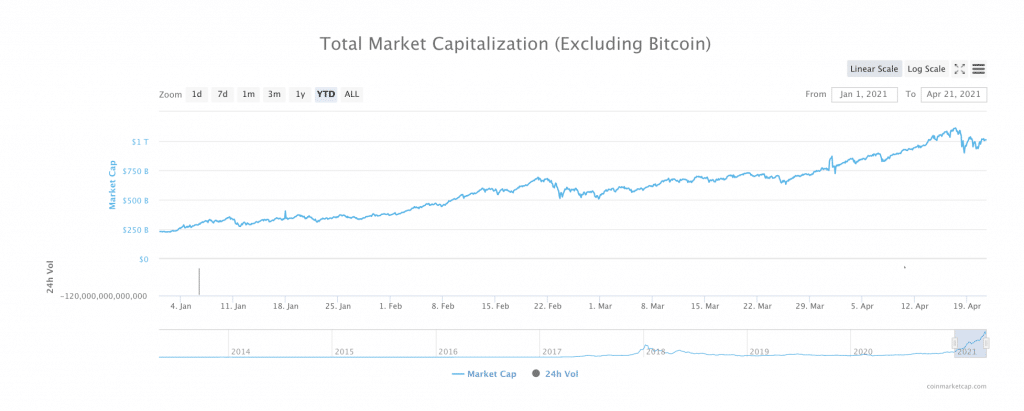

While the week may have gotten off to a rough start in altcoin markets, things seem to have taken a turn for the better. Over the past 24 hours, the total market cap of all altcoins has risen from $933 billion to $1.01 trillion, recovering some of the losses that took place earlier this week.

As such, it seems as though the correction may have just been another bump in the road or another minor correction on the path toward altseason glory. But, has alt season really begun?

What Makes an Altcoin Season, Really?

It seems that the answer could be yes or no, depending on who you ask. Some traders seem to think that altseason has been underway for weeks (or even months); others believe that altseason is still some time away.

CoinTelegraph reported that Ben Lilly, crypto economist & partner at Jarvis Labs, believes that a real altcoin season is miles away.

Why? According to Lilly, the term 'altcoin season' has many different definitions. For him, a true altcoin season is characteristically marked by “market movements that take people by surprise or at least make traders rethink what is normal.”

In other words, the altcoin season really starts when the expected range of support and resistance levels are broken by fast price action: “the type of action you want exposure to, assuming you’re on the correct side of it,” Lilly explained.

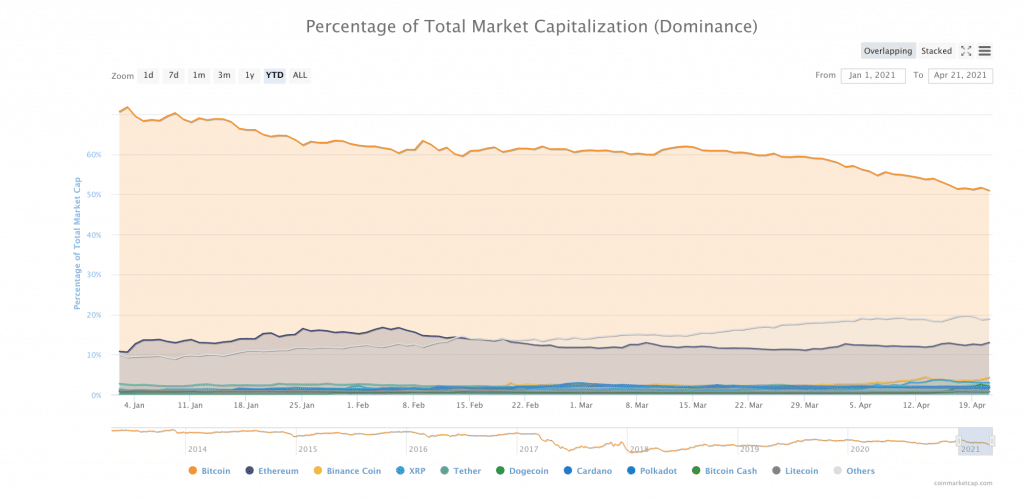

In order to determine exactly where this expected range of support and resistance levels lies, Lilly says that it is important to look at Bitcoin dominance. According to him, BTC dominance has been steadily trending downward, trading in a 'range of expectation' since late 2019, with the exception of BTC’s massive price rally at the end of 2020.

When that happened, Lilly said, “Bitcoin went on an absolute tear.” Therefore, in order for altseason to truly begin, the opposite would have to happen: “[if] we break this expected range to the downside, in our point of view, this will signify that altcoins are the asset to be sitting in, as they will generate outsized returns relative to Bitcoin. That’s when things will get wild.”

Crypto Markets May Not Be in an Alt-Season, but They Likely Are in an Altcoin Bull market

While crypto markets may not truly be in an alt-season yet, Lilly says that they are experiencing a bull run. This occurs when “investors are more likely to walk further out on the risk curve of crypto versus simply buying Bitcoin, not necessarily outsized gains compared with Bitcoin.”

Therefore, an altcoin bull market could be defined as “whenever Bitcoin dominance is falling while crypto as a whole is in a bull market.”

And, indeed, this is exactly what is happening today. The crypto market cap excluding Bitcoin is up 8 percent over the last 24 hours. However, when you add Bitcoin back into the mix, the total crypto market cap is only up 5 percent. At the same time, Bitcoin’s dominance has been steadily declining since the start of the year. At press time, BTC dominance was at 51 percent.

Institutional Cash Is Flowing into Crypto Assets

Additionally, there is evidence that money may be flowing into altcoins from new sources. For example, CoinTelegraph reported that: “institutional investors have rallied around XRP this past week,” evidenced by a nearly 100-percent increase in XRP investment product AUM.

Specifically, Coinshares’ weekly digital asset fund flows report showed that $33 million had been placed into XRP investment products just this week, increasing the total XRP-based AUM to $83 million.

The report, which was published on April 19th, also said that last week marked the most bullish week for institutional crypto investment products in over a month. $65 million went into Ether (ETH) products; Tezos (XTZ) saw $7 million come in.

Simultaneously, Polkadot (DOT) saw $5, Bitcoin Cash (BCH) saw $4 million and Binance Coin (BNB) saw $3 million. Multi-asset products received $6 million in new investments. Overall, a total of $233 million flowed into institutional funds throughout the week.

Ether Is Approaching an Institutional Hey-Day

However, even with large amounts of cash flowing into altcoin investment products, the vast majority of institutional cash is still locked into Bitcoin markets. According to CoinShares’ report, Bitcoin products represent almost 78 percent of institutional AUM, totalling $50 billion. Ether-based investment products constitute roughly 17 percent of institutional crypto product exposure. CoinTelegraph explained that: “All other crypto assets represent less than 1% of capital locked in the sector.”

As time progresses, the demand for altcoin-based investment products seems to be on the rise, although, for now, much of this demand seems to be limited to Ether. Still, the development of Ether-based investment products is happening quickly: last week, Canadian regulators approved no less than three Ethereum ETFs approved in a single day.

And indeed, the narrative around the role Ethereum plays in the crypto economy is evolving. Finance Magnates previously reported that Ethereum was increasingly gaining the attention of major institutional investors around the world.

Additionally, Coinbase published a report in January explaining that its institutional clients increasingly saw Ether as a store-of-value investment: “while our institutional clients predominantly bought Bitcoin in 2020, a growing number also took positions in Ethereum, the second-largest crypto asset by market capitalization,” the report said.

“The case for owning Ethereum we hear most frequently from our clients is a combination of i) its evolving potential as a store-of-value, and ii) its status as a digital commodity that is required to power transactions on its network.”

Could Institutional Investors Be Seeking Alternatives to Bitcoin?

However, institutional interest in Ether and other altcoins may be stemming from the same source as the reason that retail investors are interested in these coins: potential.

Artem Tolkachev, the Founder of BondAppetit, told Finance Magnates that in retail markets, “many crypto investors look at the price of Bitcoin and Ethereum and wrongfully believe that have already missed their train with potential profit. So, they look for alternatives.”

Artem Tolkachev, the Founder of BondAppetit.

“For them, altcoins are akin to penny stocks,” he said. “But, just like penny stocks, most altcoins will to zero.”

James Putra, Head of Product Strategy at TradeStation Crypto, explained this same retail phenomenon to Finance Magnates earlier this week: “many altcoins rallied simply as retail investors attempt to seek out the next bitcoin.”

“Like penny stocks, many retail investors are attracted to low-priced cryptoassets. The downsides are altcoins tend to be further out on the risk curve, many coins are still early in their developmental lifecycle, and many are still simply ideas with an altcoin.”

James Putra, Head of Product Strategy at TradeStation Crypto.

Of course, institutional investors are not buying into just any altcoins. These investment products exist for a reason: they are a safer, more regulated way for institutions to access a more diverse group of cryptoassets without direct exposure. Still, just like many retail investors, institutional investors may be tempted by the lower price points of some altcoins.

Altcoins & the World

The overall trend toward greater interest in altcoins and cryptoassets, in general, could be indicative of a continually shifting narrative about the role of Cryptocurrencies in the economy at large.

Indeed, just as Bitcoin is increasingly thought of as a store of value (or hedge against inflation), cryptocurrencies more generally could be seen as increasingly important to the future of the financial world.

Digital currency consultant, Shaune Clarke told Finance Magnates that: “one could say that altcoins are overbought and everyone should watch out for a major market correction, but look at Bitcoin. It’s been ‘overbought’ since January, and analysts were blowing the trumpets, announcing a ground-shaking drop worse than the one it suffered in 2017. We haven’t seen that yet.”

“Crypto prices are reactions to global trends. Turkey will be banning cryptocurrency trading by the end of the month. That’s a $1 billion market right there,” he said. “There have been speculations of the US Treasury charging financial institutions with money laundering. Chinese mining region Xinjiang suffered from a massive blackout.”

“Crypto does not exist in a vacuum. Just because the prices are falling doesn’t mean that a bubble has burst, or is beginning to burst. I think altcoins are on an upward trajectory, and while there will be momentary dips, there’s lots of room to grow.”

Digital currency consultant, Shaune Clark.