The second foreign exchange volume survey for 2014 has marked a milestone for the North American Forex market.

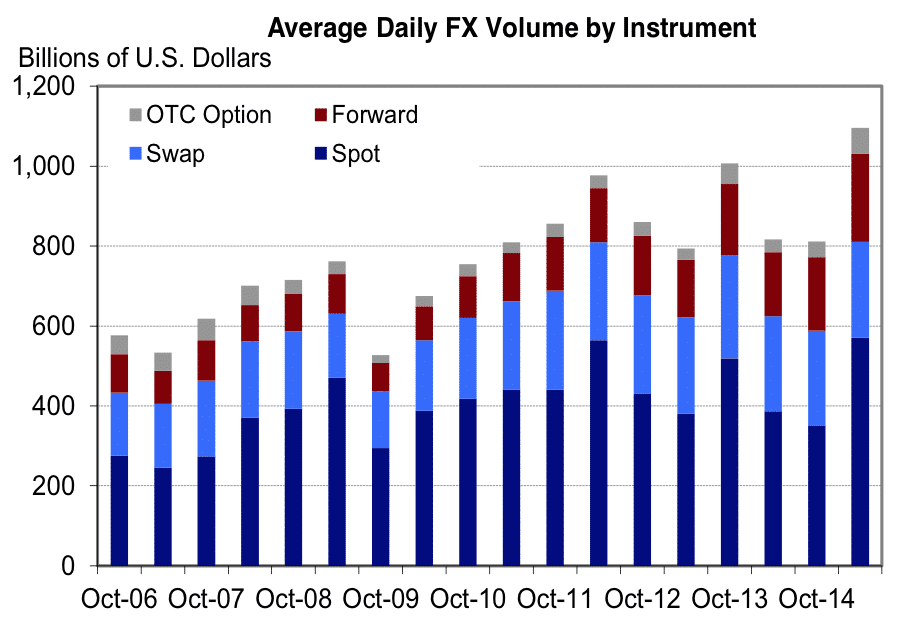

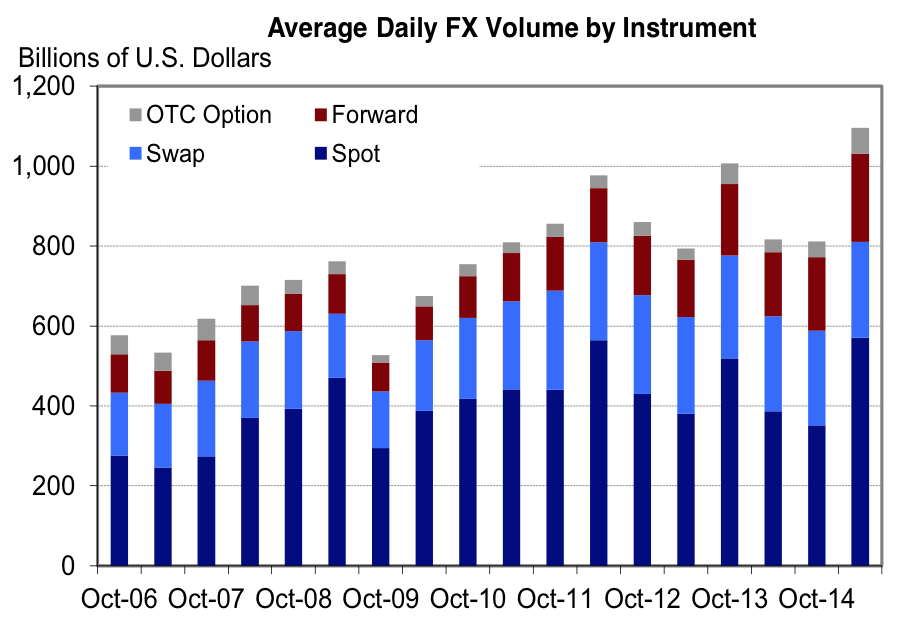

According to data collected throughout the period, over-the-counter (OTC) foreign exchange instrument transactions (including spot, outright forward, foreign exchange swap and option transactions) totaled a record $1,095 billion daily up to October 2014, which is the highest volume on record since the survey began in 2004.

The October 2014 number was 35% higher than the average daily volume (ADV) for the previous six months ending April 2014. It was also 34% higher than last year's figures.

Spot transactions have risen even sharper by 62% since the previous survey. OTC options and forwards volumes rose 66% and 20% respectively. Swaps trading consolidated, growing only one percent.

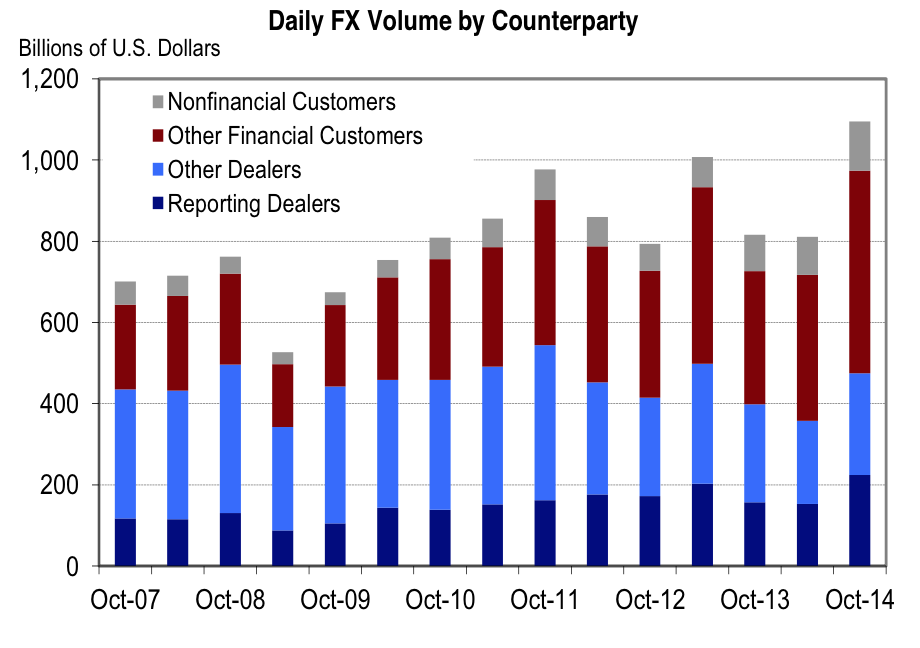

The increase in trading volumes across the spectrum is attributed to the rise of so-called "other financial customers" and reporting dealers, which respectively accounted for 49% and 25% of the growth figures.

Trading volumes across different currencies were led by the euro and the Japanese yen, which rose 52% and 41% when compared with the April 2014 figures.

Following is the full list of institutions participating in the survey: Bank of America, Bank of Montreal, The Bank of New York, Bank of Tokyo-Mitsubishi, Barclays Capital, BNP Paribas, Citigroup, Canadian Imperial Bank of Commerce, Calyon, CSFB, Deutsche Bank AG, Goldman Sachs & Co., HSBC Bank USA, JP Morgan Chase Bank, Mizuho Corporate Bank, Morgan Stanley, Royal Bank of Canada, Royal Bank of Scotland, Skandinaviska Enskilda Bank, Société Générale, Standard Chartered, State Street Corporation, Sumitomo Mitsui Banking Corporation, UBS Bank, Wells Fargo Bank N.A.

Following is the full data set of the North American Foreign Exchange Survey for October 2014.