Janet Yellen - Chair of the Federal Reserve

This year’s highly anticipated central banker symposium in Jackson Hole, Wyoming, has failed to provide concrete policy announcements and was generally considered as a tepid gathering by market analysts.

The theme for this year’s gathering was “Re-Evaluating Labour Market Dynamics," so clearly the broad focus of the meeting was on employment conditions. However, given that labour markets are so diverse from country to country and are all recovering at varying rates across the world, the takeaway from the meeting is that monetary policy divergence is inevitable.

During Janet Yellen’s first visit to Jackson Hole as Fed Governor, her comments were broadly hawkish, although such a performance was anticipated by most market participants what with October 2014 being earmarked as the date when the Fed finally begins winding down its stimulus measures which began in 2008.

Ms. Yellen reiterated that US hiring has improved and “debate at the Fed is shifting toward when we should begin dialing back our extraordinary accommodation." Adding, “There is still a significant under-use of the workforce, and the labour market has yet to fully recover from the worst recession since the Great Depression." Other Federal Reserve members offered similar views, such as Fed Bank of St. Louis President, James Bullard, saying, “Monetary policy may be tightened earlier than officials previously expected."

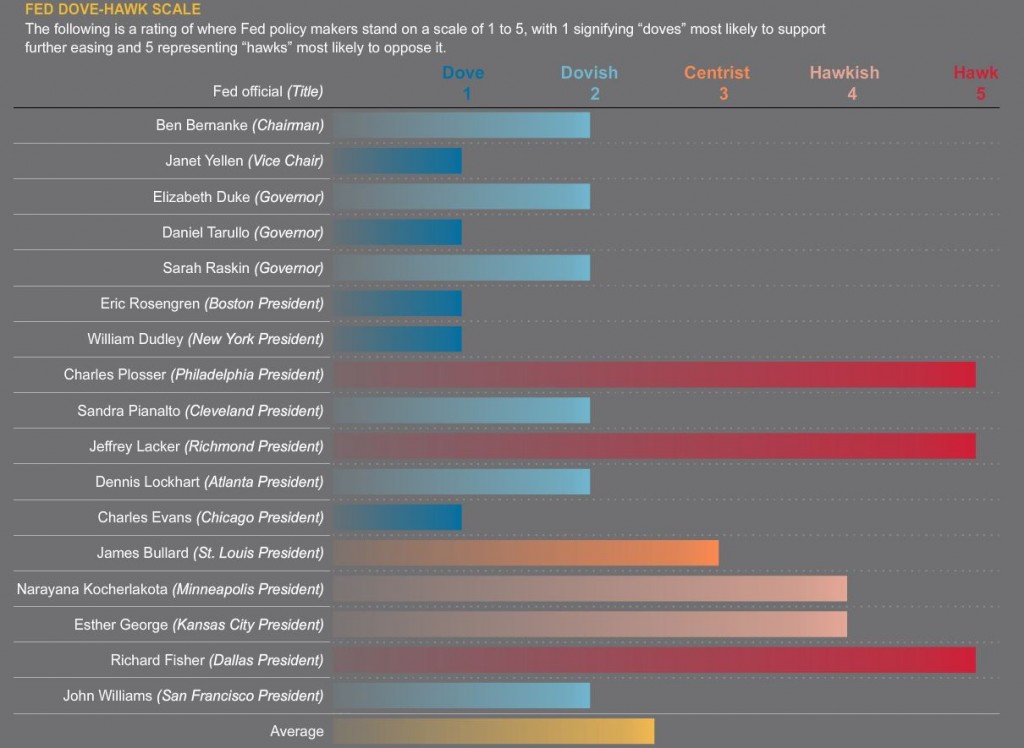

On the flip side, Atlanta Fed President, Dennis Lockhart, said "Conclusions about the strength of the economy have to be taken as tentative,” and that he was “one of those who’s thinking in terms of the middle of next year [2015]” for the first rate increase. San Francisco Fed President, John Williams, also echoing that time frame. Looking at the broader picture of Fed member stances, it is clear that Fed officials are showing an increasingly widening split concerning the future outlook.

Federal Reserve Member Stances

Source: Thomson Reuters

The Best of the Rest

Other central bank chiefs are taking a different policy path too. Mario Draghi, the acting ECB President, has a far more dovish leaning nature than even the most 'arch doves' at the Fed. Draghi’s remarks reinforced speculation that the ECB will only begin quantitative easing over the next 6-12 months, despite cutting its benchmark rate to a record low of 0.15% in June 2014, and providing a plethora of measures designed to keep borrowed capital cheap for Europe’s commercial banks.

Mario Draghi - European Central Bank President

The Bank of England’s representative at Jackson Hole – Deputy Governor Ben Broadbent suggested future interest rate increases will be gradual. He is quoted as saying, “We have tried to communicate that the path of interest rates that’s likely to be necessary to meet our mandate is going to be materially different than in the past." Mr. Broadbent was in agreement with Fed officials that central banks “must now consult labour-market data to better assess inflation given the extreme changes in market conditions,” since the start of the financial crisis in 2007/2008.

Other central bankers at Jackson Hole expressed little or no enthusiasm for tighter monetary policy. Yesterday, Bank of Japan’s Haruhiko Kuroda said the bank will persevere with low interest rates until price stability is achieved with the bank ready to act in the interim if inflation conditions changed.

Mr.Kuroda went as far as to suggest that the Bank of Japan is ready to extend its low interest rate policy beyond the 2015 fiscal year if inflation failed to reach its 2% target (including the sales tax increase in April 2014, Japan’s inflation rate is 3.6% as per July 2014 - excluding sales tax the inflation rate is 1.3%).

Ben Broadbent - Bank of England Deputy Governor

Bank of Canada’s Governor, Stephen Poloz, said that Canada’s labour market “isn’t creating the full-time jobs and income that could be expected in a recovery,” which justifies keeping interest rates near historic lows. The Canadian unemployment rate currently stands at 7% according to the latest figures released in July.

Market Reaction

The market reaction to the Jackson Hole symposium was rather different compared to previous years. After past meetings, post-market reaction was always positive for stock markets given the propensity of stocks to rise when interest rates are cut or capital becomes easier to borrow.

At the 2010 meeting where Ben Bernanke famously announced ‘QE2’, the S&P rallied by 17 points. In 2011, the S&P rallied by 51 points. In 2012, when Ben Bernanke outlined the case for ‘QE3’ the S&P rallied by 14 points. In 2013, the S&P rallied by 21 points after Janet Yellen’s unexpected dovish comments in Bernanke’s absence from the meeting.

This year, the S&P declined by 4 points, presumably due to expectations that interest rates are close to heading north for the first time since 2004. At the start of trading this week, Asian stocks were volatile but remained largely unchanged, not helped by low trading volume and a UK bank holiday.

In the FX market, several currency pairs are reflecting the comments made at Jackson Hole. EUR/USD opened at 1.3195 at the start of trading in Asia on Monday, falling over 80 pips since Thursday’s close. EUR/GBP and USD/JPY were also affected but to lesser degrees.

The Verdict

The focus on jobs suggests the Fed and Bank of England will tighten policy within a year as their economies show signs of strengthening, according to official statistics. By contrast, European Central Bank President, Mario Draghi and Bank of Japan Governor, Haruhiko Kuroda, acknowledged they may be inclined to maintain loose monetary conditions for longer or to increase their magnitude if need be. Policy divergence between the major central banks is looming.

The effect on financial markets is likely to be gradual but significant – especially for FX rates which are most sensitive to Yield differentials and future interest rate expectations. As some countries maintain stimulus measures and low interest rates (Europe, Japan, Canada) others are expected to tighten interest rates over the next 6-12 months (US, UK). The currency pairs at most risk of significant capital inflows/outflows are:

USD/CAD (at risk of rising if Fed hikes while BoC stays unchanged)

EUR/USD (at risk of falling if Fed hikes while ECB stays unchanged)

EUR/GBP (at risk of falling if BoE hikes while ECB stays unchanged)

GBP/CAD (at risk of rising if BoE hikes while BoC stays unchanged)

USD/JPY (at risk of rising if Fed hikes while BoJ stays unchanged)

GBP/JPY (at risk of rising if BoE hikes while BoJ stays unchanged)

Investors are likely to favour increasing rates of return on capital in the US and UK in favour of static rates of return in Japan, Canada and the Euro-zone. It’s also worth mentioning that negative interest rates have already reared their head in both Europe and Switzerland over the past year within institutional money markets.

What Goes up Must Come Down

According to the Bureau of Labour Statistics (BLS), the US unemployment rate is currently 6.2%, having fallen from a high of 10% at the height of the financial crisis in 2009. At the peak of the dot-com recession the US had an unemployment rate of 6%. This puts the current recovery in perspective in terms of magnitude.

All the monetary policy accommodation provided over the past 6 years has only gone so far as returning the US economy to the same labour market conditions as in the early 2000’s. The Fed seems to believe that today's unemployment in the US is cyclical whereas in fact it is structural. The jobs are not coming back for a variety of reasons, with the elephant in the room being mechanization.

Corporations are able to sustain their profitability and generate earnings growth despite stagnant labour market conditions and a lower participation rate because technological innovation is allowing companies to raise productivity and production while lowering the amount of people they employ.

This would also help explaining the increasing popularity of part-time and temporary vacancies offered by employers. It’s rather curious that the Fed omits this glaring issue in all of its communications as it continues on its quest of maintaining price stability despite the most gargantuan provision of cheap capital in history.

The fear among market participants is that when policy ‘normalization’ finally takes place, financial markets will not be able to cope because the strongest catalyst for most asset classes over the past 7 years has been cheap capital and debt – which is now being taken away.

Can the financial markets maintain their lofty levels? Or merely avoid seizure without Fed life support?... These are two questions that may soon be answered if the Fed pulls the trigger on its tightening plans later this year.