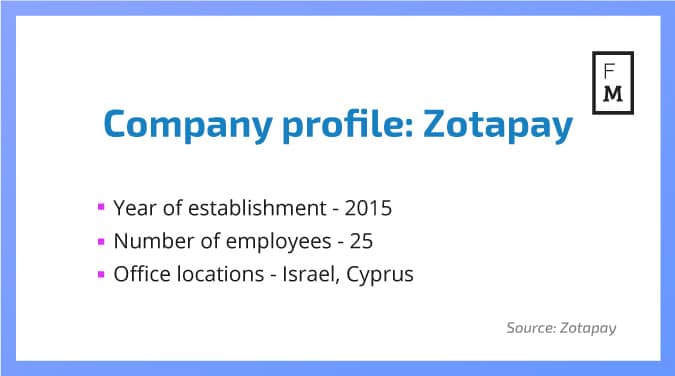

Avner Ziv is a very colorful guy, who runs a very colorful company. At the entrance to Zotapay’s office, right in the heart of one of the busiest shopping streets of Tel-Aviv, one will find three candy machines filed with chewing gums and candies on the reception desk. A sign with the company’s logo invites you to ‘have a taste of money, in all flavors’. Zotapay is a PCI level 1 certified gateway specializing in online payment processing, Risk Management and fraud protection which launched its new website last month. It offers an all-in-one solution fully customized to support clients ranging from start-up merchants to white label operations. Abe, as his friends and colleagues call him, sits in the CEO office. He is also the co-founder of Zotapay's parent company, Mabsut Payments Group, which was founded at the end of 2015. Mabsut, by the way, is Arabic for 'happy'. Ziv is a veteran of the online industry, having worked for SafeCharge, eToro, BETFRED and MARKETS.com. He is also a fluent Mandarin speaker, having studied at China’s Yunnan Normal University. Finance Magnates sat down with Ziv to hear his views about the status of the markets, the online trading industry and the solution that his company offers to both regulated and unregulated brokers.

What are the most challenging markets right now?

The most challenging markets these days would be the South-East Asian markets. We can identify an increase in traffic in the Malaysian, Indonesian, Thai and Vietnamese markets. A lot of good clients are coming from that part of the world and a lot of good forex brokers are penetrating these markets.

Regulators understand they can no longer turn a blind eye towards forex or binary options

Our challenge is to find those stable channels and to on-board them to our systems, to overcome localization challenges that come with our integration, technical aspects, translation of APIs, customization and connection to a unified cashier system. In addition, Canada, that up until six months to a year ago had been a very stable place for forex and binary options brokers to do their business, has become much tougher due to the activities of the local regulator, which has resulted in brokers exiting this market. We have noticed that recently Australia is taking the same approach.

In Canada, Visa has tightened the screw on binary options clearing. Do you think the same could happen in Australia?

Regulators have taken a much more active approach towards financial services. They have tightened their supervision on brokers, regulators can either avoid it or regulate it, and they started regulating it and going after the unregulated brokers. I believe that these actions will make the market more refined and clearer, with higher standards, as it is supposed to be. I think that the binary options industry has given a bad reputation to the online trading industry as a whole.

The binary options industry has given a bad reputation to the on-line trading industry as a whole

What are your main concerns in running the day to day business?

I have two big concerns – risk management of a single merchant, and the risk exposure we as a company have at the acquirer’s banks or PSPs. This exposure can be translated into funds stuck in the pipeline, delayed money transfers and even termination of accounts or being fined by Visa or Mastercard. Because our business is relying on money flow and services, any risk that we encounter from either side can definitely affect our business and the prestige Zotapay has. We manage to handle these risks through our solution by having as many acquirers’ banks as possible alongside PSP partners, payments institutions, acquirers, e-wallets and so on. We can offer a variety of solutions to a specific merchant so we can break the exposure to five or six acquirers. Therefore, each one will have less exposure.

What do you think sets you apart from the competition?

Zotapay has no competitors in essence. We are connected through a PCI level one gateway system to over 250 banks and PSP partners, and we basically promote their services. On the one hand, we offer a gateway solution similar to other PSPs, but on the other hand we offer that merchants keep doing business with their current banks but we can also open new markets for them. Everything is connected to one system, so merchants need to fill out one application form, and conduct one integration.

So merchants need to pay double fees?

No, our price includes it all, we sign a unified contract with the client. This contract includes bank or PSP fees, and in case he wants to stay with his existing payment relationship we will charge only 25 cents as a transaction fee and won’t get involved in the money flow between the merchant and his bank. Our philosophy is one application one integration, therefore we developed our own CRM system that can easily collect application forms. Our compliance team can chat with the costumer online once we have completed the boarding process.

We can shoot a specific application form to as many as 30 or 40 or 50 acquirers in the same day, depending on the merchant's business model, country of origin, license type and targeted market. So, if for instance a binary options provider or forex broker licensed in Belize with a bank account in Montenegro wants to target Japan and South American countries, we will find up to 10 acquirers or PSPs that will allow him to perform these activities based on the aforementioned criteria. Our success rate with banks is high because we understand what they ask for. All is done automatically once we have all the needed details.

What are the main factors one needs to be aware of before entering the Chinese market, payments-wise?

Payments is a challenging part of doing business in China but not the only one. There are also technological, cultural and language barriers that affect marketing aspects. I myself have a lot of experience with the Chinese market since I lived there and studied the language for more than four years and dealt with both B2C and B2B verticals for over a decade. In the past year the Chinese government downsized the number of certified PSPs like Ali-pay and Ten-cent from 300 to 100.

We need to provide to our merchants as many backups as possible

Our strategy is to connect with as many solid partners as possible. We understand that it’s a dynamic and unpredictable region and we need to provide to our merchants as many backups as possible. Recently, the Chinese government released a new feature – a mobile express payments solution which gives the merchant and the PSP information about the end user. This is the first time that the Chinese have allowed personal information to be taken out of the Union Pay terminal. It allows forex brokers regulated under MiFID to receive the last four digits of the client’s Union Pay card so they can match the card to the trader. This was one of the more challenging problems for FCA regulated brokers which couldn’t do the match and comply with regulatory demands. Currently this feature is on a pilot scale but knowing how the Chinese work, I’m assuming they first see how it works and expand it later.

What is the future for retail payments?

At the end of the day, all payments will go through mobile or other electronic devices. Cash will disappear in the next two decades. The first glimpse of that can be seen in the new releases by both Visa and Mastercard which allow people to transfer money to one another. The only thing a sender and receiver need to transfer funds is a credit card. Visa and Mastercard have come to realize they are losing traffic to e-wallets like PayPal.