A few months ago, we were doing what we often do in the office: coffee in hand, casually chatting about everything from work to politics. As always, the conversation turned to AI (in our office it’s always either “let’s get a coffee” or AI) and how it’s reshaping our work and hiring trends.

Then one of the team leaned back and asked, “We’re using AI every day… but are companies actually calling these ‘AI jobs’ now?”

The question stuck. So we did what the Finance Magnates Data Lab does best: rolled up our sleeves, dimmed the lights, and looked at the data.

Out of nearly 1,000 finance roles where AI is part of the daily work, only one in three had “AI” in the title—even though every one of them required skills like machine learning or using AI tools to get the job done. Roles with “AI” in the title also offered salaries 4% higher on average than those without it.

What the Numbers Tell Us

Several months later, we compiled and analysed over 10,000 global AI-related job listings and 5,000 job entries from more than 400 brokers. We also spoke with leaders and digital transformation experts from across the financial industry. And what we found sent a surprisingly clear message:

Finance is adopting AI – that’s no surprise – but it’s doing so with structure, not noise.

Let’s look at the numbers to see how the finance industry is steadily shaping the AI story in its own way.

You may also like: AI – How Close to “Human Intelligence” Are We?

Finance Is in the Top Tier but Playing It Smart

Some industries, like gaming and tech, love to talk about AI. We attended an expo a few months back, and AI was mentioned more than greetings. Within finance, though, it’s becoming more selective.

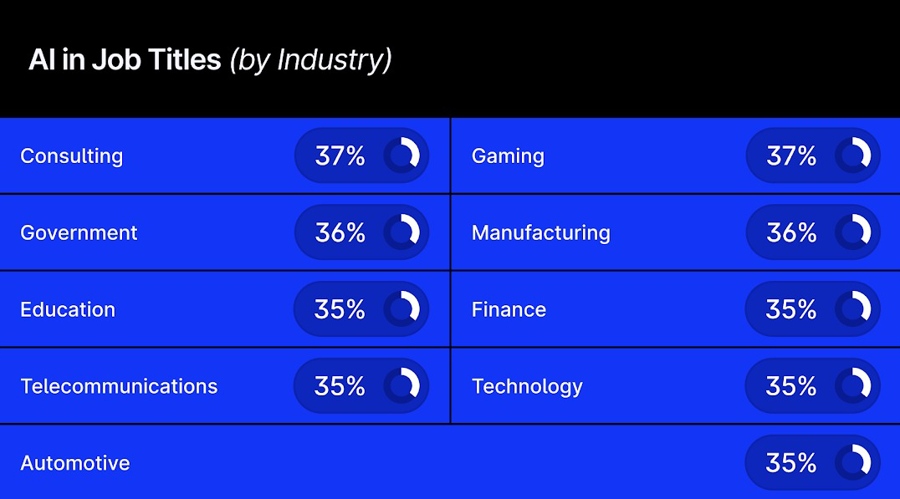

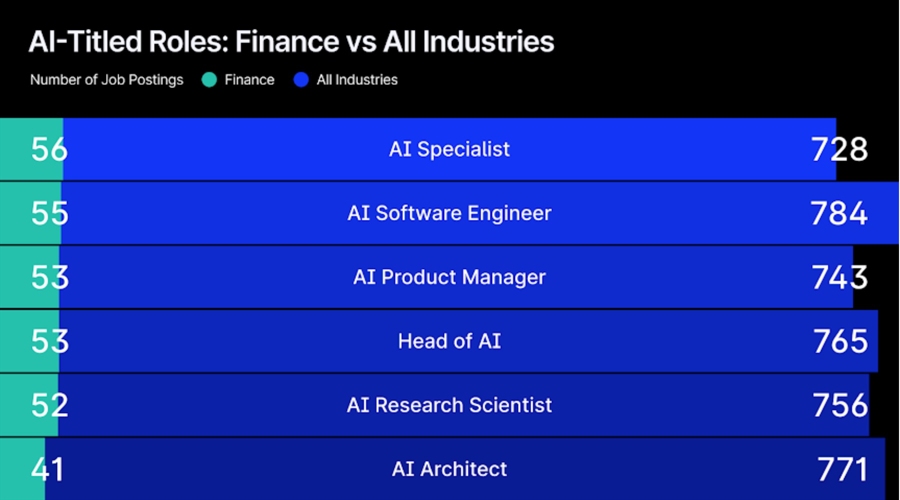

In the data we reviewed, just over 35% of finance job listings featured AI in the title, putting the sector in the top tier – but still behind more AI-driven industries. Examples include roles like AI Specialist, AI Product Manager, and Head of AI. These are starting to appear, but they’re not yet common.

This is not only a cautious approach, it’s a calculated one.

Unlike other sectors racing to appear innovative, finance is more deliberate, adding AI to job titles only when the role actually demands AI design, deployment, or governance.

“In today’s global job market, AI is rarely listed as a required skill in job descriptions... There’s a clear need for proper education on how AI can benefit both individuals and organisations,” said Fotini Masia, Group Head of HR, Ultimate Group, the owner of the FinanceMagnates.com brand.

At first glance, this appears to contradict our findings, where over 70% of finance roles in our dataset mentioned AI tools or skills in the description. But that gap may highlight the issue itself: AI is being used daily, yet many companies don’t clearly list it as a requirement or include it in the job title, leaving candidates unaware of how central AI actually is to the role.

Read more: Interactive Brokers Eases Stock Research with New AI-Based Tool

Business Roles, Not Just Titles

Within the financial industry, it’s clear that AI is not just for engineers and developers. The most common job titles – such as AI Research Scientist and AI Product Manager – show that these are roles involved in decision-making and shaping strategy. They are not just technical roles.

In other industries, we see more technically focused titles like AI Developer or NLP Engineer, where the work is mostly centred around building models.

Finance is in fact embedding AI at the business layer, not just in the back end.

“If anything, companies use ‘AI’ in titles only when clearly justified... The financial sector isn’t behind; it’s just more conservative about inflating titles without purpose,” said Donna Stephenson, Founder of Emerald Zebra.

This is exactly what we see in the data: finance is a large industry, and an AI-related title signals a serious investment – not just an attempt to create buzz or follow a trend.

The Regional Picture

The regional breakdown of AI-related job titles paints three very different pictures. China leads, with over 37% of roles carrying an AI title, but these positions offer the lowest average salary – around $87,000 gross per year.

At the other end of the spectrum, the US pays nearly double, averaging $150,000 annually for similar roles, even though the use of AI in job titles drops slightly to about 36%.

The EU sits in the middle, with a more cautious title adoption rate of around 35% and salaries of approximately $125,000 – closely aligned with the global average for AI-related finance roles.

It’s not about how loudly you label AI; it’s about how deeply you integrate it into the business.

“The fintech organisations that will lead the global market won’t be the ones with the largest AI departments... They’ll be the ones that build an AI culture across the business,” said Konstantinos Kareklas, Group Chief Digital Officer, Ultimate Group.

Read more: Dubai’s FX Sales Heads Bank Big – Twice the Pay of Cyprus Roles

The Skills That Actually Matter

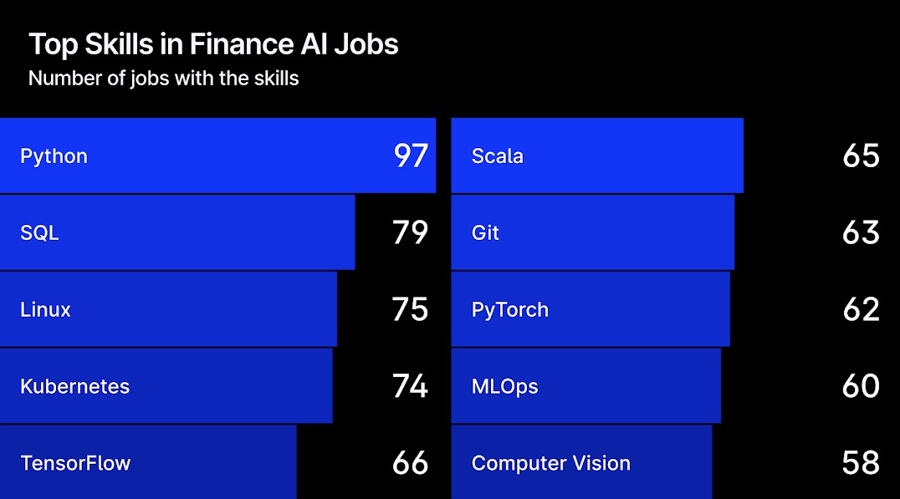

Now let’s take a closer look at the AI roles in finance. This isn’t surprising, as we know the most in-demand skills include Python, SQL, Linux, and similar tools. These are roles for people who build the systems, not just use them.

And yes, many of these roles don’t have “AI” in their job titles, which further shows how cautious the finance industry is with labelling.

“Everyone in our Group is using AI-powered tools... but the implementation is still at team level, not across the entire organisation,” added Kareklas.

So What Does This All Tell Us?

We didn’t begin this research looking for a headline. We simply wanted to understand how AI is actually being integrated into finance – not as a trend, but as a working part of the business.

What we found is straightforward but meaningful: AI in finance isn’t being overhyped, it’s being managed. The job titles may not shout “AI shift”, but the tools, workflows, and responsibilities are steadily changing behind the scenes.

Rather than exaggerating job descriptions, financial firms are being careful – building skills first, and only adding AI to the title when it truly defines the role.

That’s not slow. That’s deliberate. And in this industry, deliberate usually works best.

Final Thought

As AI tools become standard across research, compliance, reporting, and marketing, job titles will catch up – but only when it matters. The real story isn’t about what’s in the job title; it’s about what’s behind it.

Whether it’s Python in the backend, a summarisation model on the frontend, or an AI-powered decision engine in the middle, the shift is already under way.

Finance isn’t just hiring for AI. It’s building with it.

And as Kareklas puts it: “The fintech organisations that will lead the global market won’t be the ones with the largest AI departments... They’ll be the ones that build an AI culture in a decentralised, cross-functional framework.”

It brings me back to that coffee conversation: “Where are all the AI job titles?” At the time, it felt like a throwaway question. Now, I think it might be the one that actually matters.

Maybe the real question isn’t why we don’t see “AI” in more titles – maybe it’s because AI isn’t replacing jobs. It’s being folded into them. Quietly. Naturally. Like Excel once was.

Not something flashy. Just another skill added to the stack.

And as rabbit holes go, this one could go on forever. There’s always another layer to explore, another pattern to follow, another trend to check. That’s what we do at the Finance Magnates Data Lab. And honestly? We enjoy that part.

But for now, I’ll leave you with a few of the questions that stayed with me after pulling all this together:

If AI is already part of the work, not just the title, how should we be measuring adoption?

Are we underestimating how much AI is influencing decisions simply because it isn’t labelled?

Should we be rethinking how roles are named, or is AI just becoming a part of every role by default?

What does it say about a company’s culture if everyone is using AI but no one is naming it?

And most of all: when we say “AI is coming for jobs”, do we really mean it’s just… quietly merging with them?

Let’s see where the next coffee conversation takes us.