The Federal Reserve decided to keep interest rates unchanged, reduce asset purchases by $10bn and a general policy to remain on the course already set by the central bank. In essence, the contents of this week's Fed meeting was largely expected although accompanying data and commentary provide an insight into the Fed's future actions.

From Then to Now

In her iconic appearance at Jackson Hole in August, Janet Yellen emphasized employment conditions being paramount in the Fed's road map for normalizing monetary policy. With positive indicators in the form of GDP, jobless claims and a falling unemployment rate helping the Fed to justify tapering, Ms. Yellen said she was "surprised by the economy's strength," in August this year.

However, at this month's FOMC meeting, Yellen made two remarks on labor market developments that could be considered dovish upon reinterpretation at a future date. Firstly, Ms. Yellen stated, "The slow increase in wages was indicative of labor market slack." Secondly, she said that there was a "meaningful cyclical shortfall in participation." Both factors are rather macroeconomic and would take years to rectify.

The Fed maintained its vow to keep interest rates near zero for a “considerable time,” even after bond purchases cease in October this year. Forex Magnates' research suggests that the vast majority of market participants expect the Fed to make its first interest rate increase since 2006 no earlier than July 2015.

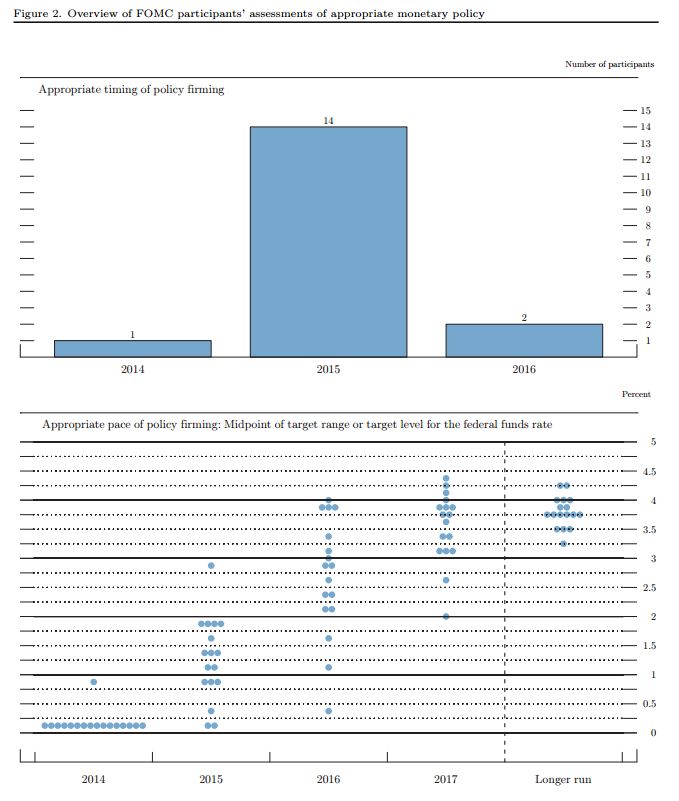

For the first time, the central bank released policy makers’ predictions for rates in 2017. Most Fed officials (14 out of 17), expect to start raising short-term interest rates from near zero in 2015, according to the forecasts released. According to the Fed's statistics, most officials see short-term rates above 3% – and somewhere near what officials consider the long-run normal rate – around three years from now. The new projections show officials expect their benchmark short-term rate, the federal funds rate, to be between 1.25% and 1.50% in late 2015 and between 2.75% and 3.0% in late 2016.

Fed Member Projections for Future Interest Rates | Source: Federal Reserve

The Fed slashed its 2015 GDP growth forecast range down to 2.6%-3.0% in September, down from 3.0% to 3.2% in June.

It's worth remembering that in January 2012, the Fed's 2014 growth forecast was in the range of 3.7%-4.0%. Now, that forecast is 2.0%-2.2%. The actual figure will only be known in 2015, and if it meets the forecast expectations, it will be the first time a Fed growth forecast has been accurate.

With Tapering Nearly Done, What Happens to Existing Purchased Assets?

The Fed's balance sheet is now $4.4 Trillion - 4 times larger than in 2008. The Fed insists it is committed to reducing the balance to a more normal size but how it plans to do that has changed. In yesterday's statement, the Fed formally announced it does not plan to sell any of its assets, a complete U-turn on the plans that were presented at the launch of all QE phases.

In a revised approach, the Fed said it will eventually stop reinvesting maturing securities and let them runoff. However, the central bank claims this process will not start only until after benchmark interest rates have risen. "The Committee has concluded that some aspects of the eventual normalization process will likely differ from those specified earlier," according to an official press release. "The Committee currently does not anticipate selling agency mortgage-backed securities as part of the normalization process, although limited sales might be warranted in the longer run to reduce or eliminate residual holdings."

“The decisions the committee makes about what is the appropriate time to raise its target for the federal funds rate will be data dependent.” Adding, “There is no mechanical interpretation of the time period.” said Ms. Yellen when asked about the likely timing of future rate increases.

The Fed also announced that it will tweak its own normalization policy in order for Fed exit policy to be more effective. Instead of focusing on base interest rate banks use to lend to each other, the Fed plans to target the level of interest received by banks for capital deposited at the Fed. Additionally, the Fed wants to introduce a rate at which non-bank financial institutions can deposit capital at the Fed at a slightly lower level than the base interest rate set by the Fed.

Market Reaction

Equity markets were volatile during the time of the press conference but overall Fed comments were taken positively. The S&P 500 rose above 2,000 to close within reach of its all-time high, while the Dow consolidated above 17,000. The U.S dollar reacted positively, appreciating across the board against all other currencies. The AUD/USD rate in particular suffered extensive declines before and after the press conference.

Dissenters

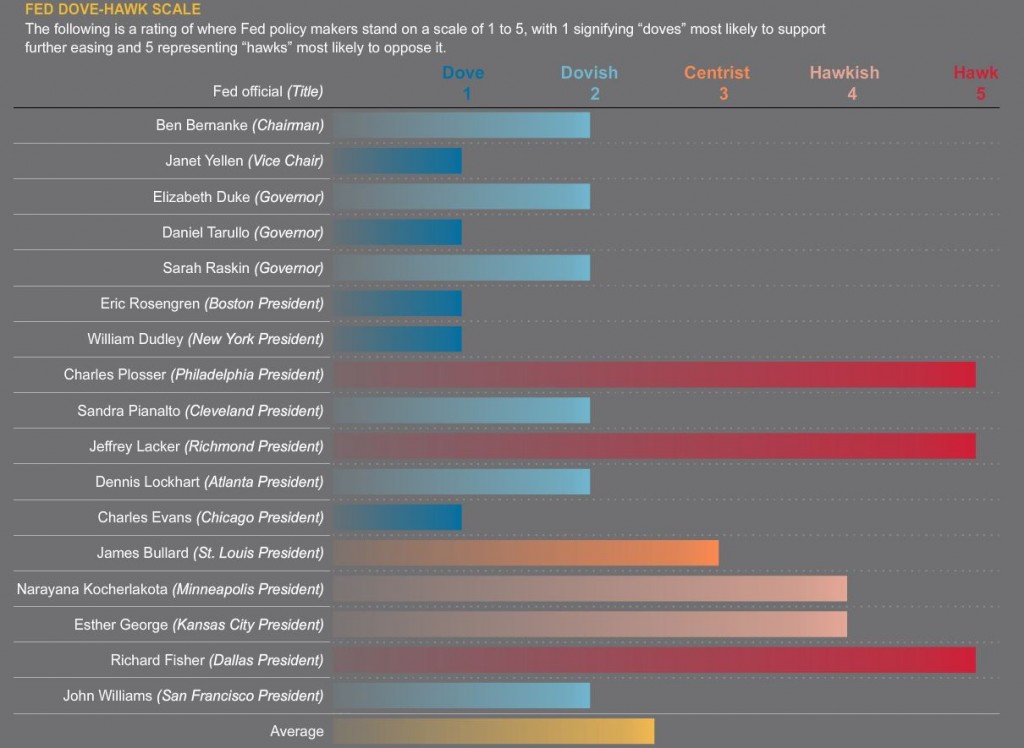

Dallas Fed President, Richard Fisher joined his Philadelphia counterpart Charles Plosser in dissenting against the Fed’s decision.Both cited the guidance on "considerable time" as overstating the amount of time the Fed has, and given their generally hawkish stance, their dissent was not unexpected.

Federal Reserve Member Stances

Source: Thomson Reuters

Related News

This week sees the resolution of the Scottish independence saga and the introduction of a new Targeted Long-Term Refinancing Operation (TLTRO) in Europe. Both of these issues have dominated market attention and price volatility more so than the Fed and this is where investor attention is focusing this Thursday and Friday.

A Scottish 'No' vote is likely to be GBP positive although a 'Yes' vote is unlikely to weaken GBP much further considering the downside price action already seen over the past 3 weeks. The event risk is to the upside. EUR/GBP will be a volatile currency pair over the next two days.

The ECB's TLTRO shows two things. One is that European authorities are ready to create new acronyms from a seemingly infinite list, and secondly, that the ECB is becoming increasingly desperate in its fight with creeping deflation and low business activity. The Liquidity and funding problems at some of Europe's largest banks has forced the ECB to reduce interest rates to 0.15% with negative interest rates on the horizon. The latest financing operation will be important in terms of its popularity and market reaction from market participants, because investor confidence isn't infinite and could eventually fall short if the ECB simply floods the markets with cheap capital a la Fed. With a banking union to be initiated later this year and more European integration being planned by the European Commission and ECB - this TLTRO is a barometer of the banking industry in Europe.