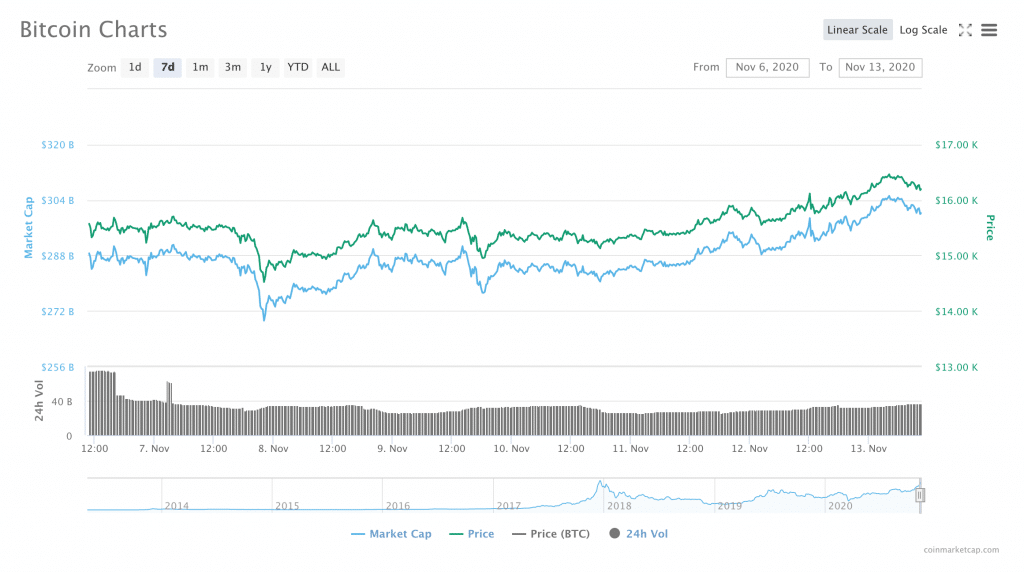

Well, folks, the moment has arrived--Bitcoin is up and past $16k for the first time in more than two years.

The pass over the $16k mark comes after a week of slow and steady gains; last Friday, BTC was already showing signs of heading to $16,000 as a continuation of a strong rally that had begun earlier in the week.

While the upward curve was slight throughout this week, the gains have been consistent, and some analysts believe that a run-up to $20k could be just around the corner.

What is driving Bitcoin up?

On-Chain Metrics Are Favorable to a Boost in BTC Price

Simon Peter, an analyst at social investment platform, eToro, said that part of Bitcoin’s upward movement has to do with BTC’s technical fundamentals.

Simon Peters, analyst at eToro.

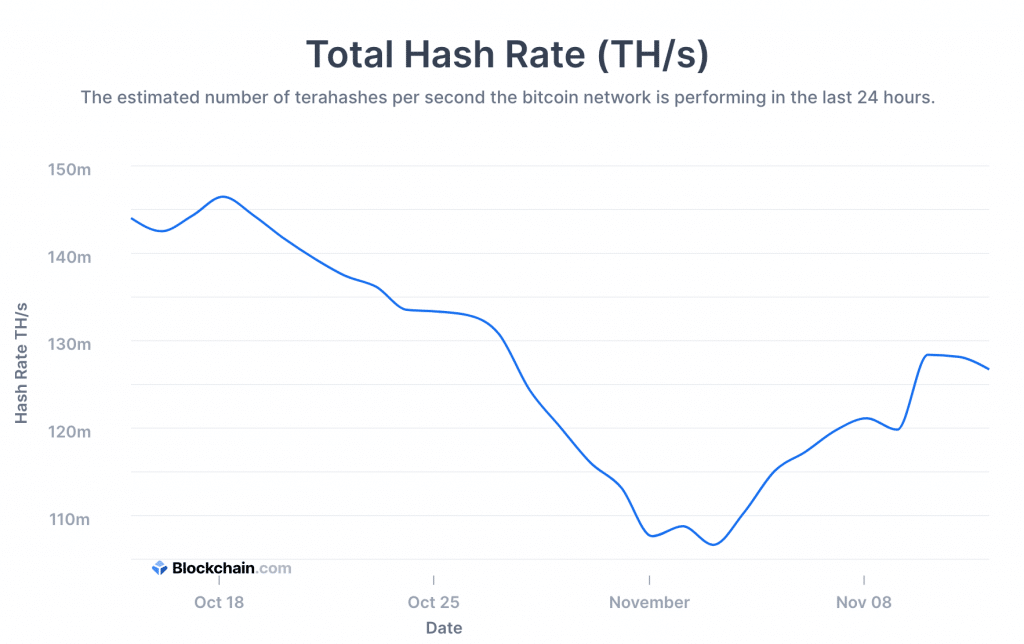

“The recent on-chain difficulty adjustment must have contributed to the latest price rise,” he explained in a statement that was shared with Finance Magnates. “It dropped to 16.878 trillion last Tuesday, the second-largest decrease of all time.”

This decrease in mining difficulty could also explain the explosion in hash power that has taken place since the beginning of this month.

“With fewer operating costs to cover, miners become less pressured into selling, which creates more demand for the crypto asset; and bitcoin, like gold, is susceptible to supply and demand price movements,” Simon continued.

And, as 'Twitter poet' and renowned broadcaster, Max Keiser always says: “price follows hash rate.”

Therefore, Simon Peter is optimistic: “given that we’ve already pushed past $15,000...my next target for investors to focus on would be $17,500.”

Big Finance and Big Tech Are Getting Bigly into Bitcoin

Kadan Stadelmann, Chief Technology Officer of Komodo, told Finance Magnates that the push past $16,000 has a lot to do with demand from the financial industry.

“Bitcoin price is being driven up partially due to the fact that major players and investors in the financial industry are showing an increased interest in bitcoin and demonstrating an acquisition appetite,” Kadan explained. “This can be seen in the most recent cash-allocations to BTC from Grayscale, Square, and other investment firms who are making the jump to BTC.”

In addition to large-scale firms making direct investments in Bitcoin, Paypal also recently paved the way for further retail adoption with the announcement that it would be allowing its users to purchase and spend Cryptocurrencies through its platform, a factor that many analysts say that Bitcoin is still seeing a boost from.

Kadan Stadelmann pointed out that “Paypal’s decision to increase weekly purchase limits from $10,000 to $20,000 is another positive sign for its crypto adoption.”

Kadan Stadelmann, CTO at Komodo.

Dr. Garrick Hileman, the Head of Research at Blockchain .com, told Finance Magnates that "Big Tech is making crypto more widely accessible and safe to buy, bringing in hesitant investors who were interested but stuck on the sidelines," adding that "Square’s recently reported $1.6B in bitcoin sales is just a starter."

But, what has been driving this institutional and big-tech interest in crypto in the first place? Hileman told Finance Magnates that the increase in crypto-related interest from institutional players that has occurred this year can be traced to the US Office of the Comptroller of the Currency’s decision to allow banks to provide custody services for cryptocurrencies.

"Big Finance is encouraged by the US Government’s greenlight on banking custody, and there’s a race to provide customers simple bitcoin investment,” Hileman said.

Is $20k in the Cards before the End of 2020?

What’s next for Bitcoin?

The consensus among many analysts seems to be that $20k is in the cards, it’s just a matter of when.

Indeed, “I believe we will likely see the price of bitcoin climb to $20k and even beyond in the short-term,” Kadan Stadelmann told Finance Magnates.

“Many investors talk about $20k as the last all-time high close in monthly candles, which is a major landmark on the charts. With sentiment at $13.8k, this month is on track to close above,” he continued. “Either way, it could potentially be the highest closing monthly candle in BTC history.”

Dr. Garrick Hileman, head of research at Blockchain.com.

Garrick Hileman also said that Bitcoin “very easily could” pass over the $20k mark, though he drew an important distinction between the predicted pass over $20k and the reach up to $20k that occurred in late 2017.

“The recent price action differs from the mad dash we saw at the end of 2017,” he said. Where 2017’s run to $20k seems to have been largely driven by extreme and short-lived retail hype, this run to $20k seems to be coming from a more sustainable place: “we’ve been building and consolidating towards this for the last two years,” he said.

“No one can say for certain, but it wouldn’t surprise me to see bitcoin reach $20k before the end of year."

“A Sell-off Is Likely in the Short-Term.”

Still, even if BTC reaches $20k before 2020 is over, there could be some bumps along the road.

“A sell-off is likely in the short-term, as many investors and traders will just attempt to profit,” Kadan Stadelmann told Finance Magnates. “Bitcoin’s current higher volatility, and market fluctuation are both a sign of such dynamic price movement.

“However, it should not negatively affect the price and value in the long-term,” he continued.

After all, there have been some recent and significant bullish indicators in the market.

For example, “the price of Bitcoin typically follows closely to the trends in other financial markets, such as stocks,” Kadan said. “Stock prices have been stagnant in recent weeks, while Bitcoin has produced gains. This could be a sign that more people are looking to enter the crypto market who were not previously involved. However, if we expect the long-term price correlation trend to continue, there could be a price correction for BTC.”

Don’t Fear the Re(aper)-Tracement (More Cowbell, Anyone?)

Simon Peter also said in his recent statement that he “remains bullish on bitcoin,” but that he would also “caution that a retracement is on the cards.” However, this retracement “shouldn’t be feared.”

What will cause the retracement to occur? In addition to investors looking for simple profit, Peter said some of the cash that has been flowing into Bitcoin could disperse into other alternative assets before Bitcoin reaches $20k: “it is likely that investors, having seen their bitcoin holding appreciate, will look to take some of the profits and reinvest in altcoins or hold in cash,” he said.

Garrick Hileman also said that a possible sell-off is nothing to fear in the short-term: “sell-offs are always possible,” he said.

“We’ve seen in the past that the price of bitcoin can take a significant dive, and sometimes it takes a while to get moving again. But Bitcoin, unlike many other asset bubbles which rise and crash and never come back, has consistently rebounded to new highs. We believe it will only continue to become more and more integrated into the everyday financial life for more people."

“History Shows That the Price of BTC Has Been Able to Recover from Massive Sell-Offs.”

Kadan Stadelmann also pointed out that even in the worst of circumstances, Bitcoin has always bounced back, eventually.

“It’s important to look at macro trends,” he said. “History shows that the price of BTC has been able to recover from massive sell-offs.

“It’s also important to remember how BTC price has historically increased as a result of the reduced supply that occurs after halving events. Even if buying demand stays relatively flat, the new supply being created is only roughly 900 BTC per day, whereas it was previously around 1800 BTC per day.”

Additionally, Kadan pointed out that “something to consider is that not only is BTC rising, but also total market cap and BTC dominance is on the rise,” a factor that he believes “makes for a possible confluence of indications for momentum-shifting with BTC.”

Indeed, data from TradingView shows that Bitcoin dominance has increased from roughly 59.6 percent to 65.8 percent over the course of the past month.