"The prop space has the potential to grow further as more people become aware of and learn about the products and services,” OANDA’s Head of Emerging Markets, Crystal Lok, told Finance Magnates in an interview: “With an attractive proposition, the prop firm industry has the potential to outgrow the traditional FX/CFD industry because it is more accessible, has lower barriers to entry, such as upfront fixed fees, and involves limited downside risk.”

"Significant Interest" from ASEAN Countries

OANDA is a well-known brokerage brand in the forex and contracts for differences (CFDs) industry. It entered the prop trading space last January with the launch of OANDA Labs Trader. Lok revealed that OANDA’s decision to launch prop trading followed a survey conducted in September 2023.

“[We] discovered that interest in this type of trading is really high amongst experienced traders in what OANDA defines as the ‘emerging markets’ segment,” Lok added and, confirmed that “significant interest” for its prop trading services came from traders in the ASEAN region, which is a bloc of ten Southeast Asian countries.

Prop trading firms allow expert traders to trade with the capital provided by the prop trading platforms. This helps traders eliminate the risk of putting their own capital at risk.

However, such services come with a lot of conditions. First, traders must pass a challenge to become eligible to receive funds from the prop trading platform. Further, they must trade under heavy conditions, with drawdown limits, time limits, and other requirements.

OANDA pointed out that it had waived the conditions of the minimum number of trading days from its challenge conditions after its trader community “feedback.”

Although, the broker considers qualified traders on its prop trading platform as signal providers. The proprietary trading models of OANDA will use the signals produced by the traders “in combination with other input variables to guide OANDA's market positioning decisions.” It is to be noted that OANDA offers virtual capital to prop traders, but shares profits in real money.

"Our prop trading environment, while making use of virtual capital to produce trading signals for our proprietary trading models via virtual trades, operates on live servers," Lok said. "We offer live market conditions for our traders, to ensure the trading activity produced is usable and valuable to our trading models."

“Retail Brokers Are Yet to Enter Prop Trading”

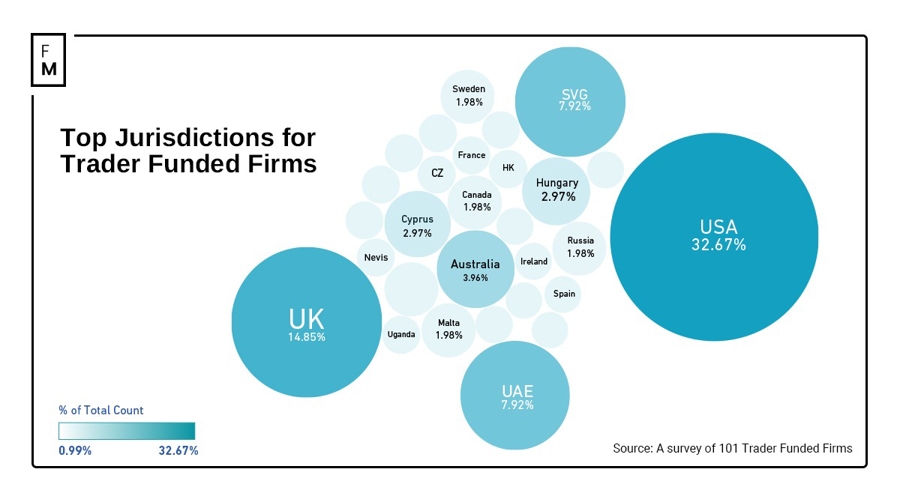

The demand for prop trading has boomed over the last few years. While there are many platforms offering prop trading, only a handful of known brokerage brands have entered this space.

Besides OANDA, other known brokerages offering prop trading are Axi and Hantec Markets. IC Markets, headquartered in Australia, also entered the prop trading sector and soft-launched its services recently. However, these are nearly all the known brokerage names in this new and rising industry.

“Major competitors in retail brokerage have yet to enter the prop trading market, which strengthened our case for being an early mover and adding real credibility to the space,” Lok added. “We are well-equipped to take on key industry risks given our regulatory experience and product knowledge.”

“Established players like OANDA entering the sector can lead to the right type of healthy competition, innovation, and liquidity in the industry, benefiting all participants.”

Prop trading is still not currently regulated. As prop traders do not invest their capital in trading, regulations for the regular brokerage industry do not apply to them. This does not mean the industry will remain unregulated indefinitely.

“We see regulation in this space as inevitable, and firms that are unprepared will be caught unprepared,” said OANDA’s Lok.

You raise your game. We’ll raise the capital.

— OANDA Labs Trader (@OANDALabsTrader) April 9, 2024

Choose your prop trading Challenge with OANDA Labs Prop Trader.

If you want to know more about our program, visit our website.

#proprietarytrading#fundedaccounts#OANDA#tradingsmarter pic.twitter.com/cTenXuS04V

Prop Trading Will “Consolidate Among Larger Players”

Meanwhile, the industry faced an alleged massive crackdown from a tech provider, MetaQuotes, which shook many businesses. MetaQuotes is the developer of two popular trading platforms, MetaTrader 4 and MetaTrader 5.

MetaQuotes stopped prop trading platforms from using its platform to onboard US-based traders. Although licensing requirements for MetaTrader are strict, several brokers ‘grey labeled’ their MetaTrader license to prop trading firms.

The alleged crackdown resulted in the termination of several brokerages’ services to prop trading platforms overnight, disrupting the services of these platforms.

“Despite rising participation from traders in prop activity, a number of brokers have ceased their services to multiple prop trading firms, and this has led to concern from traders,” Lok said. “There have also been significant interruptions to payments to successful prop traders, as certain prop trading firms were fully reliant on third-party contractor payment platforms, some of which did not actually understand the business they were supporting.”

“These changes, along with potential future regulatory scrutiny on the prop model, might lead to consolidation among larger players.”

"We Don't Rely on a Third-Party Contractor"

Although many prop trading platforms aggressively offer services in regions like the United States (where CFDs are banned) brokers like OANDA are taking a cautious approach. Although many prop trading platforms suspended their offerings in the US, they reinstated their services in the country with MetaTrader alternatives.

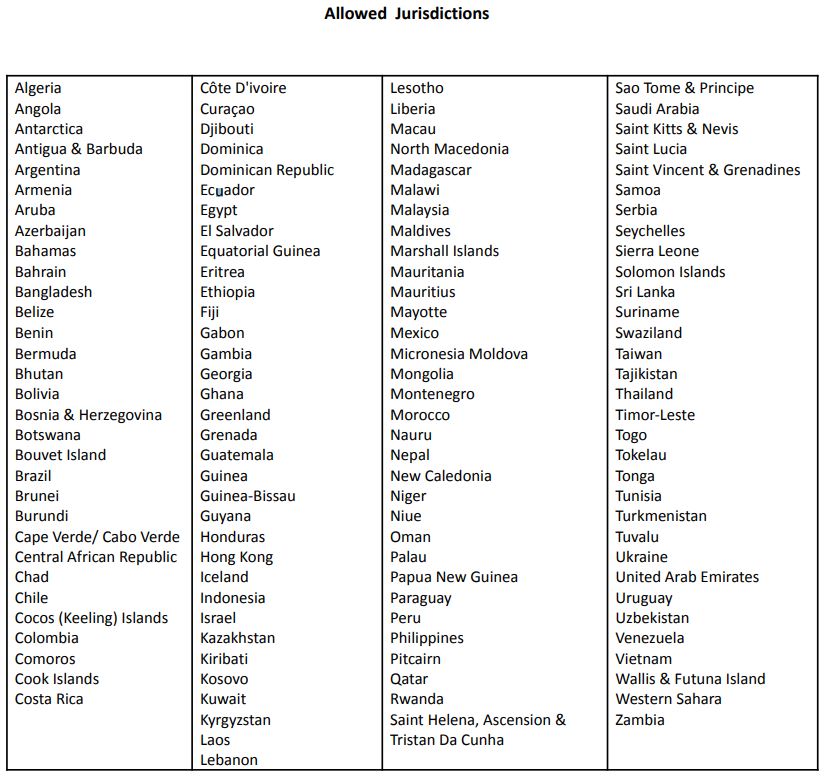

OANDA launched prop trading under its British Virgin Islands entity. It does not offer services in sensitive jurisdictions where it might face regulatory pressure.

Interestingly, OANDA does not offer prop trading services in jurisdictions, including the US, the UK, the EU, Australia, and Japan, that impose regulations on retail trading.

“We don't rely on a third-party contractor payroll firm, which may or may not understand the business it is supporting. Instead, we use the payment rails of our existing payment providers, with whom we have long-standing relationships and fully understand the service we offer,” Lok added.

“We believe that only those firms that emphasize regulatory compliance and put user interests and experience at the center of their business model will survive as the industry consolidates over time.”