Because the crypto-verse can evolve so rapidly in unexpected directions, predictions for the industry can turn out to be way off from the reality that unfolds. On January 1, 2015, who would have anticipated most of the world’s major financial institutions engaging with the Blockchain in some way by year’s end?

Bearing this in mind, we take a stab at 2016, hoping to leverage our learnings from 2015, the year of the blockchain and bitcoin’s maturing as a traded asset.

The Blockchain

Bitcoin’s blockchain technology and other distributed ledger systems inspired by it are envisioned to revolutionize the way securities and cross-border Payments are settled, among other applications. A myriad of banks, exchanges and other financial services firms have begun exploring blockchain technology, but development is currently in its embryonic stages.

We are likely to see more refined proofs of concept and the development of roadmaps toward the first real-world applications. It is unlikely that there will be meaningful live implementations for financial services in the coming year. One project to look out for is that of Nasdaq, which is trialing a Colored Coins technology for pre-IPO shares on its Private Market.

Of course, keep an eye on the various consortiums looking to develop the technology in collaboration, but this is likely to take longer. Nasdaq’s initiative will be an interesting example of how fast single players advance, at least when working with startups.

Regulation

Governments will continue to treat the regulation of virtual currency as a low priority, unless it is clearly implicated in crime well beyond the extent that we are already aware of e.g. using it to finance terrorist attacks.

There will be minor developments in how to treat bitcoin for tax purposes.

In terms of enforcement action, however, we are likely to see continued activity. Agencies such as the US Securities and Exchange Commission (SEC) and US Commodities Futures Trading Commission (CFTC) are now keeping a close eye on bitcoin, as is the New York Department of Financial Services (NYDFS), which rolled out its BitLicense regulations in 2015.

Trading Venues

2015 was also a year of major advances in the trading of bitcoin-related instruments. There are now publicly traded vehicles tracking the bitcoin price, more publicly traded crypto companies, and significantly, regulated bitcoin exchanges that are fully licensed to offer financial services.

There may not be much room for addition in 2016, but 2015’s developments will be felt in the coming year through the further stabilization of bitcoin markets and even fewer security incidents.

Bitcoin Prices

A tough one indeed. Bitcoin has not shown much of a direction during the past month. Its price is not currently trading near an extreme, so if a correction is in order, the direction is unknown. Worth watching is the halving of Bitcoin’s mining reward, which some anticipate will pressure prices upward.

What is more certain is that prices are likely to continue their trend of increasing stability. However, China’s apparent role in moving the markets has been unsettling, as have been the reported (unconfirmed) record volumes. Higher prices from the China-driven rally of late 2015 may collapse if their foundations are found faulty.

Conversely, prices may rally to new records if people jump back on the bitcoin bandwagon. If this does happen, this time may be different because more mainstream investors are now on board. More likely, however, is the realization of Newton’s 3rd law: For every action, there is an equal and opposite reaction.

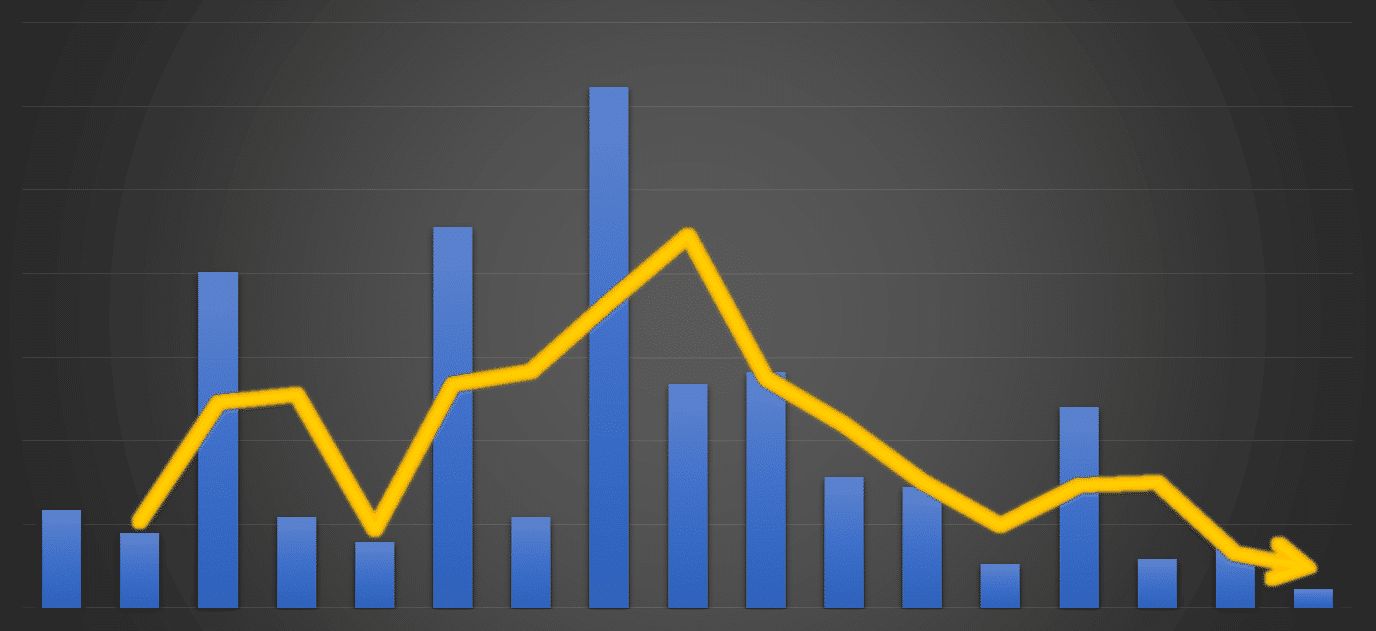

Venture Investment

Venture investment in companies catering to bitcoin as a currency/asset seems to have already peaked, and then dried up toward the end of 2015. We are unlikely to see too many blockbuster deals in 2016, if any. Investment will instead continue to be diverted to blockchain technology. Even here, it is still too early on for huge funding rounds, which are more likely to come further down the road if/when the discipline gets into high gear.

Crypto Startups Will Struggle

The laws of accounting are catching up to crypto startups, many of which have already been operating on little or no revenues for two or more years. Some were the recipients of eight-digit investments.

It is anticipated that at least one of the larger variety will bite the dust, but this is unlikely to happen in 2016. Several have at least another year of cash to burn through. However, mass layoffs similar to BitPay’s may come sooner. The tough 2016 anticipated for startups outside the crypto industry will be even tougher for bitcoin wallet services with large payrolls. But per the rosier outlook for FinTech startups, blockchain startups will fare better.

Services like Circle have been quietly moving into USD wallets, just in case the bitcoin thing doesn’t work out. Others have been announcing launches of blockchain technology offerings, and still others are rebranding as blockchain technology companies even if not changing their offerings. We’ll see more of this.

Crypto Crowdfunding

Bitcoin-focused platforms for crowdsourced investment in crypto startups will be active, but actual investment may be dragged down by the broader slowdown in startup funding. It will be interesting to see if more blockchain companies, which have been uncommon on these platforms until now, will be listed.

Bitcoin Adoption

Bitcoin for use in commercial transactions has stalled. The masses have not found it to be particularly convenient. As such, if those making purchases with bitcoin for ideological reasons lose interest, overall usage will plummet.

This can be true even if the total transaction volume over the network continues to grow, which it will. Bitcoin can be moved for any number of purposes at a very low cost. Bitcoin currency-powered remittances have been a bright spot, but even these may be supplanted by remittance services powered by blockchain technology, whereby any sum of money can be represented by even the minutest denomination of the blockchain currency.

Mining

The weakest layers have been mostly purged from the industry. The race for the most advanced and efficient hardware will continue between the industry’s remaining heavyweights.

So long as bitcoin prices do not crash, the network hash rate and difficulty will continue to grow, their rate determined by bitcoin’s price. The monumental 1 EH/s (exahash per second; 1 EH = 1018 hashes, or encryption calculations) threshold may finally be reached.

Worth looking out for is the impending halving of the mining rewards, which will cut mining revenues in half overnight. Assuming the anticipated bitcoin price rise does not pan out, many miners will have to leave the network.

Altcoins, Bitcoin 2.0, Bitcoin 3.0….

Interest in virtually all altcoins virtually disappeared in 2015. Most are likely to be forgotten in 2016, even if traded by a few bots on crypto exchanges. Expect similar for most ‘Bitcoin 2.0’ currencies, which are generally derived from Bitcoin.

Notable exceptions may be Ethereum and Ripple, which are either already employed in real-world applications or are under serious consideration. What remains uncertain is how their various currency components (tokens) will be evaluated, and if trading in them will fizzle out like the others.