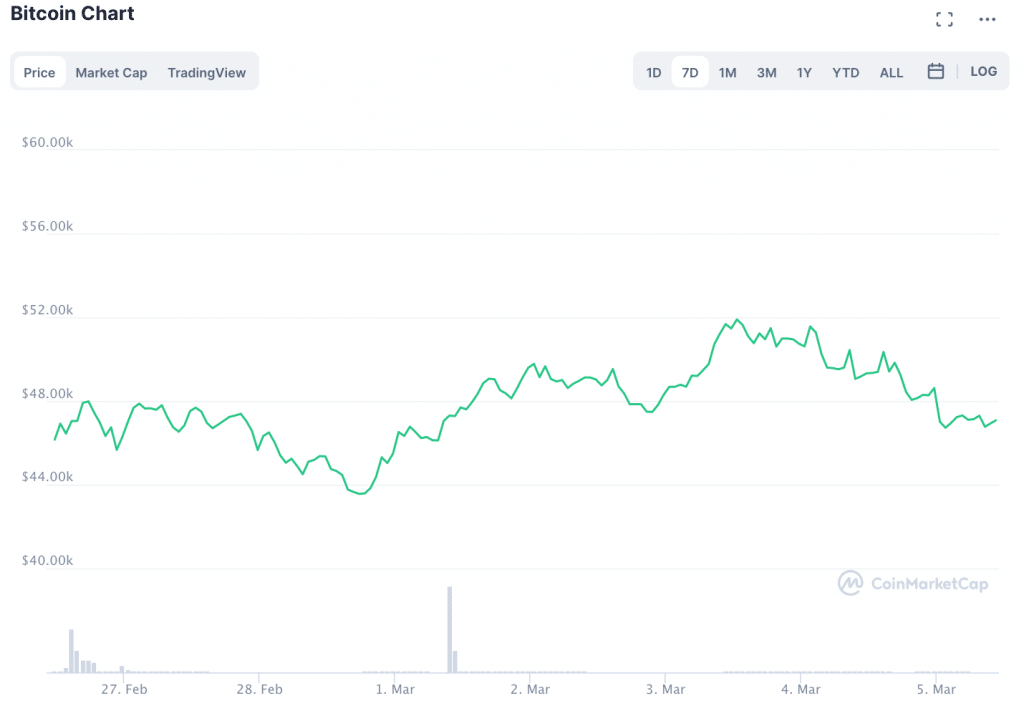

After a few harrowing moments last week, the price of Bitcoin seems to have stabilized, at least, for now.

Indeed, Bitcoin sank as low as $43K on Sunday, February 28th, before making a recovery above $46K on Monday. Since then, Bitcoin has breached the $51K resistance line, and, at press time, settled around $47,200.

And, with the exception of Sunday 28th and a few moments in early February, the conclusion of this week marks the fourth week in a row that Bitcoin has maintained levels above $45K. At its highest value during this period, Bitcoin was briefly worth nearly $58K.

As Bitcoin continues to maintain levels above $45K, questions about whether or not Bitcoin will be diving below $40K (or even $30K) seem to be less of a concern for Bitcoin hodlers.

In fact, a number of headlines over the past 24 hours point in the opposite direction. Bloomberg reported that Galaxy Digital Founder, Mike Novogratz recently reiterated his prediction for Bitcoin at $100,000; The Block reported that a “Goldman Sachs crypto survey show[ed] 22% of respondents expect $100,000-plus bitcoin.”

According to Reuters, Goldman announced earlier this week that it had “restarted its cryptocurrency trading desk and will begin dealing bitcoin futures and non-deliverable forwards for clients from next week.” In other news, Purpose Bitcoin ETF, the first bitcoin exchange-traded fund (ETF) in North America, announced this week that it now holds over 11,000 bitcoins.

In other words, $100,000 may very well be in the future for Bitcoin. However, for now, Bitcoin still has a lot of growing to do and a lot of growing pains to overcome. What is contributing to Bitcoin’s stability of $45K, and what is next for BTC?

“The Initial Fear of Missing Out Has Scaled Back. Now Investors Are Holding BTC as an Alternative to Cash Balances.”

Richard Gardner, Chief Executive of tech services provider firm, Modulus, also told Finance Magnates that BTC’s price stabilization is largely due to the fact that “mainstream entities are beginning to buy in.”

Yuriy Anosov, the Head of Trading at digital asset custody firm, Anchorage.

“From Elon Musk and PayPal to institutions like BNY Mellon and payment processors like MasterCard. Even longtime crypto foes like Shark Tank's Kevin O'Leary,” he said. “[...] The few people left naysaying Bitcoin are either those looking to buy-in at a cheaper price, or those with a vested interest in making sure that it fails.”

However, Yuriy Anosov, the Head of Trading at digital asset custody firm, Anchorage, told Finance Magnates that it is not just the fact that more institutions are buying into Bitcoin. It is the way that they are doing it.

“The initial fear of missing out has scaled back, now investors are holding BTC as an alternative to cash balances,” Anosov said. Indeed, institutional investors in particular seem to increasingly see Bitcoin as a hedge against inflation or a store-of-value as the Federal Reserve continues to print more USD.

”We’re Seeing Institutional Investors Ask for Services That Make Money Whether Bitcoin’s Price Moves up or Down.”

Companies that buy Bitcoin may not have large portions of their balance sheets in BTC holdings, but Anosov explained that the companies that have taken the leap are in it for the long haul.

“Tesla and Microstrategy’s moves have become the play for a devoted group of corporations and retail,” he said, adding that “at Anchorage, we’re seeing institutional investors ask for services that make money whether bitcoin’s price moves up or down.”

Therefore. Anosov believes that it is these long-term hodlers that are holding the line for Bitcoin: “the move down last week caused futures markets to liquidate over $6 billion of positions,” he said. “After the Leverage cleared out, the market naturally came back to more even-handed levels as long term holders continued to buy Bitcoin.”

“We are starting to see crypto native companies such as Coinbase and BitGo reporting through various filings that they hold significant BTC on their balance sheets, which is giving investors more confidence in long-term crypto investments,” he added.

”March Is Historically a Bearish Month for Bitcoin.”

Barney Mannerings, Founder of Vega, also told Finance Magnates that Bitcoin’s recent price stabilization is par for the course. Vega is a decentralized derivatives trading protocol that bridges traditional finance and DeFi.

Barney Mannerings, Founder of Vega.

"Aggressive moves are always accompanied by periods of consolidation, which occur when traders collectively sell out of their positions to book profits,” Mannerings explained, although he does not see Bitcoin’s hold over $45K as 'stabilization' so much as a 'correction'.

“Bitcoin appears to be entering into a prolonged corrective period around $50K, rather than stabilizing at a constant price,” he explained. “How long the market will trade sideways for is difficult to predict, though many speculate that March is historically a bearish month for Bitcoin as a result of the tax cycle coming to an end in many major economies."

Gardner told Finance Magnates that indeed, “Bitcoin will be Bitcoin.”

Richard Gardner, Chief Executive of tech services provider firm, Modulus.

“It will ebb and flow, up and down. Bitcoin has a tendency to go through exponential price increases followed by market downturns. This makes the market dynamics of Bitcoin, like all Cryptocurrencies , different from traditional markets, though it doesn’t mean that Bitcoin is predictable. As with most markets, it is still highly speculative, and as the old CFTC disclaimer goes, ‘past performance is not necessarily indicative of future results’.”

"Corrective Periods in Bitcoin Bull Markets Often Represent Good Opportunities to Acquire Altcoins at a Discounted Price.”

In other words, Bitcoin could have a rough few weeks ahead.

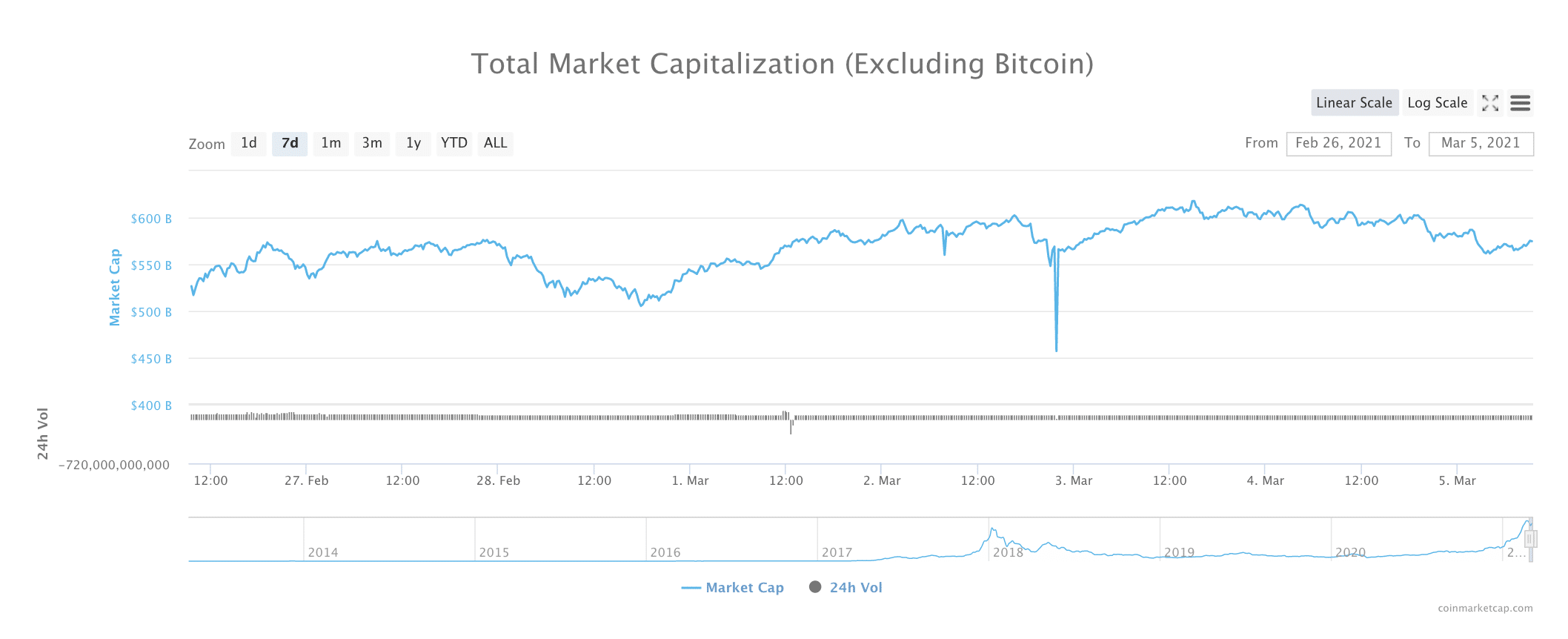

This could, in turn, negatively affect altcoin prices in the DeFi space and beyond. After all, altcoins have traded on a highly correlative level with Bitcoin throughout the year so far. For example, when BTC’s market cap dipped on Sunday, February 28th, the altcoin market cap fell right along with it.

However, Mannerings believes that these corrective periods in the altcoin space are ultimately a positive thing. "Corrective periods in Bitcoin bull markets often represent good opportunities to acquire altcoins at a discounted price,” he said.

“Altcoins correlate heavily with Bitcoin, but they are much more volatile. For many traders, this offers them a chance to pick up altcoins at a large discount compared to their recent highs. We often see a lot of accumulation taking place before prices run even higher than they were before as the Bitcoin market begins to move higher yet again."

“The Altcoin Market Is Being Affected Tremendously.”

And, even if altcoin markets have more corrections ahead in the near future, Gardner pointed out that pieces are still on the upswing in terms of longer-term trends. “The altcoin market is being affected tremendously, most notably through a resurgence in interest,” he said. “Prices are rising as they were in 2018, and those who invested in altcoins at the 2018 highwater mark and held onto it. Those people are now in the black.”

Beyond token prices, the price of Bitcoin is having an effect on the DeFi lending platforms that offer Bitcoin products to their clients.

Anosov told Finance Magnates that: “while BTC itself does not much impact the crypto markets besides their innate correlation, DeFi continues to attract more volume as crypto lenders rely on DeFi platforms more to source coins they are looking to lend to their clients.”

DeFi Presses Onward

And, while DeFi token prices may continue to be even more volatile than Bitcoin, a number of projects within the space are continuing to steadily work towards their technological goals.

Wall Street veteran, Jim Bianco, who is also the president of Bianco Research and a Bloomberg columnist, recently told Fox News that “DeFi could disrupt the current financial system the way ride-sharing companies disrupted taxi companies or the internet disrupted newspapers, or e-commerce disrupted retailing.”

Indeed, the amount of viable DeFi projects is continuing to grow. For example, Coindesk recently reported that: “Insurance broker Aon is dipping a toe into decentralized finance (DeFi)”: the company has partnered with insurtech platform Nayms to provide cryptocurrency holders with decentralized insurance that will cover software- and hack-induced losses.

There is certainly a market for this kind of insurance in the DeFi space. Just this week, a DeFi project known as 'Meerkat Finance' claimed that it had been robbed of $31 million in a single day after its launch on the Binance Smart Chain.

Unfortunately, these kinds of incidents are a fairly regular occurrence in the DeFi space. Jim Bianco said that DeFi is “nascent and buggy. It’s got problems, but they will solve those.”