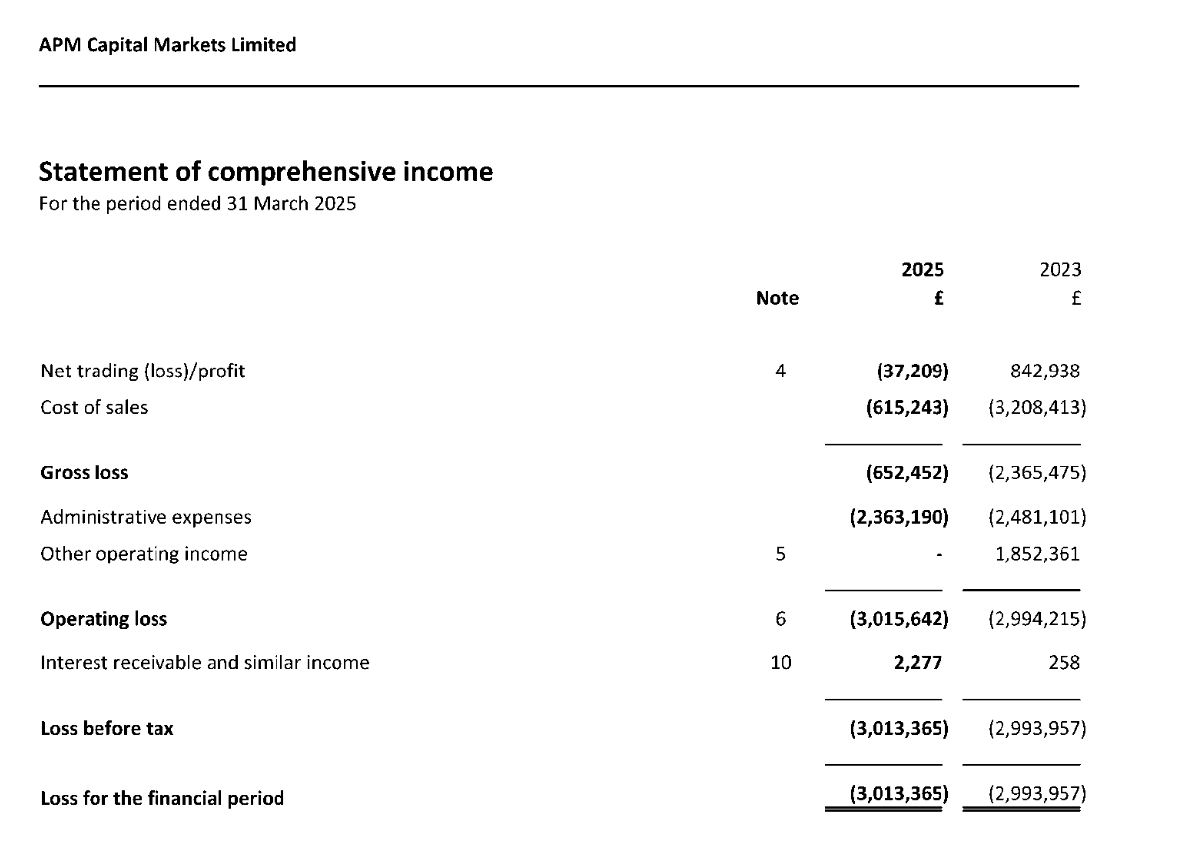

APM Capital Markets Limited, formerly BUX Financial Services, posted a post-tax loss of £3.0 million for the 15-month period ending 31 March 2025. This is slightly higher than the £2.9 million loss recorded in the previous 12 months. According to UK company filings, the company attributes the decline to a strategic pause and corporate restructuring following its sale in the second quarter of 2024.

Net Trading Profit Collapses Amid Restructuring

Audited statements show net trading profit fell from £843k in 2023 to just £37k, while administrative expenses remained significant at £2.36 million. Other operating income, previously boosted by £1.85 million in intercompany fees, dropped to zero.

- Retail Trading & Prop Firms in 2025: Five Defining Trends - And One Prediction for 2026

- Retail Brokers Can Now Access Risk and Trading Solutions via Spotware and iSAM Securities

- APM Capital Markets’ Revenue and Profit Decline Ahead of Acquisition

The strategic report notes: "The key reason for this are due to a reduction in the client base and halt in trading operations as a result of the sale process." The report adds that 2024’s strategy was "not to grow the business" but to position it for sale and relaunch.

Earlier this year, the firm appointed Joshua Owen as CEO following UAE-based APM Capital’s acquisition of BUX’s UK unit. Owen, now also an Executive Director on APM Capital Markets’ board, replaced Salim Sebbata, who joined Capital.com.

Net Assets Rise Amid Cash Decline

Net assets rose slightly to £1.536 million, supported by £3.115 million raised through share issuance. Cash and cash equivalents fell from £6.28 million to £2.75 million, reflecting a £6.6 million net cash outflow from operations and reductions in creditor balances.

The company is preparing a rebrand and a dual-market strategy targeting retail and corporate clients. Retail offerings will focus on digital access, educational tools, and platform usability, while corporate services will include bespoke trading solutions.

Technology Upgrades, Rebrand Planned Ahead

APM highlighted its risk management and regulatory compliance. The firm operates under the FCA, follows the Investment Firms Prudential Regime, and maintains an Internal Capital Adequacy and Risk Assessment process.

Looking ahead, the firm plans technology upgrades, a global rebrand, strengthened compliance measures, and the introduction of exchange-traded derivatives.

APM stated: "While revenue performance over the period has been impacted by this transitional activity. These short-term financial results are in line with expectations and reflect deliberate investment into repositioning."