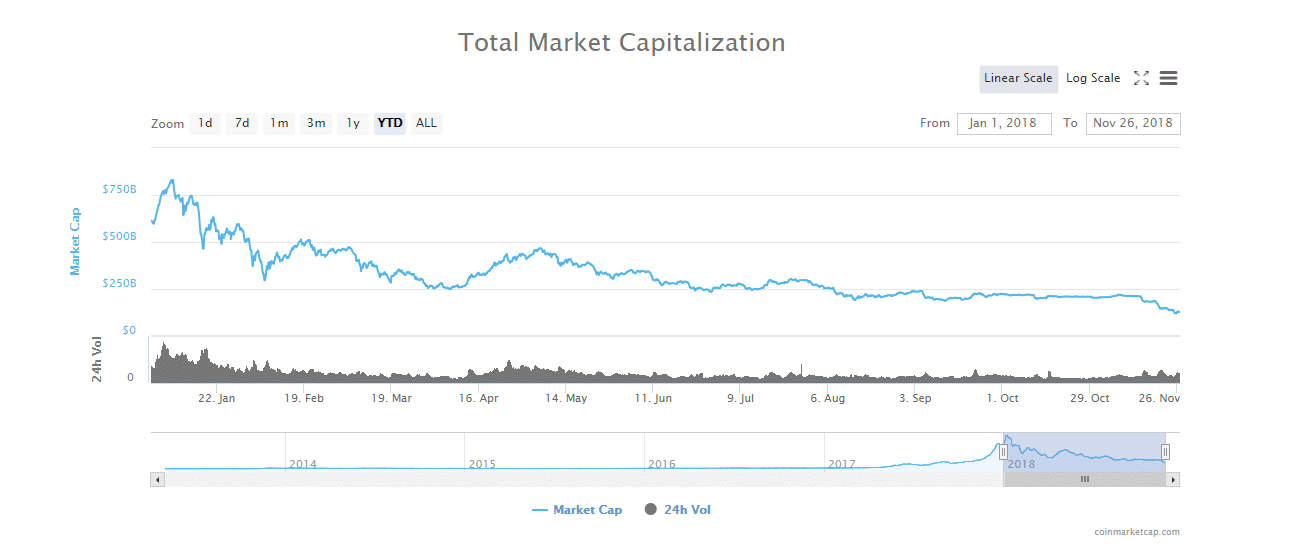

The recent, massive declines in cryptocurrency market caps have once again stirred serious questions in governments the world over. What kinds of regulations are necessary to protect citizens from losing massive amounts of cryptocurrency? Are such regulations necessary? Are they even possible?

In the UK, these questions were brought to the forefront several months before the tailspin that has been the cryptocurrency markets over the last several weeks. In mid-September, a group of UK lawmakers called for more oversight and regulation of the cryptocurrency markets; their call was prompted by a UK Treasury Committee initiative to explore the benefits and risks of Cryptocurrencies .

A report published by this group of lawmakers claimed that cryptocurrencies have “no inherent value” and are “particularly vulnerable to manipulation,” and that ““the introduction of regulation [to the cryptocurrency space] should be treated as a matter of urgency.” The report also stated that “the development of ICOs has exposed a regulatory loophole that is being exploited to the detriment of ordinary investors.”

Now that the cryptocurrency markets at large are at a lower level than they have been in over a year, what could be the direction that the UK is headed for in terms of its regulations? And how is the industry that has emerged around Blockchain technology affecting--and being affected--by these regulations?

Can a ”Healthy Balance” Be Achieved?

James Davies, CFO at Crypterium, longterm financial technology and derivatives markets expert, told Finance Magnates that in the UK and Europe, “cryptocurrencies are not regulated, but a lot of what you might want to do with them is (such as futures, funds or payment services.)”

James Davies, Chief Financial Officer at Crypterium.

As such, Davies believes that “the direction of Cryptocurrency legislation is clear, we are moving toward them being treated as either financial markets securities, or as FX, depending on the individual cryptocurrency. Past experience suggests this will come fairly quickly, and that AML rules will swiftly clamp down on any anonymity.”

However, the question of “healthy balance” in the blockchain and cryptocurrency industry in the UK still remains unanswered. If this regulation does come “fairly quickly”, exactly what kinds of restrictions will be placed on anonymity and other aspects of blockchain platforms--and what effect will this have on industry growth in the UK?

Akin Fernandez, the founder of the Bitcoin Startup Azteco, compared the governmental desire to reduce anonymity on blockchain and cryptocurrency platforms to the desire to gain control over “Public Key Cryptography of the kind used in SSL to secure your browser.”

Fernandez’ prescient and highly regarded writing on Bitcoin and its potential spanning from 2010 to today are widely circulated and reveal a deep understanding of the different aspects of the software from the legal, technical and societal positions.

“The UK and US governments have been trying for years to cripple this essential software technique so all messages are transparent to them, but they’ve failed because enough people understand that breaking SSL and other tools makes everyone online less safe.”

“There is no need for regulation of software,” he added. “The existing rules covering fraud are sufficient for all circumstances, with generous relief for victims. That is all that’s required. Lawmaking should never be triggered by or built upon buzzwords like ‘cryptocurrency.’”

”Computer Illiteracy, Crony Capitalism, and Fear”

Indeed, Fernandex believes that the primary influencing factors on initiatives designed to regulate cryptocurrency in the UK are “Computer Illiteracy, Crony Capitalism and fear (as well as False Evidence Appearing Real).”

“The idea that a ‘proper regulatory environment’ is required for the software industry to flourish is absolutely false,” he continued. “The World Wide Web on the Internet grew without any regulation at all, and the same thing will happen with Bitcoin, which is nothing more than a new database and communications protocol.”

Fernandez went on to argue that “the form of the services is something the market must determine without distortion”; distortion, in this case, meaning regulation. “ No one will wait for the UK to wake up to what’s happening. They will select free market territories like Hong Kong to incorporate in, just as BitMEX has.”

“There is a naive class of participant that thinks regulation means banks will be more willing to offer them services. This is false. Regulation cannot force banks to offer you their services; banking is not a right,” Fernandez added.

Indeed, a number of figures in the cryptocurrency industry have called for greater regulations in order to “legitimize” the industry in the government’s eyes. One of the voices calling for greater regulation comes from CryptoUK, a group of blockchain and cryptocurrency companies that joined earlier this year to form self-regulatory industry standards and work with lawmakers.

CryptoUK wants the FCA to license and regulate crypto exchanges. More from @aprilalexandra1 https://t.co/Nbq6jsrZ19

— CBROnline.com (@cbronline) May 1, 2018

“If banks could be forced to serve any and all comers without exception as a legal right, the 1,000,000 unbanked Brits would all be served. It is the unbanked that Bitcoin will serve globally, and there are over two billion of them. 1.5 billion people use WhatsApp, so it is not beyond the realms of possibility that that many people will be using Bitcoin,” Fernandez explained.

Despite an Uncertain Future, Innovation Presses Forward--But How Will the UK Establish Itself as a Blockchain Hub?

Connor Cantwell, European Partner at Cosimo Ventures, has also identified skittishness in banking when it comes to blockchain and cryptocurrency. “I suppose the financial institutions probably see opportunity in blockchain to improve their own products and services but to date have pretty much steered clear of crypto and particularly for crypto projects it's very difficult to find banking,” he told Finance Magnates. “And even if you do find banking, it's very difficult to get auditing services to get you through your commitments that a traditional audit would normally satisfy."

Still, Cantwell says that the cryptocurrency industry is "very dynamic.”

Connor Cantwell is a European Partner at COSIMO Venture Partners, Specializing in Deep Tech and Blockchain.

“Blockchain, in particular, is extremely dynamic in the UK. It's been embraced right across the board. Both inside financial services and outside financial services. Lots of FinTech companies bringing products into the market which are built on blockchain,” he said.

“Lots of companies tokenizing. We've seen a flood of early-stage companies launching that are built on blockchain. I certainly go around a lot of accelerators and incubators and there's an increasing presence of blockchain projects in those incubators and accelerators."

The Correct Strategy to Attract Crypto Companies? “Do Nothing.”

Fernandez agrees. “Software development in Bitcoin is going at a cracking pace,” he said, adding that“all of this innovation is being done globally, mostly by small teams.”

“Britain can capture them all and have them in Shoreditch making it the global center for this specialised form of database development. The time to attract these companies is now, not in the future when they are all established and settled.”

However, contrary to the beliefs of many other industry participants, Fernandez reiterated: “the correct strategy to attract them is to do nothing. No regulation, no new legislation. Let the companies grow just as all other software companies do.”

Is the best strategy to build the cryptocurrency industry in the UK and elsewhere in the world to stay completely hands-off? Or is this irresponsible? Leave a comment below--we would love to hear from you.