Cryptocurrency markets saw a bit of a shakeup this week after Tesla Founder and Chief Executive Elon Musk abruptly announced that the company would no longer be accepting Bitcoin payments, citing environmental concerns.

“Cryptocurrency is a good idea on many levels, and we believe it has a promising future, but this cannot come at great cost to the environment,” Musk wrote. “[...] We are concerned about rapidly increasing use of fossil fuels for Bitcoin mining and transactions, especially coal, which has the worst emissions of any fuel.”

Tesla & Bitcoin pic.twitter.com/YSswJmVZhP

— Elon Musk (@elonmusk) May 12, 2021

At the end of the announcement, Musk also mentioned that Tesla is “looking at other Cryptocurrencies that use <1% of Bitcoin’s energy/transaction.” Several hours later, he followed up with another tweet: “To be clear, I strongly believe in crypto, but it can’t drive a massive increase in fossil fuel use, especially coal.”

https://twitter.com/elonmusk/status/1392950720979030019

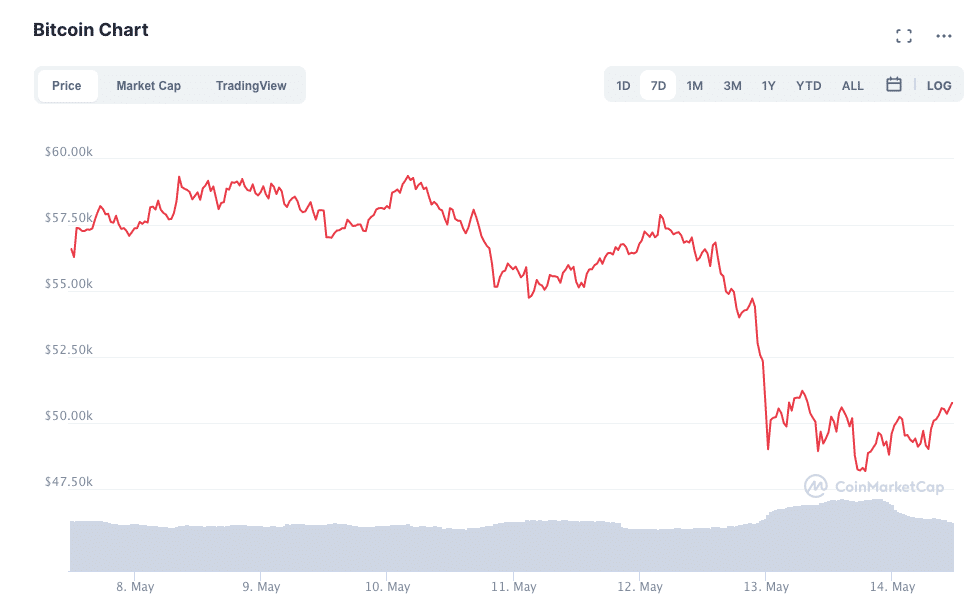

The announcement sent off shockwaves of sales across crypto markets. As the clear subject of the message, Bitcoin seems to have been affected the most.

Less than 24 hour after the tweet was posted, the Bitcoin’s price plunged approximately 17 percent, falling from roughly $58K to $49K. While the price of BTC seems to have stabilized, the asset has not managed to fully recover its losses; at press time, BTC was sitting just below the $50K mark.

Tesla’s Rejection of BTC Could Reinforce Public Perception of BTC as an Energy-Gluttonous Beast

While Musk clarified that Tesla would not be selling any of the 38,300 BTC that it holds on its balance sheet, the announcement seemed to present a clear tonal shift in Tesla’s attitude toward the cryptocurrency.

While BTC is increasingly understood to be a store-of-value or “hedge against inflation” asset, Bitcoin cannot seem to shake its reputation as an energy-hungry, carbon-intensive network.

Just last month, the New York Times published a piece that exclaimed, “[Bitcoin] accounts for so little of the world’s total transactions, yet has the carbon footprint of entire countries.” Additionally, Ars Technica reported last month that a private equity firm revived a defunct coal-fueled power plant to mine BTC; the Washington post recently reported that the Iranian government blamed a large power outage on Bitcoin miners.

While certain factors, including the usage of renewable energy in Bitcoin mining, have put the facts about Bitcoin’s carbon footprint up for debate, Bitcoin is still seen by much of the general public as problematic. Therefore, it seems fairly logical that Tesla, which is famous for producing low-emission, “sexy” electric cars, would take a step back from BTC in order to maintain an image of sustainability.

Still, the Bitcoin community pushed back on Tesla’s claim that the Bitcoin network’s fossil fuel consumption was “rapidly increasing.”

Energy usage trend over past few months is insane https://t.co/E6o9s87trw pic.twitter.com/bmv9wotwKe

— Elon Musk (@elonmusk) May 13, 2021

“Elon … you realize that 75% of miners use renewable energy, right? This energy story has been debunked over and over again,” wrote Anthony Pompliano, Founder of Pomp Investments, in reply to the announcement. Indeed, last month, Ark Investments claimed that 76 percent of Bitcoin miners use renewable energy. To date, no comprehensive scientific study has been conducted to measure exactly what the carbon footprint of the Bitcoin network is.

But, just as Tesla championed the acceptance of Bitcoin earlier this year, and perhaps inspired other corporations to come into the fold, could its step away from BTC lead other corporations to take some distance from Bitcoin?

There does not seem to be much evidence of this, at least, not yet. However, if Tesla adopts 'other cryptocurrencies' that have lower rates of carbon consumption than BTC, crypto-curious companies and institutions may follow in its footsteps.

Will Tesla Accept Dogecoin (DOGE)?

Indeed, Elon Musk’s declaration that Tesla was exploring “other cryptocurrencies that use <1% of Bitcoin’s energy/transaction” has led many in the crypto community to speculate on which coins could be in the lineup.

https://twitter.com/APompliano/status/1392958108742324225

Given Elon Musk’s apparent fixation on Dogecoin (DOGE), the coin may seem like the most obvious choice. Musk even published a Twitter poll on Wednesday asking the public whether or not Tesla should start to accept DOGE as payment; nearly 80 percent of respondents said ‘yes.’

https://twitter.com/elonmusk/status/1392030108274159619

On Friday, Musk tweeted that he was “working with Doge devs to improve system transaction efficiency. Potentially promising.” The price of DOGE appeared to jump in the wake of the Tweet. In the 24 hours before press time, DOGE was up roughly 35 percent.

However, some crypto community members seem to be growing suspicious of Musk’s intentions with DogeCoin. “Name these developers. The world is very curious,” author, Preston Pysh tweeted in reply. “...Or is this another ‘Developers Secured’ tweet?”

Crypto market analyst, Michael van de Poppe wrote, “Can you just stop tweeting?”

Cardano (ADA) Price Surges to a New All-Time High after Cardano Foundation Asks Elon to “Get Your People to Talk to Our People.”

So far, analysts are following the money. When the price of Bitcoin crashed, the prices of many other top-10 cryptocurrencies fell on the order of five to ten percent. However, ADA, the native token of the Cardano network, has hit a new all-time high, leading some to speculate that ADA could be a strong contender for Tesla Payments .

Indeed, after Musk posted his announcement, the Cardano Foundation tagged him in a tweet, asking him to “get your people to talk to our people.”

Cardano x Tesla: An obvious match? 🤔

— Cardano Foundation (@CardanoStiftung) May 13, 2021

A thread 🧵...#Cardano #CardanoCommunity #Blockchain pic.twitter.com/zJAlDV3muw

Since then, ADA supporters have jumped on the #Tesla4ADA movement like mad.

Get this hashtag trending -> #Tesla4Ada

— Rick McCracken - DIGI🍨 (@RichardMcCrackn) May 13, 2021

However, other fans of ADA would rather that the cryptocurrency network keeps its distance from Elon Musk. A Twitter user with the handle @CryptoNelson17 wrote that: “While I would love [Tesla to accept ADA] from a utility-perspective, I feel like @elonmusk is a bit unstable & it could hurt $ADA somehow,” he wrote.

“I mean take this ‘no longer purchasing teslas with $BTC’ thing - you’re telling me Elon didn’t know it wasn’t green? He’s a kid in a candy store, playing (sic).”

While I would love that from a utility-perspective, I feel like @elonmusk is a bit unstable & it could hurt $ADA somehow.

— Tyler Nelson (@CryptoNelson17) May 13, 2021

I mean take this ‘no longer puchacing teslas with $BTC’ thing - you’re telling me Elon didn’t know it wasn’t green? He’s a kid in a candy store, playing

Could XRP Be Tesla’s Future Payment Coin?

The XRP community has also been vying for Elon’s attention. While Ripple Labs appears to have stayed silent on the issue, XRP holders were quick to point out that the Ripple network claims to have one of the lowest carbon footprints of any blockchain on the market.

After #Ripple writes history, Elon can make his tweet saying Tesla accepts #XRP pic.twitter.com/8WT7GiNiLf

— Razvan Stanciu (@RazvanStanciu9) May 13, 2021

Crypto analyst Mr. Whale (@CryptoWhale) tweeted, “Elon Musk says Tesla is looking for cryptocurrencies that use less than 1% of Bitcoin's energy consumption. Good thing $XRP uses less than 0.001% of Bitcoin's energy and only costs $0.0000136 per transaction.”

Elon Musk says Tesla is looking for cryptocurrencies that use less than 1% of Bitcoin's energy consumption.

— Mr. Whale (@CryptoWhale) May 13, 2021

Good thing $XRP uses less than 0.001% of Bitcoin's energy and only costs $0.0000136 per transaction. pic.twitter.com/STtEH3X0y7

David Gokhshtein, the Founder of Gokhshtein media, also tweeted that he could “see Elon take $XRP on as payment for Tesla products.”

I could also see Elon take $XRP on as payment for Tesla products.

— David Gokhshtein (@davidgokhshtein) May 13, 2021

👀

However, just as within the DOGE and ADA communities, some XRP users were not too happy about the idea of Elon Musk publicly embracing XRP.

Twitter user @Beat_Diem wrote, “I don’t really want Elon inside XRP, I don’t want a manipulated market. “

“We need adoption. It’s so easy to pay for a Tesla with bitcoin using BitPay or any other crypto debit card even if Elon doesn't want it. This is really stupid. (sic)”

What are your thoughts on Tesla’s decision to stop accepting BTC payments? Which cryptocurrencies could Tesla accept instead? Let us know in the comments below.