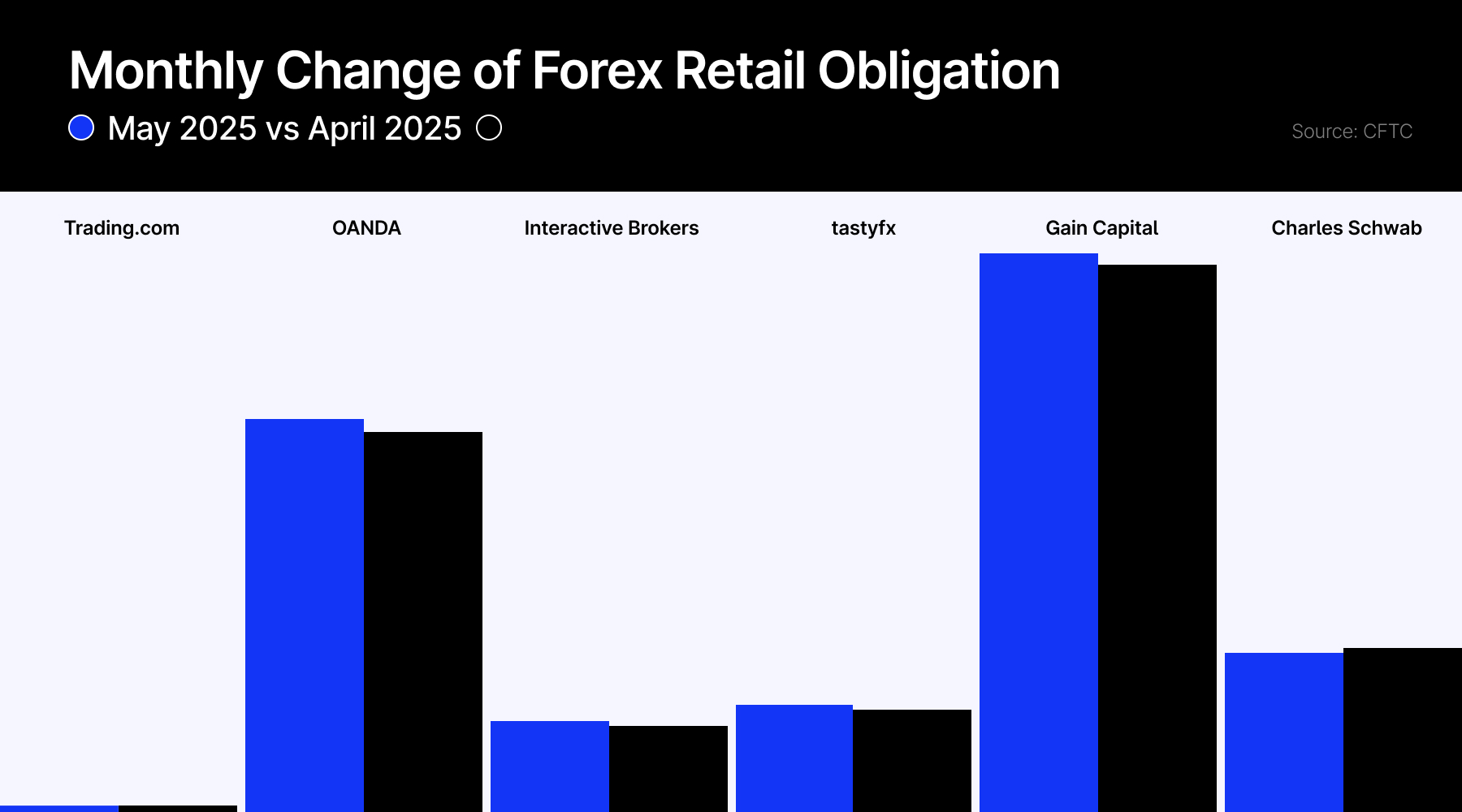

The data, compiled from regulatory filings with the Commodity Futures Trading Commission (CFTC), shows how retail forex traders reacted to heightened currency volatility that month. Interactive Brokers bucked the broader trend, recording a 6.4% jump in retail forex obligations to $35.3 million from April's $33.1 million.

But the gains weren't universal. OANDA, one of the larger retail FX platforms, saw deposits drop 5.8% to $151.5 million in May from $160.9 million the previous month. The decline came even as trading volumes typically spike during periods of increased market volatility.

The FX deposit movements coincided with a sharp turnaround in dollar sentiment. After hitting three-year lows in April, the greenback staged a comeback in May as traders reassessed Federal Reserve policy expectations and global economic conditions.

Deposit Flows Reflect Trading Sentiment

Charles Schwab maintained relatively stable client funds, posting just a 2% decline to $61.5 million in May from $62.8 million in April. The modest drop suggests retail traders at larger platforms may have adopted a wait-and-see approach during the currency turbulence.

Smaller players showed more dramatic swings. GAIN Capital managed to grow deposits by 1.9% to $215.1 million, while tastyfx (formerly known as IG US) gained 3.9% to reach $41.4 million in client funds.

Year-Over-Year Performance Also Reveals Industry Divide

In the yearly comparison, Interactive Brokers emerges as the clear winner with client funds surging 22% to $35.3 million in May 2025 compared to the same month in 2024. The success story contrasts sharply with OANDA's 23% year-over-year decline to $151.5 million, representing one of the steepest drops among major US forex platforms.

Meanwhile, GAIN Capital maintained its market leadership position with $215.1 million in client funds, though growth remained modest compared to previous years. Charles Schwab showed stability with minimal year-over-year changes at $61.5 million.

Trading.com posted a solid 10.6% year-over-year increase to $2.4 million.

Safeguarding Client Assets

The CFTC requires forex brokers operating under its jurisdiction to maintain substantial financial buffers as a safeguard for customer deposits. Latest filings reveal that all six examined companies meet or exceed the regulator's prescribed capital thresholds.

These numbers come from monthly reports that futures commission merchants and retail foreign exchange dealers must file with the CFTC.