2018 was a year of big changes and big disappointment for many involved in the cryptosphere. Although the year started off on the wrong foot, it seemed that so many still had faith that everything would be ok - that the waning marketcap of Bitcoin and so many other Cryptocurrencies was just a temporary dip, just a low moment in Bitcoin’s journey to $50,000; no, $100,000; no, $1 million.

Not so. The markets sit lower than they have been in over a year, with little sign of recovery anytime soon. While major coins like Bitcoin and Ethereum are still widely used (in spite of their decline), there are hundreds of “altcoins” that have all but “died” this year--or disappeared completely.

The Death of Cryptocoins: An Autopsy

How can a coin die? Some coins never really “lived” in the first place--they belonged to projects that were controlled by individuals either too negligent or too ignorant to successfully keep their platforms running. Money was squandered and projects so poorly managed that they were run into the ground. In turn, this caused investors to abandon ship, and price valuation to flatline.

Are #altcoins dead?

— Crypto Boss (@LegendOfCrypto) October 12, 2017

“Some projects usually have very ambitious and visionary team members, but in many cases don't necessarily have the experience and skills required to follow through their promises,” said Jonha Richman, PR advisor for Blockchain firms, in an email to Finance Magnates. “For example, teams with no diverse background and skill set (usually a group of founders with similar professional experiences), get together and promise a highly technical project and product. That is an immediate red flag, especially if all they've got are CEO, CMO, CSO - but no CTO (chief technology officer).”

Jonha Richman.

Some of these coins were manipulated as ‘pump-and-dump’ schemes. Unbeknownst (or perhaps beknown) to the coin’s creators, ICO tokens could be bought up in massive amounts by a small group of investors who would then “dump” them onto an exchange at the first opportunity, dropping a coin’s valuation so low so suddenly that the coin was essentially “killed.” Various token sale models have been created to prevent this from happening, but that hasn’t stopped many from falling victim to this scheme.

Other coins disappear or die for even more nefarious reasons. “Exit scams” have become an unfortunately popular occurrence within the cryptocurrency sphere--companies that falsify platforms and coins to attract investors, only to shut down their websites and abandon ship when they have managed to secure a healthy pile of capital--taking the money with them, of course.

“[A report by] Ernst & Young suggests that 10% of $3.7 billion ICO funds are either stolen are lost,” Richman said. “Either these firms premeditated the move, or they were unable to deliver the technology that their investors expect from them.”

Where Do Coins Go When They Die, Mommy?

What happens to these dead coins? The ones that actually existed in the first place end up in the crypto graveyard - deadcoins.com.

The list of deceased coins is more than 800 tokens long, and it’s growing even longer--as the cryptosphere continues to evolve, more and more coins are dying. While it’s true that more and more are also being created, the dimming of the hype around the crypto markets has slowed the birth rate of new coins; the crypto market demographics are starting to resemble those of a country with an aging population.

Making cryptocurrencies is a lot less fun than making people, and if this trend continues, it’s possible that we’ll reach a point where nearly all cryptocurrencies are dead. “Any nascent industry has a funny way of getting rid and purging fake projects,” Richman said. “About 90% of ICO projects purely are smokes and mirrors. Lots of hype, with no real-world applications so there's a good chance that as the cryptocurrency market continues to suffer in bearish sentiments, more and more of these projects will eventually float and wither away.”

#1: Pincoin

Pincoin is one of the more famous examples of a token that disappeared this year, most likely because it’s known as the largest ICO scam in history. Together with Ifan, another blockchain company, 32,000 investors were duped out of the equivalent of $660 million.

The mission of the @pincoinofficial is simply to serve members of the Community, making better life for all. #pincoin #ico https://t.co/4lJvcOwjmx

— Roda Eracho-Orlina (@mike_dada0509) January 31, 2018

As far as scams are concerned, however, Pincoin was especially egregious. The company “promised its investors a 40 percent monthly returns on their investment. The company claimed to be overseen by PIN Foundation, and to lure in more investors, Modern Tech promised an eight percent reward to every investor for bringing in another investor, making it a classic multi-level-marketing scheme,” Arnab Shome wrote for Finance Magnates at the time.

Eventually, the team behind the coin disappeared. So far, no arrests related to the scam have been reported.

#2: BRIG

BRIG was another exit scam that took place this year. Its obituary on DeadCoins.com reads that BRIG was a “SCAM coin that totally collapsed. SCAM Developers who called themselves Jack BRIG and Jay BRIG. The coin is worthless garbage now and people lost their money.”

BRIG data from MasterNodes.

Data from MasterNodes.com shows that the BRIG coin is now completely worthless.

The BRIG website simply reads “Apache is functioning normally.” Huh.

#3: Titanium

The SEC got involved with this one. “This ICO was based on a social media marketing blitz that allegedly deceived investors with purely fictional claims of business prospects,” said Robert A. Cohen, Chief of the SEC Enforcement Division’s Cyber Unit, in an official announcement.

The Titanium ICO Pre-Sale is now open. The world has changed. Join us. We are the revolution. https://t.co/lohwgxZKfr #tbis #ico #ethereum #bitcoin pic.twitter.com/YmOpRbEXKb

— TBIS Inc. (@TBISINC) November 10, 2017

The charges filed against the company “Titanium President Michael Alan Stollery, a/k/a Michael Stollaire, a self-described ‘blockchain evangelist,’ lied about business relationships with the Federal Reserve and dozens of well-known firms, including PayPal, Verizon, Boeing, and The Walt Disney Company. The complaint alleges that Titanium’s website contained fabricated testimonials from corporate customers and that Stollaire publicly – and fraudulently –claimed to have relationships with numerous corporate clients.”

The Titanium ICO was halted before it was finished.

#4: Hamster Marketplace

In Hamster’s case, it’s somewhat unclear whether this was an outright exit scam or a simple disintegration of the team that was responsible for its creation.

What was Hamster Marketplace? “Soon Hamster Marketplace will open the niche electronics market to thousands of vendors around the world who cannot currently afford to work with incumbent marketplaces,” reads a Medium post apparently written by the platform itself. “It will offer hundreds of thousands of goods to millions of buyers without any middleman’s negative influences, such as price markup and low quality clone products.”

And for a while, things seemed to be going well. “Team members, bounty hunters, and investors were to be paid in HMT token for the work and the rest would go to marketing and gaining users,” reads a report by CryptoInsider. “Research went into how much it would cost per user and merchant acquisition. Without much more research, the plan sounded solid and many were excited for this new marketplace to come to existence. The website even had a prototype of the marketplace,”

“Unfortunately, the team focused more on the ICO than the building of the product itself,” the report continues. The prototype marketplace never came to fruition, and the project appears to have been abandoned.

#5: LottoCoin

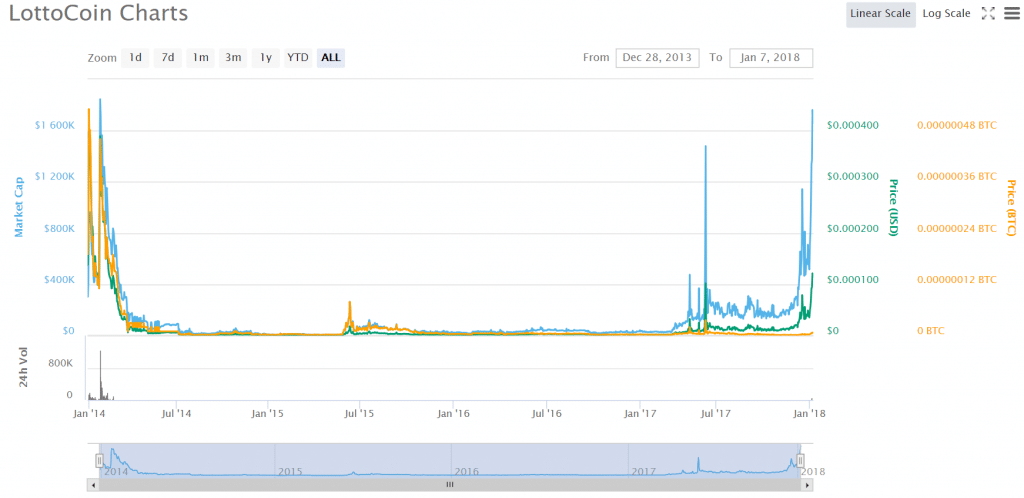

This is a coin that hasn’t quite kicked the bucket yet but is well on its way. Coinopsy, a site similar to DeadCoins.com, lists LottoCoin as “struggling.”

And so we see a coin that’s near the end of its life--”LottoCoin was founded in 2013 and is not trading on any main exchanges. Was added to the dead coins list due to being a struggling Coin with no volume. Founder/CEO is Unknown,” Coinopsy’s report on the coin reads.

At the time of writing, a single LottoCoin was worth $0.000114. Some last signs of life have appeared in its charts.

The Future

“Meanwhile companies such as Block.One, Coinbase and Ripple feel more centralized, than decentralized and more just like regular businesses who are part of a movement to usurp the space,” wrote Blockchain Mark Consultant Michael K. Spencer in a Medium Post. “The blockchain movement is mostly being spear-headed by young software developers who believe that the world can do better. There is a lot of pretending going and decentralization propaganda.”

“Decentralization propaganda,” of course, refers to the popularization and subsequent loss of meaning of the word “decentralized.” The term has become so trendy and overused that it no longer offers any kind of indication as to how decentralized something actually is.

With all of the malicious and deceptive activity that has taken place within the crypto space, this is one of the more subtle crimes--but insidious nonetheless. When words lose their meaning, movements lose their meaning; if cryptocurrency networks aren’t truly decentralized, then what’s the purpose in the first place?

“If you are a private business and pretend to be something you are not, is that not the worst fraud?”, Spencer wrote. Is it not?