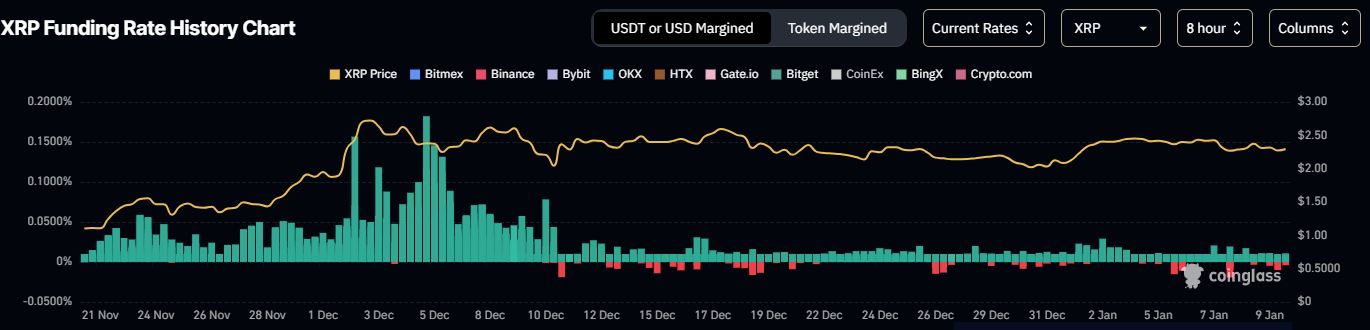

XRP, the cryptocurrency supporting the Ripple blockchain, might experience bearish momentum as funding rates have turned negative on multiple derivatives exchanges today (Friday). Although the rates shifted into the positive region on many exchanges, some still show negative rates.

Bearish Movement Ahead?

XRP funding rates refer to the periodic payments exchanged between traders in a perpetual futures market, depending on the relative demand for long and short positions. These rates are used to maintain the price of XRP perpetual contracts close to the underlying spot price.

If the rates are negative, there are more short sellers in the market than traders taking long positions. Similarly, a positive funding rate indicates the dominance of long positions in the market.

The average XRP funding rate hovers around the 0.01 per cent level. However, in the last 24 hours, it has flipped to the negative region, indicating a possible decline in the XRP price.

The dollar value of Ripple's XRP jumped significantly since November, following the election of Donald Trump as the 47th President of the United States. Further, the confirmation of the resignation of Gary Gensler as the Chair of the Securities and Exchange Commission (SEC) further boosted the cryptocurrency price.

XRP’s value peaked in mid-December, crossing $2.5 apiece compared to $0.54 only two months ago, an increase of 363 per cent. However, the value still remains much lower than the token’s all-time high value in January 2018.

Returning to the recent rally, sentiment is turning bearish, and analysts expect that the XRP price might test the $2.2 level. At the time of writing, the token is trading at $2.3.

Meanwhile, the long-term performance of XRP is projected to have significant upside potential, as some analysts believe it can reach $5 in 2025.

Developments around XRP

With the recent ongoing adoption of cryptocurrencies into mainstream financial markets, XRP is also showing promise. Multiple companies have filed for approval for the listing of XRP exchange-traded funds (ETFs), but the SEC has yet to approve any.

Furthermore, the adoption of Ripple is also anticipated to gain traction this year, particularly in Japan. SBI CEO Yoshitaka Kitao recently announced that every bank in Japan will use Ripple’s ledger by 2025 following the integration of the Interledger Protocol (ILP), which aims to streamline cross-border payments and simplify currency conversions.