Remember the video of that crazy guy screaming about BitConnect at a conference in Thailand? It may seem like a lifetime ago but that short clip, which epitomises everything that was wrongheaded in the cryptocurrency craze which swept the globe at the end of 2017, is barely a year old.

Fast forward to today and Bitcoin has just had a huge slump in value, interest in cryptocurrency is down and many now see the industry as a minefield of scammers and ponzi schemes.

[embed]https://www.youtube.com/watch?v=QKO6IChjojI[/embed]

Thus, it wasn’t too surprising to see a more subdued set of Blockchain and cryptocurrency executives turn out to Krypton’s Next Block conference in Tel Aviv this Wednesday.

But though there may have been no screaming about 10000 percent returns and Bitcoin hitting $1 million by the end of the year, most speakers were, strange as it may seem, positive about the current state of the cryptocurrency market.

Fewer scammers

With fewer scammers and traders, banking on the greater fool theory paying off, looking to make a quick buck, the market is maturing and we’re being left with the serious companies and investors. That’s the theory anyway. Things were best summed up by the founder and CEO of loans company Celsius, Alexander Mashinsky.

“We’re seeing more sellers than buyers and that’s a good [development],” he said. “We don’t want those people. They were not here for the long run, they just wanted to make some instant cash.”

One of the best sessions of the day was hosted by Finance Magnates’ very own Michael Pearl. With the CEO of a vegan cryptocurrency project, a blockchain educator, the founder of an enterprise technology company, and the Strategic Director of a cryptocurrency derivatives firm all on one panel, there was an array of different perspectives and, consequently, some interesting disagreements.

Celsius CEO Alexander Mashinsky gives his presentation

Regarding the perception that the cryptocurrency market is comprised of a bunch of fraudsters, Isaac Thomas, co-founder and CEO of Vegan Nation, said that even legitimate companies were partially to blame.

“People were marketing their companies, and the wider industry, saying ‘look there’s no Regulation , we can do what we like,’ he said. “That wasn’t the right thing to do. Firstly, it’s not true. There is very clear regulation in most places. But it also gave the ecosystem a bad reputation.”

ICO-ut of action

It is in large part because of this reputation that the ICO market has tapered off in recent months. Unlike at the start of this year, not everyone is trying to sell their services in tokenized form.

“People are waking up to the bullshit,” said Eran Tirer, a former IBM executive and the founder of insurance technology company Ledgertech. “When the market was hyped, and everybody who said ‘blockchain’ or ‘crypto could sell whatever they wanted, companies that would have never passed the first round at a venture capital fund started to raise money. That doesn’t make any sense for the long run.”

[embed]https://twitter.com/juanbenet/status/950142785373405184[/embed]

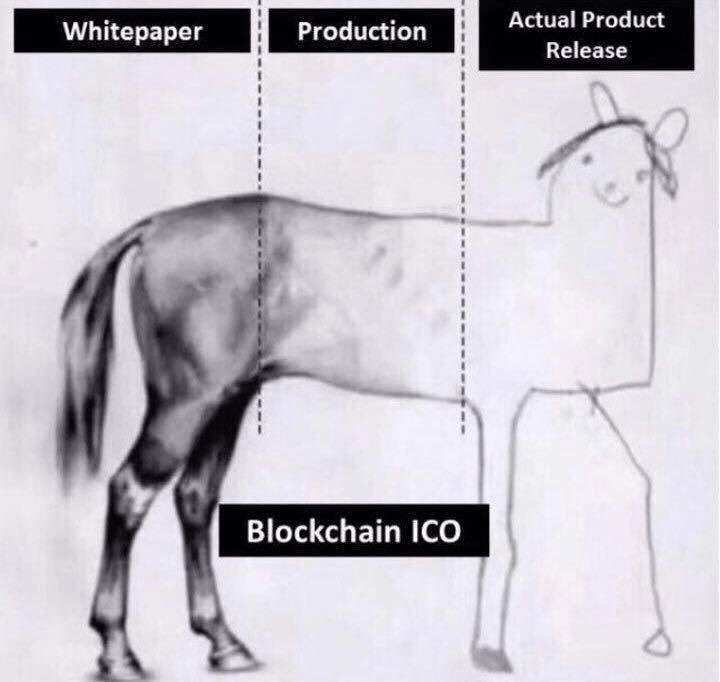

A key component of these crappy companies’ plans was providing a ‘whitepaper’ detailing what they would do with any of the money they raised. Many of these papers were total rubbish and some, when run by the real scam artists, were just copied and pasted from other startups.

More products, fewer papers

“That’s something I see changing in the industry,” said Aviv Lichtigstein, founder of blockchain education company 101 Blockchains. “We’re going to see more companies building technology before publishing a whitepaper. There need to be more working products and fewer papers.”

Artist's depiction of the ICO process

Isaac’s Vegan Nation is one company that has done just that. Though the company, which hopes to create a cryptocurrency for vegans across the world, has been around for over a year, it is yet to launch its ICO.

“We could have done it back in February and probably raised a $100 million,” said Isaac, “but if the coin lost 90 percent of its value then, in the long run, we would lose the trust of our community. So, instead of that, we built all the infrastructure and products - things most companies are talking about doing two or three years after the ICO - in order to launch with a token that is backed by everyone in the vegan community.”

Consolidation

All of the above may give you the impression that cryptocurrency executives are turning into cynics. That isn’t the case. After all, everyone who was at Krypton’s event is still working in cryptocurrency or blockchain.

Instead, people seem to believe that the market is maturing. As noted already, the get-rich-quick traders and fraudsters are filtering out and leaving behind serious companies and genuine entrepreneurs.

“We’re going to see a lot of coins delisting,” said Sandris. “A lot of exchanges and projects will be going bankrupt too but we’ll see more mergers and acquisitions like the Bithumb or Poloniex buys that we saw this year. I think there will also be more segmentation in the cryptocurrency market. Security tokens and utility tokens are two very different things but we are yet to see that in the market itself.”

Back at the beginning of October, we here at Finance Magnates said that a decline in interest would, paradoxically, be good for the cryptocurrency industry. That view seems to be popular not just amongst us hacks but the people working in the industry itself.

True, a more mature, subdued industry is less exciting than someone running around on a stage in South-East Asia screaming about impossible returns, but it is a sign that we can start taking the blockchain industry more seriously. Isn’t that what the cryptocurrency fanboys have always wanted?