The meme-driven cryptocurrency Dogecoin (DOGE) has surged nearly fourfold over the past two months. Although it is currently undergoing a corrective pullback, this remarkable rally has prompted investors to wonder how high Dogecoin's price could climb.

At present, the psychological barrier appears to be the $1 mark. However, according to one expert, DOGE is on a solid trajectory to reach $1.50 within the next four weeks and potentially $10 by 2025.

Dogecoin News: Current Market Performance

As of Wednesday, December 11, 2024, Dogecoin is trading at $0.4 per token. The cryptocurrency is battling this local support level for the third consecutive session, despite testing monthly lows.

Dogecoin currently ranks seventh among the largest cryptocurrencies by market capitalization, at $59 billion, significantly below sixth-placed BNB's nearly $100 billion. However, in terms of daily volume, Dogecoin substantially outperforms BNB with $9.6 billion in 24-hour trading volume, also exceeding fifth-ranked Solana's $7.8 billion.

Leveraged position liquidation data also shows continued downward pressure. In the past 24 hours, $514 million in leveraged positions were liquidated, with $373 million in longs. While Ethereum ($90 million) and Bitcoin ($70 million) led the liquidations, Dogecoin accounted for approximately $27 million, with $20 million in long positions1.

Despite the current weakness of the cryptocurrency market, Dogecoin has dominated 2024 with a 350% gain, nearly triple Bitcoin 's performance. This comes as Bitcoin itself reached a significant milestone, testing $100,000 for the first time in history.

In November alone, Dogecoin surged 160%, and from October to December peaks, investors who entered at the $0.1 low and exited above $0.48 could have nearly quadrupled their investment.

Dogecoin Technical Analysis, DOGE Price and $0.5 Resistance

The current focus remains on Sunday's December peak when Dogecoin reached $0.4846, its highest level in over three years. Technical analysis reveals that while the price had been moving in an upward regression channel, Tuesday's decline caused it to break below this formation.

Testing the broken lower channel boundary confirms this polarity shift and may signal a short-term correction. The $0.35 region should act as significant support and present a buying opportunity at lower prices, similar to the $0.3 level, which almost perfectly aligns with the 50% Fibonacci retracement measured from October's lows at $0.1.

Currently, strong resistance zones include the mentioned local maximum at $0.48 and the psychological $0.5 level. Breaking these could pave the way to the previous all-time high of $0.7.

Dogecoin Support and Resistance Levels

Technical Indicator | Value |

Support Level | $0.4, $0.35 and $0.30 |

Immediate Resistance | $0.44 |

Secondary Resistance | $0.48–$0.50 |

Third Resistance | 0.74 |

50-Day Moving Average | $0.335 |

200-Day Moving Average | $0.203 |

However, long-term analysts suggest DOGE has the potential for stronger appreciation, with one analyst projecting a Dogecoin price target of $10 or higher by 2025.

Expert Dogecoin Price Prediction 2024 and 2025

Recent price predictions for Dogecoin show significant variation among analysts, with current forecasts being notably more bullish than earlier estimates, especially given DOGE's current trading price of $0.40.

2024 Projections

The most recent forecasts for 2024 suggest DOGE could reach between $0.494 and $0.60 by year-end. More conservative estimates from CryptoNewsZ indicate a range of $0.277 to $0.4942.

2025 Outlook

Analysts show wide-ranging predictions for 2025:

- InvestingHaven projects a range of $0.222 to $1.4452

- BTCDirect forecasts approximately €1.04 ($1.12) by December

- Changelly suggests an average price of $0.2393

You can also check the previous long-term analysis by Finance Magnates, where we tried to answer another question: “Will Dogecoin Reach $1?”

Will Dogecoin Reach $10? This Expert Says Yes

A cryptocurrency market analyst has identified a potential bullish pattern for Dogecoin, suggesting the meme cryptocurrency could see significant price appreciation in the coming months.

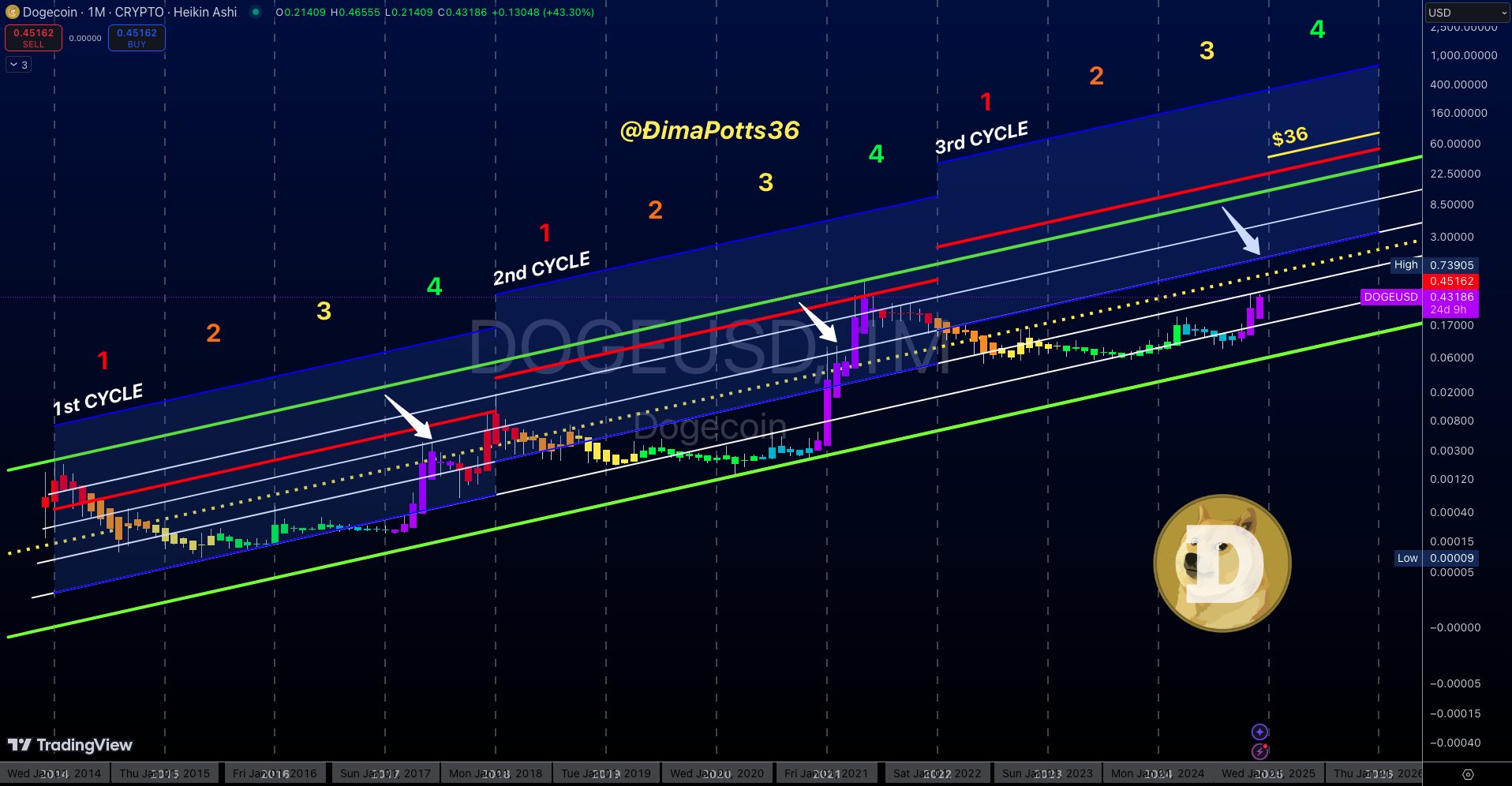

The analysis, shared by crypto analyst Dima James Potts, examines Dogecoin's monthly chart patterns across multiple market cycles. Potts identifies a recurring pattern where DOGE reaches key resistance levels within four-month periods, marked by purple monthly candles.

Previous cycles demonstrated accelerating momentum, with the second cycle reaching the resistance level faster than the first. The current pattern, which Potts identifies as the third cycle, could see DOGE testing similar resistance levels by January 2025.

The analysis suggests a potential price target of $1.50 if the pattern completes this month, though Potts notes the target increases over time due to the ascending resistance line.

$DOGE $10+ DOGECOIN?! 🚀🚀

— Ðima James Potts (@DimaPotts36) December 7, 2024

In this monthly chart of #DOGECOIN, I'm highlighting what has happened in previous cycles when Dogecoin reached this same level within four purple monthly candles.

• 1st cycle: Dogecoin took four purple monthly candles to reach its first major level… pic.twitter.com/TmWfNOWetu

“Currently, we're in the 3rd cycle. If history repeats, I believe we'll see a similar scenario where Dogecoin reaches the same line it did in the previous two cycles before the end of January 2025 (the 4th purple candle),” commented Dima James Potts. “If Dogecoin reaches that line this month, it would put the price at $1.50. Keep in mind that the line increases over time, so the target price also rises accordingly.”

The chart presented by Dima, along with his own analysis, suggests that Dogecoin's price could reach the white line marked on the chart, as it did during the previous two cycles. Currently, this line is positioned around—or more accurately, clearly above—the $10 level.

As a result, the analyst does not rule out a scenario where DOGE reaches these levels by 2025. Other, slightly less positive but still far from the current price, scenarios suggest that DOGE can reach a new all-time high of $5.

Catalyst and Risks Driving Potential $10 Target

The key catalysts driving Dogecoin's potential $10 target include several technical and fundamental factors, while significant risks exist.

Bullish Catalysts

- Formation of an Inverse Head and Shoulders pattern, historically leading to parabolic rallies

- Exit from the oversold zone, indicating the potential for a new bull phase

- Increased trading volume and whale activity, with $149M in recent whale inflows

- Growing institutional interest and merchant adoption

- Strong community support and influencer backing, particularly from Elon Musk

- Integration into global payment systems

Major Risks

- Would require a market cap exceeding $1.37 trillion, surpassing the market cap of Ethereum threefold.

- Unlimited supply creates constant selling pressure

- Early investors likely to take profits during price increases

- Requires sustained bull market conditions and massive adoption

The current price of $0.40 would need an approximately 2,400% increase to reach $10. While technical indicators and market sentiment suggest a potential upside, the structural challenges make this an ambitious target requiring significant market changes and sustained momentum.

Dogecoin Price Prediction, FAQ

Can DOGE reach $10 dollars?

Reaching $10 would be an extraordinary achievement, requiring a 400x increase from current prices. While not impossible, it would need massive market adoption, technological improvements, and substantial demand growth. Most analysts provide more conservative estimates, with predictions ranging from $1–3 by 2030.

How high can DOGE realistically go?

Based on current analysis, DOGE could realistically reach $0.85–$1.00 by 2025. For 2030, most credible predictions suggest a range between $1.19 and $1.50, with some analysts forecasting up to $2.94. These projections take into account market dynamics, adoption rates, and historical price movements.

What will DOGE be worth in 2030?

Expert predictions for 2030 show varying estimates, with DigitalCoinPrice suggesting values between $2.67 and $2.94, while Changelly forecasts a more conservative range of $1.19 to $1.47. CryptoNewsZ provides a moderate outlook, predicting DOGE to trade between $0.57 and $0.82 by the end of the decade.

How much will 1 Dogecoin cost in 2025?

Price predictions for 2025 demonstrate significant variation among experts. DigitalCoinPrice suggests a maximum of $0.20, while CryptoNewsZ forecasts a range between $0.25 and $0.39. Coinpedia offers a more optimistic outlook with a potential high of $1.07. These differences reflect the uncertainty and volatility inherent in cryptocurrency markets.

What is the maximum reach of Dogecoin?

Looking at extremely long-term predictions, some analysts suggest Dogecoin could potentially reach $69 by 2040 and $99 by 2050. However, these long-range forecasts should be approached with considerable caution, as cryptocurrency markets are highly unpredictable and subject to numerous external factors that could significantly impact prices over such extended periods.

Check also other Finance Magnates commentaries on the most popular crypto assets. For example, the XRP token used by Ripple is currently on the rise due to the newest New York License the company gained for running its own stablecoin, RLUSD.