The crypto market experienced a significant sell-off today, with Bitcoin (BTC) dropping notably below $94,000. Along with BTC, major altcoin prices are also declining, and the total cryptocurrency market capitalization has fallen to $3.3T, marking the lowest level in almost a month.

This sell-off stems from last week's Federal Reserve's (Fed’s) monetary policy announcement, with Bitcoin falling below $100,000. Market participants witnessed a sharp decline across cryptocurrencies, triggering substantial liquidations and affecting the total market capitalization.

Let’s check together why crypto is down today and what the technical price predictions for Bitcoin, Ethereum, Ripple , and XRP are.

Why Is Crypto Crashing?

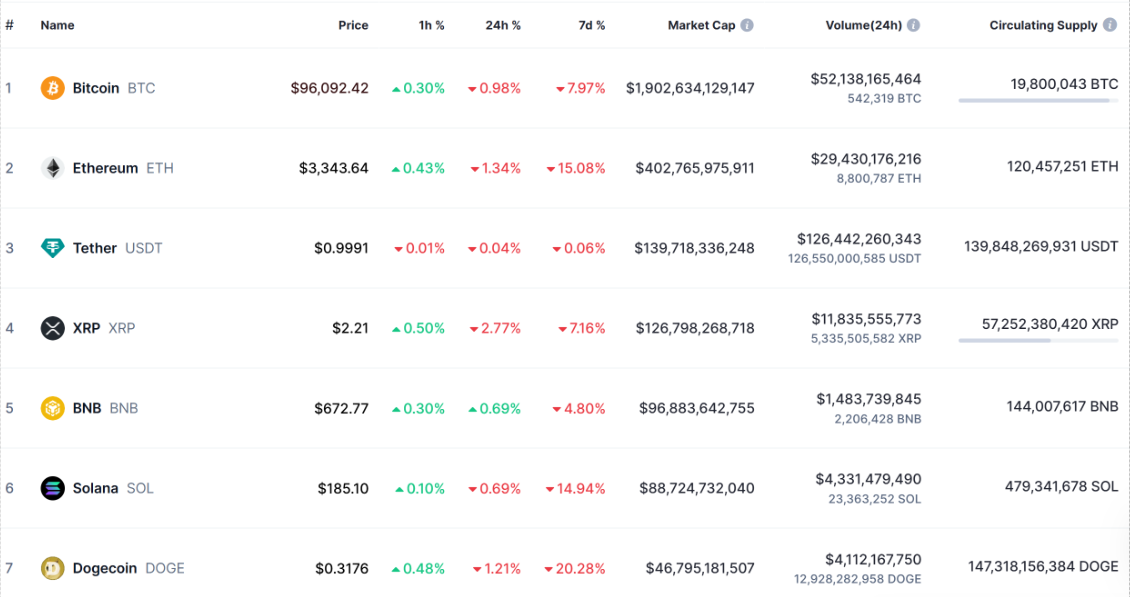

The cryptocurrency market has had a challenging period over the past day and week. Both Bitcoin and major altcoins, including Ethereum, XRP, and Dogecoin, have experienced significant losses. During Monday's session, Bitcoin's price briefly dipped below $94,000. While it has since recovered somewhat to $95,800, it still shows an 8.5% decline over the past week.

Ethereum has seen even steeper losses, dropping nearly 16% during the same period, with its current price hovering around $3,300. XRP has declined by 8% and now trades at $2.20. Meanwhile, the meme-inspired Dogecoin, which ranks as the seventh-largest cryptocurrency by market capitalization, has shed 21% of its value, currently trading at $0.31.

These declines in major cryptocurrencies have negatively impacted the total market capitalization, which now stands at just over $3.3 trillion—the lowest level in a month.

The Fear and Greed Index for cryptocurrencies, which had consistently remained at extremely high greed levels, has now moved closer to 50, indicating a neutral market sentiment. This suggests investors are currently in a wait-and-see mode, neither panicking about dramatic drops nor eagerly buying the dip.

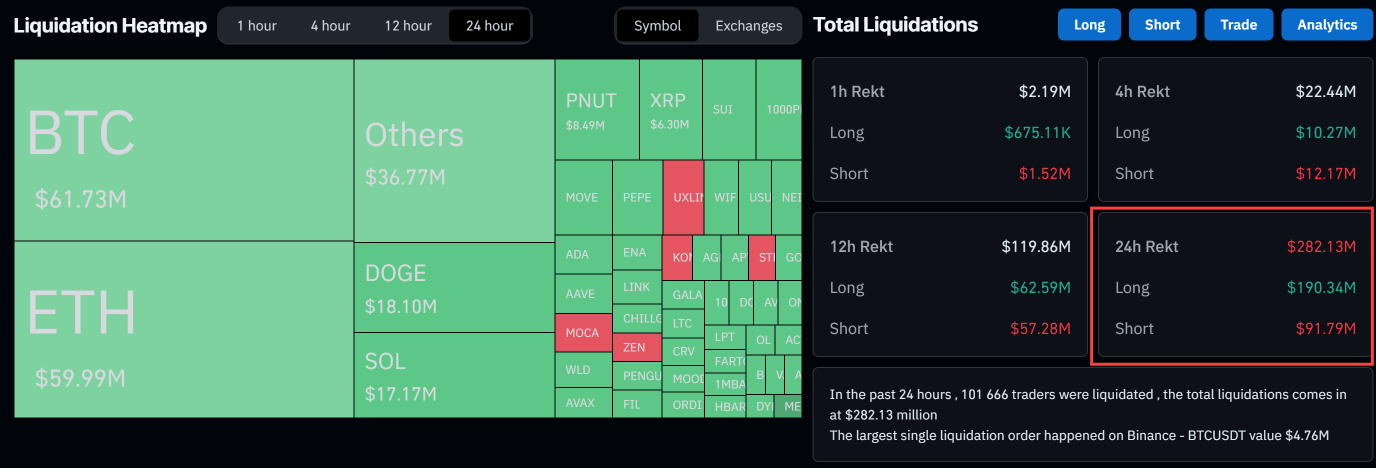

Liquidations: Almost $300M in Crypto Leveraged Positions Gone

Despite the market downturn, there hasn't been a significant surge in leveraged position liquidations over the past 24 hours. According to Coinglass data, $283 million in leveraged positions were liquidated, with $191 million in long positions and $92 million in short positions.

This indicates that those betting on stronger gains for Bitcoin, Ethereum, XRP, Dogecoin, and Solana have suffered the most losses, being forced to close their positions as the market moved south. Bitcoin and Ethereum dominated the liquidations, each seeing around $42 million in long positions and approximately $19–20 million in short positions liquidated.

Federal Reserve Factor, Why Is Crypto Down Today?

The Federal Reserve's recent monetary policy stance has significantly impacted the market. While the Fed cut rates by 0.25%, Fed Chair Powell's cautious statements about future rate cuts and emphasis on maintaining restrictive policy to control inflation spooked investors. The Fed's projection of only two rate cuts in 2025 was less aggressive than markets had hoped.

The Fed's decision had a significant impact on the cryptocurrency market. When it was announced last Wednesday, Bitcoin slid from near its historic highs, losing almost 6% in a single day. The current monthly lows continue to be a direct consequence of Powell's announcements.

Federal Reserve Chair Jerome Powell says the Fed is "not allowed to own Bitcoin"

— Bitcoin Archive (@BTC_Archive) December 18, 2024

They weren't allowed to own Corporate Bonds before Covid either.

Rules change... 😉 pic.twitter.com/3UBBUuKtdF

Global liquidity conditions are tightening, with central banks reducing their balance sheets and rising bond market volatility making conditions unfavorable for risk assets. This has particularly affected Bitcoin and other cryptocurrencies, which are sensitive to liquidity changes.

Crypto Technical Analysis: Bitcoin, Ethereum, Dogecoin and XRP

From a technical analysis perspective, Bitcoin's long-term outlook remains relatively stable. BTC is retesting local support just below $93,500, a level that has been regularly tested since late November.

This support coincides with the local peaks established on November 13, when this level marked a new record high. Currently, Bitcoin faces crucial technical support, reinforced by the round number of $92,000 and the 50-day exponential moving average. The psychological barrier of $90,000 lies just below, which bulls are likely to defend strongly.

In my opinion, buyers should only become concerned about Bitcoin's future if the price drops below $74,000, where the 200-day exponential moving average intersects with support levels from October 29. Key resistance levels are at $100,000 (psychological), $104,000 (October 5 highs), and $108,000 (current all-time high from December 16–17).

According to the experts from VanEck, after the current correction, Bitcoin will be returning to the price discovery phase. They predict the BTC price at $180,000 next year.

Ethereum is currently testing support at the 61.8% Fibonacci retracement level, coinciding with month-old lows. Below this lies the more significant support at $3,000, reinforced by the 200-day moving average and 50% Fibonacci retracement.

Analysts project ETH could reach between $4,000 to $6,500 by the end of 2024, and even $32,000 by 2030.

Dogecoin has been forming support around $0.30 for nearly a week, matching month-old lows. If this level fails to hold, we might see a decline toward the 200-day EMA near $0.22.

Last month I was trying to find an answer to another important question: “Will Dogecoin Reach $1?”

Finally, XRP has been maintaining local support at $2.20 since mid-November. Even if this level breaks, the psychological support at $2.00 lies just below, and only a drop below this level might cause genuine concern among Ripple token investors.

According to the CryptoGeek XRP price prediction, the token could soar to almost $1,000 next year.

XRP BULL RUN HAS STARTED!! $XRP WILL BE $973 by 2025!

— CryptoGeek (@CryptoGeekNews) November 16, 2024

The XRP Price charts just reflected previous patterns exactly. If you do the TA this bull run XRP could reach almost $1000! pic.twitter.com/7yH1xiwKOl

FAQ, Why Is Crypto Down?

Why is the crypto market dropping?

The crypto market is experiencing a significant decline primarily due to the Federal Reserve's recent monetary policy announcement. Despite a 0.25% rate cut, Fed Chair Powell's hawkish stance and indication of fewer rate cuts in 2025 have dampened investor sentiment. Additionally, tightening global liquidity conditions and rising bond market volatility have created unfavorable conditions for risk assets.

Will crypto ever go up again?

Historical patterns and market fundamentals suggest recovery potential, as evidenced by Bitcoin's quick rebounds above $100,000 after recent dips. The 2024 market has shown resilience through increased institutional investment and favorable political developments, though current market conditions remain volatile.

What has happened to crypto today?

Bitcoin has fallen below $94,000, while Ethereum dropped to around $3,350. The total market capitalization has decreased to $3.3 trillion, marking the lowest level in nearly a month. This decline triggered approximately $1.5 billion in liquidations across the crypto market.

Why is Bitcoin dropping now?

Bitcoin's decline is attributed to multiple factors: the Federal Reserve's hawkish stance on interest rates, fears of a slower-than-expected rate cut cycle in 2025, and pre-holiday low liquidity conditions. Market structure weaknesses and high leverage have also contributed to the downward pressure.

Why is XRP crashing?

XRP's decline aligns with the broader market downturn following the Federal Reserve's policy announcement. Like other cryptocurrencies, XRP is responding to macroeconomic factors and the general risk-off sentiment in the market.

Why is Dogecoin falling?

Dogecoin's decline is attributed to multiple factors: the Federal Reserve's policy impact, decreasing transaction volume, and reduced daily active addresses. Additionally, a recent network vulnerability that resulted in 69% of Dogecoin nodes crashing has contributed to negative market sentiment.