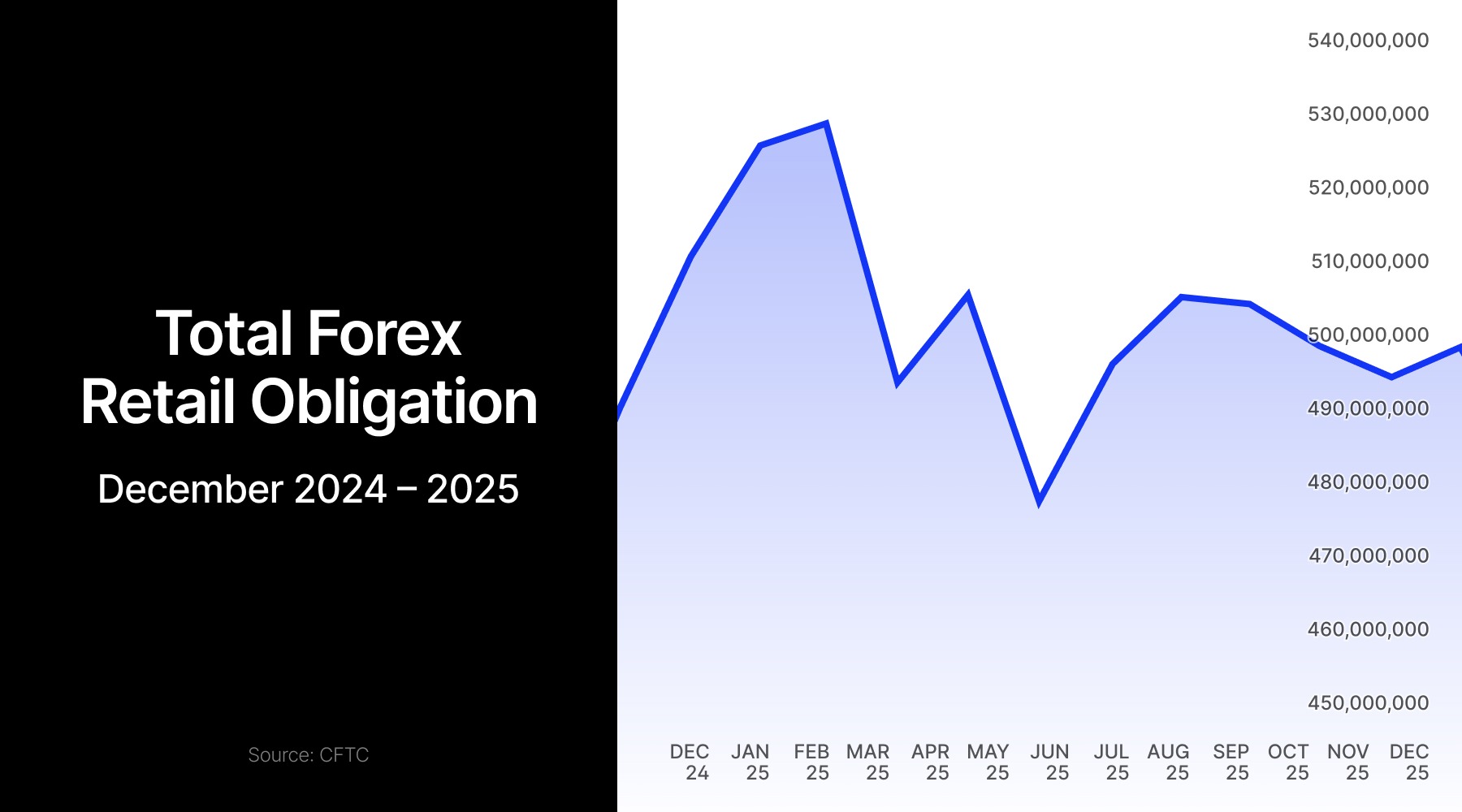

Retail forex deposits across major US platforms edged up 0.8% in December 2025, rising to $499.9 million from November's $495.7 million as the industry snapped a three-month decline that started in September.

The modest recovery pushed total deposits back toward the $500 million threshold but remained well below the $530.1 million peak reached in March 2025. Year-over-year, deposits grew 2% from December 2024's $491.3 million, suggesting retail currency traders faced persistent headwinds throughout the year despite isolated spurts of growth.

Interactive Brokers Posts Sharp Recovery

Interactive Brokers delivered December's most dramatic turnaround, jumping 20.8% to $32.5 million from November's $25.7 million. The $6.8 million monthly gain reversed the broker's steep November pullback and marked its strongest month-over-month percentage increase in recent periods.

The rebound coincided with broader momentum at the electronic broker. Interactive Brokers reported fourth-quarter 2025 revenue of $1.64 billion and earnings per share of $0.65, surpassing analyst expectations. Trading volume in options, futures, and stocks increased by 27%, 22%, and 16% respectively during the quarter.

Total customer accounts on the platform jumped 32% year-over-year to 4.4 million in the fourth quarter, while customer equity increased 37% to $779.9 billion. The firm also rolled out stablecoin funding for US clients, cutting account funding time to near instant.

Year-over-year, Interactive Brokers forex deposits climbed 8% from December 2024's $29.8 million, extending the platform's longer-term client acquisition momentum despite volatile monthly swings.

Schwab Recovers Ground After Sustained Decline

Charles Schwab posted the second-largest monthly gain in dollar terms, climbing 5.4% to $61.8 million from November's $58.5 million. The $3.3 million increase represented Schwab's strongest monthly performance since August and halted a slide that began in October.

The institutional broker added forex trading capabilities to its thinkorswim platform in April 2024, offering commission-free access to over 65 currency pairs. Schwab also expanded 24-hour trading access to retail clients in February 2025, joining an industry push toward round-the-clock market accessibility.

- Major Forex Brokers Feel the Pain as Dollar Hit Rock Bottom

- US Forex Deposits Rebound From 4-Month Lows as Dollar Strengthens

Despite the December gain, Schwab's deposits remained 3% higher than December 2024's $59.7 million, marking one of the more modest year-over-year increases among major platforms. The broker shed roughly $6.7 million in deposits during the final three months of 2025 as retail forex trading remained subdued.

Market Leader Faces Client Fund Outflows

GAIN Capital recorded December's largest monthly decline in dollar terms, dropping 1.9% to $211.8 million from November's $215.8 million. The $4.0 million outflow marked the broker's fourth consecutive monthly decrease and extended a pattern of client fund withdrawals that began in September.

Despite the recent slide, GAIN Capital maintained its position as the largest US retail forex broker by client funds and posted a 7% year-over-year gain from December 2024's $197.9 million. The platform held nearly 43% of total US retail forex deposits at year-end, though its market share has eroded from earlier peaks above 44%.

Smaller Brokers Show Mixed Results

tastyfx, the US brand of UK-based IG Group, declined 2.6% to $46.3 million from November's $47.5 million, shedding $1.2 million during the month. The pullback snapped two months of gains and brought deposits below the broker's September level.

Year-over-year, tastyfx posted a 13% increase from December 2024's $40.1 million, reflecting strong longer-term growth. The broker launched Prime accounts in September targeting professional traders with 6% promotional yields and reduced trading costs. Parent company IG Group reported record revenue of $50.9 million in the third quarter of fiscal 2025, up 30% year-over-year.

Trading.com slipped 4.7% to $2.9 million from November's $3.0 million, posting a $136,000 monthly decline. Despite the December setback, the platform showed the fastest annual growth rate among tracked brokers with deposits up 27% from December 2024's $2.1 million. Trading.com, part of the Trading Point Group that also operates XM, secured US regulatory approval as a retail forex dealer in April 2020.

OANDA Holds Steady Amid Ownership Transition

OANDA edged down 0.4% to $144.6 million from November's $145.2 million, slipping $614,000 during the month. The marginal decline extended the broker's losing streak to six consecutive months and marked its lowest deposit level since December 2024.

The December data arrived as prop trading firm FTMO completed its acquisition of OANDA from private equity firm CVC Asia Fund IV. The transaction, announced earlier in 2025, received final regulatory approval in November after an eight-month process involving five separate regulators. FTMO has indicated plans to maintain OANDA as a standalone business.

The figures reported monthly by US forex brokers represent “Total Retail Forex Obligations” rather than simple customer deposits. These obligations reflect the total amount brokers owe to retail forex customers, combining initial cash deposits with unrealized profits or losses on open positions plus other payable balances like margin excess and account credits.