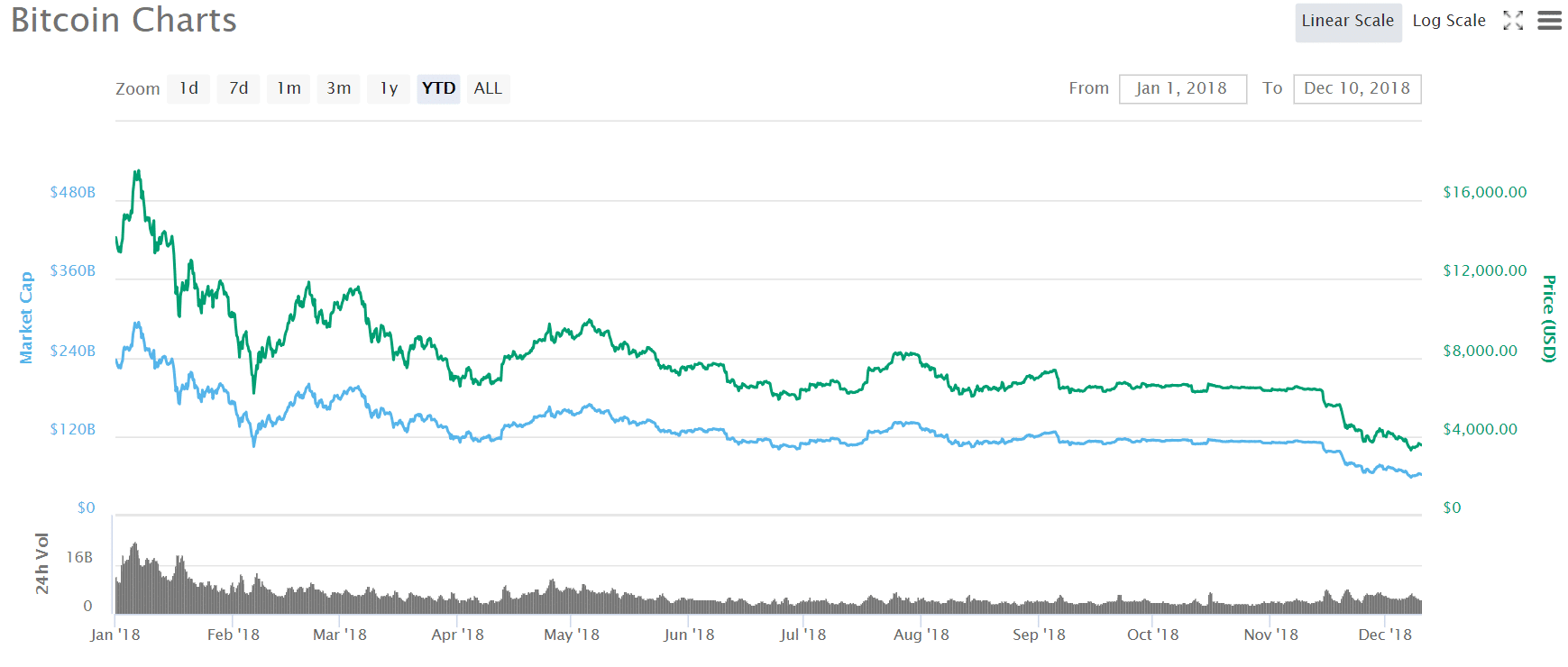

It’s been a horrendous year for Bitcoin. It started bad, and it’s finishing even worse. The recovery that Bitcoin bulls were hoping would come at some point this year is all but a pipe dream at this point--even within the past month, Bitcoin’s valuation has nearly halved from $6400 to roughly $3565 at the time of writing.

And yet, some analysts, executives, and traders have refused to drop their bullish predictions for Bitcoin. Squeezing their optimism to the last drop, they hold onto the idea that Bitcoin will not only recover, but it will shatter expectations, pushing past its all-time high of $20,000 and straight “to the moon.”

Who are these relentless bulls, and why are they holding onto these predictions?

Bobby Lee Sees Triple in 2021

At first glance, it seems that Bobby Lee has a somewhat realistic approach to Bitcoin price predictions (at least in the short-term sense.) Lee is a Bitcoin Foundation board member and co-founder of the BTCC cryptocurrency exchange. On December 7th, 2018, Lee tweeted that he believes that Bitcoin will “bottom out” at $2500 in January of 2019.

Lee’s long-term predictions may be a little less realistic. He went onto say that the next rally will begin in late 2020, bringing a height of $333,000 in December 2021, followed by a crash at $41,000 in January of 2023.

If history repeats perfectly, then the current bear market for #Bitcoin would bottom out at $2,500 next month, in Jan 2019.

And then the next rally would start in late 2020, peak out in Dec 2021 at $333,000, and then crash back down to $41,000 in Jan 2023. Something like that?? https://t.co/M8ljIVnt73 — Bobby Lee (@bobbyclee) December 7, 2018

Lee’s predictions are apparently primarily based on a simple “history-repeating itself” pattern. He also explained that his rationale is based on his prediction that Bitcoin’s market cap will eventually surpass gold’s market cap. “One more coincidence: If the next #bitcoin rally (in 2021?) does indeed reach $333,000, that’ll bring Bitcoin’s price to roughly that of #Gold, at $7 trillion each!”, he wrote.

From then all-time high of USD $1,200 in Dec 2013, for next 13 months, #Bitcoin went down by over 87% to bottom out at just $150 in Jan 2015. Rock bottom! #AllHopeLost?

Now from Dec 2017 high of $20,000, going down 87% would take it to $2,500. So maybe bottom out in Jan 2019? ? — Bobby Lee (@bobbyclee) December 7, 2018

John McAfee Says that a $1 Million Valuation by 2020 is a “Conservative” Estimate

Lee’s long-term predictions may sound outlandish, but he’s not the only one with pie-in-the-sky high hopes. John McAfee, founder of McAfee cybersecurity software firm and eccentric millionaire, told CoinTelegraph in November that a Bitcoin valuation of $1 million by the year 2020 is a “conservative” prediction. However, he did add a small caveat, saying that the “real value” of $1 million could be reflected differently in the future due to hyperinflation in fiat markets or other widespread fiscal problems.

Yeah, right.

Perhaps McAfee could be a little bit worried about having to fulfill a small promise that he made last year.

if not, I will eat my dick on national television.

— John McAfee (@officialmcafee) July 17, 2017

According to McAfee, his method of prediction is “simple”--he’s simply drawing a correlation between the growing number of transactions increased amount of users on the Bitcoin network. By these standards, McAfee explained that the value of the Bitcoin network is “growing tremendously.”

McAfee wasn’t wrong about the growth in transaction volume. Diar recently reported that in Q3 this year, the number of Bitcoin transactions that happened on the Bitcoin Blockchain had reached an all-time high, shattering Q1 2018’s record by about 70,000 transactions. The same report also noted that BTC transactions have been steadily increasing 3-5% month-by-month since March of this year.

So what of the bear market? McAfee says that BTC’s downward spiral is only “temporary,” the result of “artificial pressures.”

Fiat Collapse Could Bring the Price of Bitcoin Up

McAfee added in his interview with CoinTelegraph that an increase in BTC valuation could also be caused by what he sees as an inevitable collapse of fiat currencies. “You will see the collapse of fiat,” he said, ominously.

While it’s currently unclear whether or not the world’s fiat systems will collapse anytime in the near future, McAfee could be correct in his supposition that a fiat collapse would bring about greater usage of Bitcoin and other Cryptocurrencies .

This is evidenced by countries who have experienced financial crises that have destroyed their national currencies. Take Venezuela, for example--as the Bolivar collapsed and hyperinflation plagued the country’s economy, citizens turned to Bitcoin as a method of storing the value of their savings; mining Bitcoin and other cryptocurrencies provide a source of income for individuals and families who lacked the funds to buy necessities, like food and clean water.

Before Venezuela, a similar phenomenon happened in Zimbabwe. Long before Bitcoin hit $10,000 in the rest of the world, the value of BTC on Zimbabwean exchange Golix was pushed to $14,000 because of high trading volume within the country.

Smart Valor CEO Olga Feldmeier spoke about the phenomena of Bitcoin as a financial safe-haven in an interview with Finance Magnates conducted earlier this year. “Bitcoin and decentralized money give the same [privileges] to everybody,” she said. “You can always purchase one or two Bitcoins, and [use it as protection] from inflation in your home country.”

However, relying on some sort of "inevitable" financial collapse isn't exactly solid ground to base a price prediction on.

An ETF Could Bring BTC Back from the Dead

Other Bitcoin bulls are counting on the approval of a Bitcoin ETF (exchange-traded fund) to breathe life back into BTC.

Indeed, this has been the hope of countless investors throughout 2018. In the days running up to the SEC’s decision on the Bitcoin ETF application submitted by Cameron and Tyler Winklevoss and their Gemini Exchange, the price of Bitcoin rallied to nearly $10,000, a high that it hadn’t reached for months. Unfortunately, the SEC’s rejection of the application sent BTC’s valuation tumbling.

More recently, though, a study published by tom Alford at TotalCrypto.io has predicted a 500% increase in the price of Bitcoin should an application for a Bitcoin ETF be approved. There are currently several applications under review, including one by VanEck and SolidX, and one by CBOE. While the jury is still out (and likely will be for several months), many voices across the financial community believe that at least one of these applications has the stuff to get an approval.

BitPay COO Sonny Singh also believes that the appearance of a Bitcoin ETF on the market could send Bitcoin up again. Singh told Bloomberg that he believes that the price of Bitcoin could reinvent itself throughout the first two quarters of 2019, resulting in a valuation of anywhere from $15,000-$20,000 per BTC.

New Capital On-Ramps for Institutions Could Fatten BTC

Some analysts argue that another factor that has been contributing to Bitcoin’s decline is a lack of investment on-ramps for institutions and high-volume investors.

“Number one, the on-ramps for new capital is very difficult,” said digital assets trader at Susquehanna Bart Smith. “If you’re a global institution, it is still very difficult to buy Bitcoin in a way you might want to. A wealthy individual from the G.I. Generation is not going to take a high-resolution picture of their driver’s license and send it to a website and send money there.

Instead, Smith argues these kinds of investors want the security that comes with traditional institutions: “they want to invest with Fidelity. They want to invest with Bank of America.”

So, the lack of these kinds of avenues into Bitcoin has left many big investors out of the game. However, more and more platforms that have been designed to serve high-volume and institutional investors specifically have appeared on the scene. ICE’s subsidiary exchange Bakkt is one of these; ErisX also recently launched a trading platform designed for institutional investors.

The Three-Body Problem

Of course, no matter what your opinion on the future of Bitcoin may be, it’s extremely important to remember that the only person who really knows what will happen is named Josiah Stimm, and he lives on a tiny and undiscovered island in the Atlantic ocean, where he is completely unreachable by telephone or any other means.

Ok, you got me--that was a lie. There is no such Josiah Stimm. The real answer is that no one knows.

“These forecasts are, for the most part, exercises in futility,” wrote opinion columnist Barry Ritholtz in a recent article for Bloomberg. Ritholtz also pointed to his colleague Nick Maggiulli, who reminded us all in a tweet that it is impossible to predict chaotic systems.

Where did all these people go wrong? When they made a Bitcoin price prediction in the first place.

You CANNOT predict chaotic systems. It’s the Three Body Problem. pic.twitter.com/IeMJQ761Sw — Nick Maggiulli (@dollarsanddata) November 24, 2018

The Three-Body problem refers to the problem of taking three different point masses and predicting the way that they will interact with one another based on Newton’s laws of motion and gravitation--it’s impossible.

Of course, there are those who do not view Bitcoin as such a chaotic system. Renowned researcher and cryptocurrency analyst Willy Woo has developed an algorithm that actually sort of mirror’s Bobby Lee’s predictions for the future price of Bitcoin--shorter-term fall and a longer-term boom.

However if you're into timing games, then my own NVT Ratio is saying we are still in the middle of a bear market. NVT is simply the ratio of volume carried by the blockchain to the historic price. (This indicator is due for recalibration after the Liquid Sidechain launch) pic.twitter.com/hcnI50QAnd

— Willy Woo (@woonomic) October 26, 2018

The fact is, though, that we cannot predict the future based on the past alone. Sure, there are some data points that we can track and analyze various types of patterns. But the economy shrinks, grows, and changes every day with unprecedented inputs and losses. We can’t reliably predict the future of Bitcoin because we can’t reliably predict the future of anything.