As Revolut gears up to become a fully licensed UK bank, it's on a hiring spree, aiming to transition from a disruptor to your primary banking partner.

Revolut's Recruitment Rampage: Staffing Up for Banking Glory

Revolut, the fintech darling that made traditional banks sweat with its sleek, app-first approach, is now playing an even bigger game. After years of shaking up global finance, the company has set its sights on full-fledged UK banking status. But becoming a bank isn’t just about slapping a new title on the door—it requires a massive operational upgrade. Enter Revolut’s latest power move: a full-blown hiring spree.

Revolut UK hiring a hundred new bank staff, from regulatory reporting analysts to financial risk controllers, as it prepares to exit the bank mobilization phase in July. CEO Francesca Carlesi told Bloomberg that the bank went from 35 to over 100 staff members through hires and… pic.twitter.com/G43ULLoaR8

— Max Karpis (@maxkarpis) March 13, 2025

The company is recruiting more than 100 new employees to bolster its banking operations in the UK, a clear signal that it's gearing up for the final stages of securing a full banking license, according to Bloomberg. Revolut has already made banking plays in Europe, holding a license in Lithuania that allows it to operate across the European Economic Area (EEA). But the UK, one of the world’s most tightly regulated financial markets, has been a harder nut to crack.

According to Bloomberg, the company is hiring 100 new employees across roles such as regulatory reporting analysts and financial risk controllers as it moves past operational restrictions imposed by the UK central bank. Since obtaining a restricted banking license last summer, the London-based fintech has grown its UK banking division from 35 to over 100 employees through both new hires and internal transfers, according to Francesca Carlesi, Revolut’s UK CEO. Carlesi added that the UK banking unit is expected to reach around 200 staff members by the end of the year. The digital challenger bank recently secured its long-awaited UK banking license.

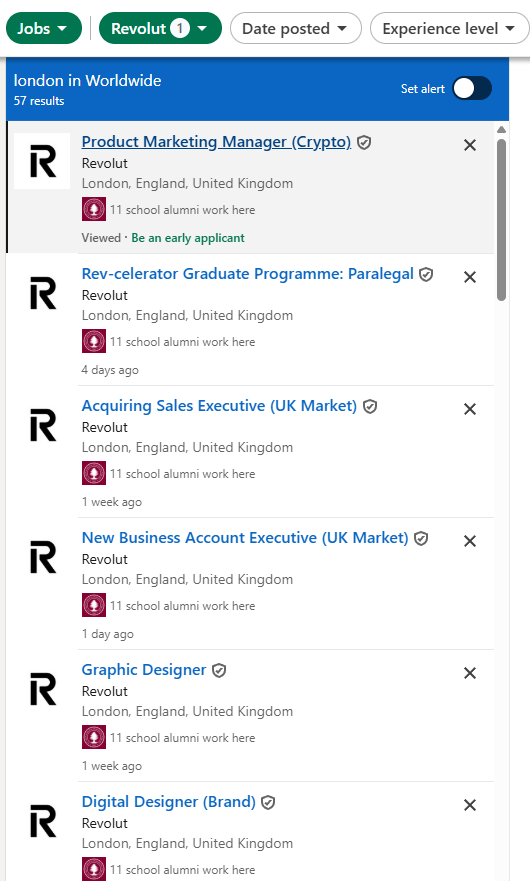

At the time of writing, there were 57 open jobs at Revout listed on LinkedIn, filtered by location, London. The positions included Product Owner, Credit Analytics Manager, Group Head of Sanctions (Risk), Acquiring Sales Executive (Enterprise), FinCrime Risk Manager (KYB), Legal Counsel (Private Bank), Regulatory Strategy Lead and more. While it’s impossible to confirm that these hires are (all) related to the company’s UK moves, it certainly seems as if things are happening in London.

This hiring push follows years of back-and-forth with the Bank of England and UK regulators, who have scrutinized Revolut’s internal governance, compliance processes, and financial reporting. Now, with key roles being filled and a clear regulatory roadmap, the fintech giant is betting big on its future as a fully licensed British bank.

From Disruptor to Dominator: The CEO’s Vision

Francesca Carlesi, Revolut’s UK CEO, recently shed light on the company’s ambitions at the MoneyLive Summit in London. Her message? Revolut isn’t content with being a flashy alternative bank—it wants to be the bank for millions of Brits.

“We want to move from being a disruptor to being a primary banking partner,” Carlesi declared, emphasizing that the fintech’s long-term goal is to become the go-to institution for everyday banking needs. “It’s about deepening the relationship with our customers, it’s about not just having a Revolut card in your wallet when you travel but making sure Revolut comes top of mind for any financial needs,” she said.

Revolut UK CEO stresses Revolut's ambition to shift from “disruptor” to primary bank https://t.co/Nt2zKBgDr1 pic.twitter.com/BgKS5Vg1Pj

— Tech.eu (@tech_eu) March 10, 2025

Revolut has long been the bank you use when you travel or the app you keep for managing different currencies. But Carlesi’s comments make it clear that the company is positioning itself as a viable alternative to high-street banking, capable of handling salaries, savings, mortgages, and business banking—all under one digital-first roof.

But to do that, it needs a full banking license. And that’s where things get complicated.

The Regulatory Rumble: Revolut vs. The Establishment

The UK’s financial regulators have never been ones to roll out the red carpet for disruptors, and Revolut has had its fair share of run-ins with the powers that be.

One of the biggest hurdles? Compliance concerns. The Bank of England has scrutinized Revolut’s ability to meet the rigorous oversight and reporting standards required of traditional banks. There have been whispers of concerns over financial controls, risk management, and even accounting practices—issues that have delayed the licensing process.

And then there’s the ongoing battle over interchange fees. Revolut has clashed with regulators over the fees it collects when customers use their cards, with critics arguing that the fintech ’s structure allows it to exploit loopholes in the UK’s payment rules.

Fintech News 🚨: @RevolutApp and @Visa Challenge UK Proposal to Cap Interchange Fees

— Sam Boboev (@samboboev) March 11, 2025

Revolut and Visa reportedly filed legal challenges against the U.K.’s Payment Systems Regulator (PSR), seeking to overturn the regulator’s proposed cap on interchange fees on cross-border… pic.twitter.com/vSNvMbt9ZP

Yet, despite these challenges, Revolut remains undeterred. It has worked extensively with regulators to tighten compliance measures and strengthen governance frameworks. The current hiring spree is part of that effort, ensuring that the company has the right personnel in place to navigate the increasingly complex world of UK banking regulations.

“We have been in constant and open dialogue with our regulators, to ensure our mobilization meets the highest standards,” Carlesi said. “We’re in no rush, as getting this right matters more, so once everyone is ready, we’ll launch the UK bank and begin to operate as one of the UK’s newest banks.”

Mobilization Mode: The Final Countdown

Right now, Revolut is—in its own words, “mobilizing”, where it’s built out its banking infrastructure while working closely with a limited number of customers to test its systems before going fully live. Think of it as the final dress rehearsal before stepping onto the big stage. If all goes to plan, Revolut expects to complete this phase by July of next year.

Once mobilization wraps up, Revolut will shift its millions of UK customers onto its new, fully licensed banking entity. This will bring a host of benefits, including access to FSCS-protected deposits and a wider range of financial services.

Of course, all of this hinges on regulators giving Revolut the green light. But with the hiring spree in full effect and operational upgrades underway, the fintech appears more prepared than ever to take on the UK’s banking elite.

The Big Picture: A Fintech Force to Be Reckoned With

Revolut isn’t going away. With over 50 million customers worldwide and more than 10 million in the UK, the company has already built an empire that most challenger banks can only dream of.

Its aggressive expansion strategy, coupled with its commitment to innovation, positions it as a serious threat to traditional banks. Whether regulators approve its full banking license or throw more hurdles in its path, one thing is clear—Revolut is on the up.

And if it gets that final stamp of approval? The UK’s banking landscape may never look the same again.

For more stories around the world’s most impactful fintech firms, visit our fintech section.