The “mass adoption” of cryptocurrency and Blockchain technology seems as though it may actually be underway--but it may not look like what most crypto enthusiasts and analysts may have thought that it would.

The largest cryptocurrency networks have not been adopted for use on any kind of widespread scale.

While more institutional players have entered into the market--and a few companies have started to accept crypto as payment--the world isn’t really any closer to adopting Bitcoin (or any other crypto) as its singular currency.

Indeed, the Bitcoin network has been struggling with the same scalability issues that it is had for years; while web apps for Ethereum and other blockchains are continuously being developed, the technology that powers these major networks (and their respective coins) simply hasn’t been able to match the speed and user-friendliness that Fiat-powered, centralized apps have.

However, there is one corner of the cryptosphere that has been blossoming where mainstream crypto companies have lagged behind: stablecoins. Stablecoins are cryptocurrencies that have stable valuations, usually by “pegging” coins to fiat currencies and other assets--and new ones have been appearing on the scene at an accelerating pace.

What is Causing the Stablecoin Explosion?

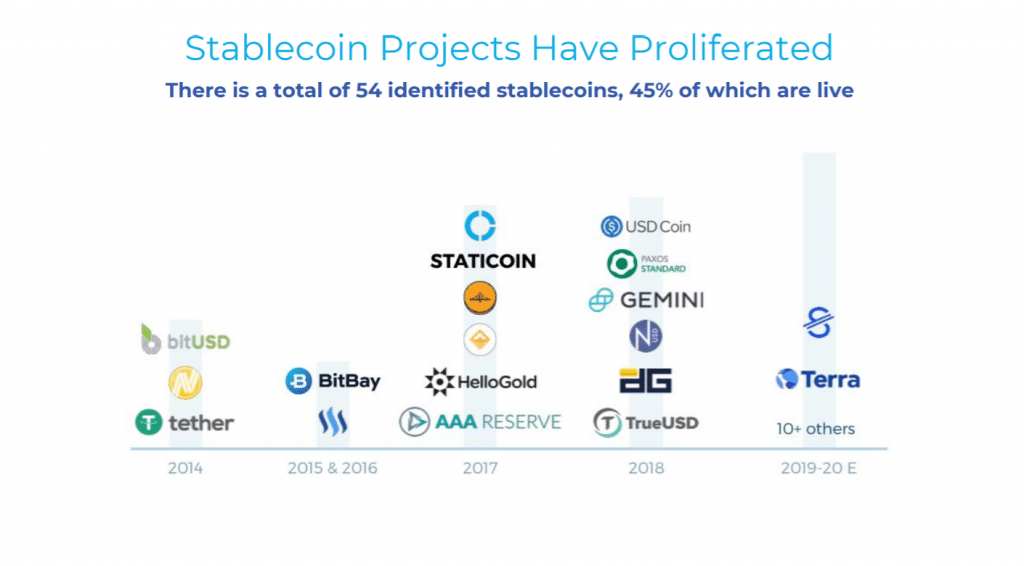

According to a report from crypto research firm Blockchain, there were only a handful of stablecoins on the market at the end of 2017; now, there are dozens--54, to be exact.

Stablecoin proliferation. Source: Blockchain

These 54 stablecoins now comprise 2.7 percent of the total market share of all cryptocurrencies, up from 1 percent in 2018; over $260 million in venture funding has been raised by stablecoin projects as of February of this year. Eighty-three percent of existing stablecoins are asset-backed, while the remaining 17 percent are algorithmic.

As the number of stablecoins continues to rise, competition between them continues to grow fiercer. Is there room in the market for all of them--or will some of them have to go?

In-House Stablecoins Could Bring in Big Profits for Corporations

“Generally the explosion of stablecoins reflects a competitive scramble, and generally more activity in the market is a good thing,” said Stan Stalnaker, Founding Director of Hub Culture, in an email to Finance Magnates.

He added that this activity is likely to continue: “the reality is that soon most banks are likely to have a stable of stablecoins in the market as tokenization and blockchains make it possible to issue value into the market.”

Additionally, it seems that corporations and financial institutions are starting to catch onto the benefits of building their own stablecoin ecosystems. Several mainstream companies, including Nike and Facebook, have either floated the idea of launching a coin or are in the process of launching one already.

Point blank, “issuers of successful stablecoins can become wealthy,” explained Jeffrey Stollman, Principle Consultant at Rocky Mountain Technical Company, to Finance Magnates.

“Even if they back their coins 1:1 with the asset that the coin is tied to, they can receive interest on overnight loans of their collateral. The more coins that they mint, the more collateral they have to lend, and the more money they make.”

Issuing a stablecoin can be an even more profitable if it manages to become adopted as a widely-used means of exchange: “the goal is to have your stablecoin become a leading currency for commerce,” Stollman said. “Then trillions of dollars worth of the coin will be needed. It doesn't take high-interest rates to make money on trillions of dollars of collateral.”

Jeff Stollman, RMTM.

This may indeed be why Facebook was reportedly seeking e-commerce partners to accept its cryptocurrency, which is expected to be launched sometime this year. Stollman explained that the fact that Facebook already has so many users could lead to the widespread use of its stablecoin--but not necessarily.

“Facebook's stablecoin has some potential to become a dominant stablecoin if they are able to excite their huge user base into using it... But just because Facebook has a large user base does not mean that they will all begin using their stablecoin.”

However, the widespread use of Facebook’s currency could serve to lift other stablecoins rather than stamp them out entirely: “if enough people start using it, it will move stablecoins to the next level,” Stollman explained.

A recent report by Binance Research on the evolution of the cryptocurrency industry came to a similar conclusion.

"Non-financial companies (e.g., Facebook or Samsung) are likely to be less risk-averse than traditional financial companies, and have greater incentive to disrupt the Payments industry, with the added ability to execute at a faster, scalable pace," it said.

"As a result, these companies may help to define future key growth drivers for both the global payment and the digital asset industry.”

Whatever the Cause, The Net Effect of Stablecoin Explosion Has Been Positive

Regardless of what may or may not be causing the number of stablecoins to rise, “the increase of stablecoins eager to prove their solvency is having a positive effect on the industry,” said Angelo Frisina, Founder and CEO Sunlight Media LLC. After all, “a year ago, there were only a few stablecoins in existence, some of them with rather shady and controversial reputations,” he added, referring to Tether.

Angelo Frisina

Now that competition has gotten fiercer, users can afford to choose: “stablecoin companies can’t afford to cut corners anymore when it comes to being transparent and secure.”

And stablecoin companies will continue to race to create products that will entice new users. “For these new technologies to be adopted by consumers, they need to provide a user experience that is straightforward, simple, familiar and ultimately better and cheaper than what consumers already use.”

Indeed, “the population at large is not interested in complicated technology for the sake of something different or new or unique. They are interested in things that make their lives simpler, easier, and make their transactions and purchases cheaper.” Stablecoin companies who can’t manage to do that for their customers--whether they be individuals or financial institutions--are unlikely to survive long term.

Projects that Will Survive Longterm

Which are the projects that will survive long term? Stability and trustworthiness are certainly essential--“the best stablecoins will become indistinguishable from digital cash because they are reliably backed in full and exchangeable,” said Stan Stalnaker.

Stan Stalnaker.

However, once unreliable coins are weeded out, he believes that there is room for more than one coin at the top: “coins that fail to achieve that level of security and reliability will have a hard time succeeding, while the rest will converge into a convertible ecosystem,” he said.

Stablecoins that have proved themselves to be unworthy of users’ trust are already starting to lose market share. According to a report by research firm Diar, Tether is beginning to lose its grip on the market, although it is still the most widely-used stablecoin by far.

“Tether is less secure as a store of value than other stablecoins,” Jeffrey Stollman said, adding that “the issuers of tether have not been content to merely obtain interest on short-term lending of their assets, they have made medium-term loans that reduce the cash available to back their currency.”

“Coins such as Gemini maintain their 1:1 backing and are more secure. So tether will likely continue to lose ground to better stablecoins. But the key is acceptance of other stablecoins by the exchanges.”

Stablecoins Are Probably the Ultimate Path to Crypto Adoption

Regardless of whether the future market will consist of five or five hundred stablecoins, it seems that they are a vital part of crypto’s path forward.

“Stablecoins are the key to any viable transition from cash to crypto,” Jeff Stollman said. In a way, they offer the best of both worlds: “while many zealots decry the fact that stablecoins are tied to a sovereign currency, this is the main benefit.”

After all, “most large economies have stable currencies. And they also enjoy stable pricing. Stablecoins provide a transition to cryptocurrencies and their benefits while still providing users with a known value for their holdings.”