After the unfolding of an escalating geopolitical spat between the Ukraine and Russia, which evolved into "the West" and Russia, currency Volatility is slowly picking up despite the usual summer industry slowdown. Today we received the news that the Ukrainian currency, the hryvnia (UAH), has marked a new all-time low. While the news in itself hardly comes as a major surprise, as well as having barely any direct relation to the Forex industry, a chain of events which could shake up FX volatility going forward is developing.

As the Ukrainian currency has hit a new all-time low, the Russian ruble hovered close to its rock bottom mark in March this year, just below 37 RUB per US dollar. But wait, since we have had this ongoing theme for so long, why should we worry about the value of the hryvnia or the ruble now? What has changed since March when we witnessed the most dire conditions for the ruble on the FX market?

The major change is the rhetoric between the parties in the geopolitical conflict and the ongoing sanctions war which is on the brink of bringing about a drastic change in the economic livelihood of a big part of the region (and by saying "the region", I do mean Europe). Major FX volatility appears to be turning the corner, albeit conclusions of a material recovery would be hasty, especially bearing in mind that we are trading through August now - a month with historically low activity in the currency markets.

FX Volatility Chart, Source: GAIN Capital Q2 Earnings

Escalation Post Flight MH 17

The unfortunate event which caused the Ukrainian army and the West to harden their stance on the Eastern Ukraine, allegedly Russian supported separatists, has been a trigger for present two-way sanctions. While for months companies have been downplaying the conflict and denying any major effects on trade relations between the EU (European Union) and Russia, the time has come when it has become increasingly difficult to ignore the looming consequences of a two-way sanctions war and an increasingly isolated Russia.

According to an International Monetary Fund (IMF) spokesperson, Christine Lagarde, the Managing Director of the IMF had a meeting with Governor of the National Bank of Ukraine, Valerya Gontareva and Minister of Foreign Affairs, Pavlo Klimkin on July 28, in Washington, D.C. The discussion focused on the recent political developments in Ukraine and the authorities’ efforts to implement the economic reform program supported by a Stand-By Arrangement with the IMF. The managing director encouraged steady implementation of the authorities’ reforms, including the policy package needed for completion of the first review under the program supported by the IMF.

The reforms which were requested by the IMF have resulted in the resignation of Ukrainian Prime Minister Arseniy Yatsenyuk, however, a move that was never ratified by the parliament. Necessary harsh budget cuts and the ongoing war effort in Eastern Ukraine can have a lot of weight on the hryvnia going forward, as political parties can rapidly lose the support necessary for these reforms.

Global Oil Prices

While the conflict is ongoing across the pond, Russian authorities are seeing oil prices declining on a protracted basis. In July we saw crude oil dropping by almost 3%, still ongoing throughout the beginning of August.

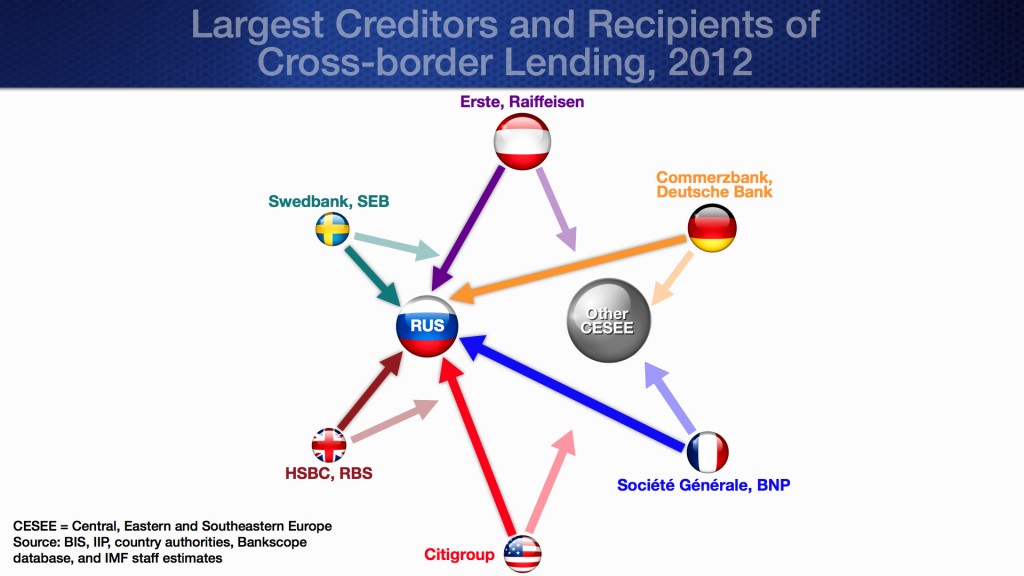

According to the IMF Commodity Market Monthly, "The declines occurred despite geopolitical tensions in a number of countries in the Middle East, Africa and Central Europe, because of slowing demand and well supplied markets." With the Russian budget counting on an average price of $100 per barrel we are getting dangerously close to that level now. Spillover Effects to the European Union If there are material disruptions in trade and financial flows with Russia, there are a number of countries which would suffer. Many Eastern European countries have close connections with Russia, a number of those could be materially impacted by an escalating sanctions counter-sanctions Exchange . With the Western European economies being less affected in a direct way, they do have exposure to Eastern European countries, so the resulting rift can quickly move to affect the core of a fragile European economy. According to IMF Direct, "For Russia’s immediate neighbors such as Belarus, Ukraine, Moldova, and the Baltics, whose exports to Russia exceed 5 percent of their respective GDP, the impact could be substantial." The same source published a research paper dubbed, "Europe’s Russian Connections" which also states, "Many Western banks have sizable exposures to Russia. Notably Austrian, Hungarian, French, and Italian banks have subsidiaries in Russia and also lend directly to customers in Russia from their branches outside Russia. For some of these banks, their Russian operations have accounted for a large share—in some cases over one third—of their profits in the last few years."

Cross Border Lending, IMF Direct, Source: BIS, IIP, Country Authorities, Bankscope Database, IMF Staff Estimates

This summer could be different for FX volatility - while it may not immediately spell out increasing volumes for the industry, it can certainly play a role in the unfolding of some more tumultuous events come September, when the major market participants return to their screens. With the Federal Reserve's adding its tapering efforts to the mix, we may just see the usual increase in market moves.