Late last month, a group of EOS Blockchain community members and block producers from around the world met in Hong Kong to unveil the EOS Alliance.

The group describes itself as a “coordinating group [that] will further unlock the full potential of EOS...by providing a platform for collaborative, transparent decision-making and information-sharing within the EOS community.” It will be funded by private donations, capped at $1 million per year.

The formation of the foundation has been described by many as an effort to unite EOS in the face of some harsh criticism from the crypto community. Despite the fact that EOS has been one of the most hyped cryptocurrency projects this year (with no fees, high scalability, instant transactions, and strong support for dApps), the hype has not really managed to shake several serious concerns.

Even John Oliver got in on the fun--he criticized EOS on his television show, Last Week Tonight, in March.

The first of these is the ongoing topic of centralization. One of the blockchain industry’s most common buzzwords is 'decentralized', a term that describes the way in which blockchain networks are stored and maintained. While a centralized network is stored on private servers (usually kept in one or a small number of locations), a blockchain network is spread across a network of computers, called nodes.

A blockchain network can become centralized when the majority of its nodes belong to one entity or a small group of entities. This is dangerous for a blockchain network--it makes it more susceptible to tampering and to hacking.

Concerns of Centralization on EOS

What does centralization have to do with EOS? Let’s back up for a moment.

EOS is a delegated proof-of-stake (DPOS) network. In order to understand what that means, it’s important to know that ‘blocks’ are bundles of transaction data that get added to a decentralized ledger in a linear fashion, forming a chain (thus, the name: blockchain).

In a proof-of-work network, blocks are ‘mined’ by the nodes that have the greatest amount of computing power (usually, this means the guy who has the fanciest equipment). In proof-of-stake networks, block producers are chosen by the amount of coins that they have staked (or locked in) to the network.

The security of blockchain networks comes from the fact that they are so decentralized--on most popular networks, thousands of nodes are running at all times, earning token rewards for the work that they do to add new blocks to the blockchain. Compromising the integrity of a blockchain network would mean compromising more than half of its nodes.

EOS, however, runs on only 21 block producers at any given time. 21. Therefore, it would theoretically be possible to compromise the EOS mainnet by compromising just over half of these block producers. While the block producers are powerful entities like Bitmain, it is certainly possible that these block producers could be attacked and at least temporarily taken out of commission.

Block Producers Could Use Massive Token Holdings to Elect Themselves

What is considered to be even more concerning is that block producers on EOS are elected by stakeholders (this is where the ‘delegated’ part comes in). CoinMonks described the EOS voting mechanic this way: “Each staked EOS token can be used to vote for up to 30 different block producer candidates, with each token representing 1 vote per BP, or up to 30 different BP votes per token. Votes are weighted pro-rata based on the total number of staked tokens, and the 21 block producers who receive the most stake weighted votes will be elected as the ‘active’ block producers.”

In other words, he who has the most coins has the most votes. And who might have the most coins? You’ve got it--the block producers.

Essentially, the concern is that block producers use their staked coins to keep electing themselves as such. “Every year there is a maximal inflation of 5% to pay the block producers, which equals at the current price of EOS $332,476,257,”wrote pseudonymous crypto analyst ‘Crypto Peter Griffin’ in a Medium Post. “All of this money goes directly into the pockets of the (probably not much changing) 21 block producers and grants them with even more power and stake in the network.”

EOS Block Producers Earn a Hefty Sum

Crypto Peter Griffin estimated that the block producers “get paid 300-30 Million USD annually to cover their cost of a one-time payment of 20–22K (hardware) + $200 a month for a badass internet connection.” This forms a sort of crypto-oligarchy: not only do the EOS block producers have an immense amount of power and potential control over the EOS network, they’re getting paid crazy amounts of money to have it.

Indeed, Enrolled Agent Crystal Stranger told Finance Magnates that “while DPOS works reasonably well for Steemit and maintains its decentralized nature because the tokens are distributed widely to content producers, it does not work so well for a system where tokens are purchased and accumulated by investors. As in the case of platforms like EOS the power moves to the hands of the wealthiest token holders.”

Crystal Stranger, EA.

(There is a clause in the EOS constitution saying that no single entity can control more than 10 percent of all EOS tokens. However, EOS itself controls roughly ten percent of the total token supply, another factor that has raised eyebrows. Concerns about the vague wording of the EOS constitution have also been murmured about across the internet.)

A Problematic Mainnet Launch

The launch of the EOS mainnet was another hiccup in EOS’ history that brought a good deal of side-eye from the global crypto community.

Just a couple of days before the scheduled EOS mainnet launch in early June, Chinese cybersecurity firm Qihoo 360 published a report detailing how vulnerabilities in the EOS code could be exploited by hackers. The company also publicly said that it had shown the weaknesses to the EOS team, and that the team would be postponing the mainnet launch until the issues were resolved.

EOS clapped back, saying that “[the] media has incorrectly reported a potential delay in the release of EOSIO V1 due to software vulnerabilities. Our team has already fixed most and is hard at work with the remaining ones. EOSIO V1 is on schedule; please stay tuned to our EOSIO channels for official information.”

The EOS Mainnet Launch: A New Dawn https://t.co/DcPc9ASExE #eoslaunch #eos $eos

— EOS New York (@eosnewyork) June 9, 2018

However, just a couple of days later, EOS announced a bug bounty program. EOS CTO Dan Larimer also tweeted a $10,000 reward for bugs found in the EOS code, leading many to suspect that EOS had concerns about the strength of its own software.

Some in the crypto community believed that EOS deserved a little bit of slack--even Qihoo 360 said in its report that the nascent nature of the blockchain industry means that technical errors are bound to happen. With so much money on the line, however, others found EOS’ potential technical issues to be unacceptable.

To be fair, however, EOS’ mainnet has been running without a hitch since the launch.

EOS’ $4 Billion ICO

The EOS ICO has also been the subject of much controversy. Taking place over 12 months and raising $4 billion, it is one of the biggest and longest token sales in history.

The scale of the ICO is not problematic in and of itself. Rather, the concerns were mostly centered around the plans for what the money would be used for, which (at the time of the ICO) were vague at best.

Indeed, EOS’s MVP had not been publicly released at the time that its ICO finished. John Oliver tore into the EOS ICO during the infamous aforementioned cryptocurrency segment on his TV show, pointing out that although EOS had raised $1.5 billion at the time the show aired, it still “hadn’t launched yet.” Oliver also pointed to a Wall Street Journal report that called EOS “a software startup that doesn’t plan to sell any software.”

There were a few other issues that Oliver named during the segment. He advised his audience to google the words “Brock Pierce scandal”, which shed some uncomfortable light on Pierce, the network’s co-founder. Pierce, a childhood movie star, was embroiled in a number of child sex accusations a number of years ago. He was removed from his station at EOS after Oliver’s segment.

Added to the fact that Block.one, the startup behind EOS, is incorporated in the Cayman islands, all of this did not shape up well for the network. EOS published a tongue-in-cheek response (https://medium.com/eosio/dear-john-oliver-6aa5ac5fff26) to Oliver’s criticisms, saying that it “[agrees] with [his] message regarding general industry wide caution.”

Still, in spite of the criticism, the ICO was record-breakingly successful. Crystal Stranger also pointed out that “with the 4bln raised I would imagine some excellent projects will receive development grants to build on EOS and this will increase over time.”

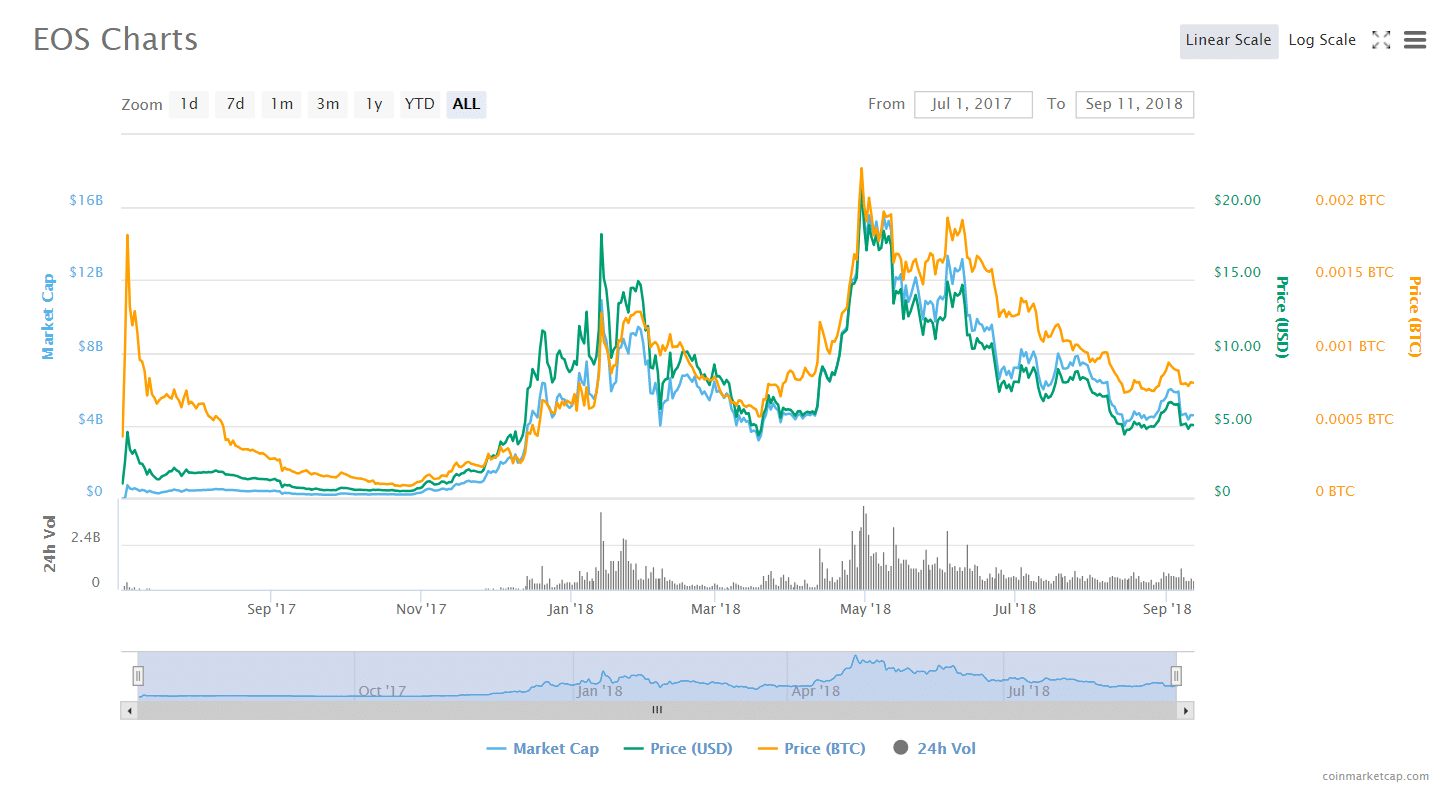

The EOS token has had its ups and downs since then, along with the rest of the cryptocurrency market. After briefly shooting up over $20 in May of this year, the coin now sits quietly around $5. The world is waiting for its next big move.