As Bitcoin (BTC) has continued to grow throughout 2021, the narrative around Bitcoin has continued to evolve. Bitcoin is increasingly seen as a store-of-value or perhaps more precisely as a hedge against inflation. In the United States, the Federal Reserve has added an estimated $9 trillion into circulation since September of 2019.

As a result, more and more companies and individuals are beginning to think of the dollar as less of an asset and more of a liability. Simultaneously, assets like Bitcoin may be gaining ground as possible antidotes to an inflationary economic environment.

Finance Magnates recently spoke to Russell Lacour, Chief Technology Officer of Tantra Labs, an algorithmic research and development platform built for generating Bitcoin alpha. Russell spoke with us about the effects of USD inflation on wealth inequality, about Bitcoin in this current moment, and about the future of alternative assets.

Finance Magnates · FMTV: Russell Lacour, CTO at Tantra Labs

This is an excerpt that has been edited for clarity and length. To hear Finance Magnates’ full interview with Tantra Labs’ Russell Lacour, visit us on Soundcloud or Youtube. This is a sponsored piece.

“Making Money Is Sexy”: The Origins of Tantra Labs

Who is Russell Lacour?

“I’m a conscious software engineer who is working to create financial algorithms that allow people to denominate themselves in an asset other than the dollar,” Russell said. Therefore, Tantra Labs’ work is “primarily focused on Bitcoin and Ethereum, and allowing investors to earn returns in BTC and ETH,” rather than offering returns in dollars.

Russell explained the meaning behind Tantra Labs’ rather unusual name. “Many westerners are familiar with the concept of tantric sex, and with the concept of ‘tantra’ being this sexual thing, and honestly, making money is sexy,” he said. “But ‘tantra’ actually means technology.”

“So, we named our company Tantra Labs because we’re a technology company that’s all about transforming finance. We want to allow people to denominate in the asset of their choice, especially as it becomes more and more toxic to hold assets like the dollar.”

Why is the dollar so “toxic”? Russell explained that the COVID-19 pandemic, and the economic fallout that ensued, exacerbated an important issue. “We have zero control over the USD or any government-issued fiat currency.”

USD Inflation & “Poverty Wages”

Additionally, “we have a lot of ‘poverty wages in the world today, which has resulted in the formation of a group of people who are basically ‘slaves’ to the financial system,” Russell said.

“It’s been going on for decades now, we have a low-income population and a poverty wage that keeps people in that population. They have almost zero say in that; these are people that will live their entire lives without ever having the chance to invest in an asset, that will rent from the day that they’re born to the day that they die, and they’ll never escape slavery to the system that they have absolutely no say in.”

“Yes, they can vote for an elected official, but even the elected official isn’t controlling the actions of the Federal Reserve of the United States.”

Russell Lacour, Chief Technology Officer of Tantra Labs.

Russell explained that the past 18 months have been a prime example of what can happen when this kind of destructive system goes into overdrive. “We’ve injected trillions of dollars into the economy,” he said. “In the US in particular, many of us recently received a $1400 stimulus check. However, for that $1400, the Fed actually printed $5000.”

“The remaining $3600 actually went to your local government or to unemployment, a bunch of people that you’ll never meet or hear from, and will never directly help you,” he said. “To me, that’s a symptom of a broken system.”

“Not only did the US government inject all of this capital into the market, but those who work minimum wage jobs are directly affected, but perhaps unaware of exactly how affected they were because of inflation, because of real estate prices going up, and more,” he said.

“Now, when you look at the buying power that people have with the cash that they hold, it’s gone down tremendously. If you wanted to buy real estate two years ago, it was literally half the price that it is today...we’re not taught about this in school, even though money literally rules most of our lives.”

“No one ever tells us that the dollar isn’t an asset. It’s a liability.”

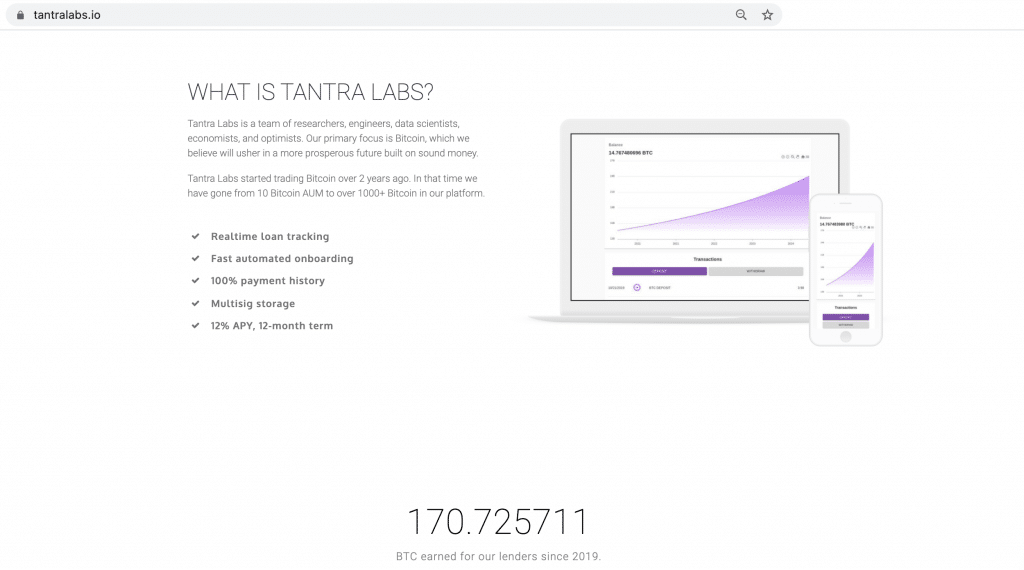

How Does Tantra Labs Work?

What is Tantra Labs doing to fight against this dollar “toxicity”?

“I started writing algorithms for stock trading about six years ago,” Russell explained. “I created bots that would work for me.”

“Over time, I saw that what I was doing was basically animating a simple set of rules, for example, ‘if the 10-day crosses over the 20-day, I want to buy. If it crosses under, I want to sell.’ You can automate that entire process,” he said. AI-powered “genetic algorithms” can also be created to improve their own performance.

“At Tantra Labs, we developed a system that is written in Golang, a programming language that is developed by Google. It’s extremely fast, and it has enabled us to run about 50 algorithms in our portfolio. Each of these algorithms constantly evolves and updates itself based on market conditions.”

“We also have developed market-making algorithms that provide Liquidity to the market, we’ve created algorithms that operate option spreads, arbitrage, all different types of algorithms can be created with an underlying genetic model that allows it to optimize itself.”

“We’ve automated the entire process, which would allow us to open ourselves to retail investors, if we could.”

“Everything That [Tantra Labs Is] Doing Today Is Working Towards Either Educating Individual Investors, Or Pushing Forward to a New Paradigm of Money:”

Unfortunately, “another aspect of this broken financial system means that we are only available to accredited investors in the United States” and investors outside of the US, Russell said. In the US, accredited investors are those with a net worth of at least $1,000,000 (excluding the value of one's primary residence) or those that have an income of at least $200,000 per year for the last two years (or $300,000 in combined income if married).

“Truly, when you look at the situation, the SEC and the other three- and four-letter organizations in the US have placed barriers to entry that don’t allow working-class people to access opportunities that could benefit them. I would like to think that Tantra Labs could be one of those opportunities,” he added.

The problem with opening these options to retail investors at the moment is that there is not much precedent. “No one has done what we’re trying to do [and has been engaged with a regulator],” Russell explained. Therefore, “we fall into a strange, legal gray area, but there are no straight answers” with regards to whether offering investment products to non-accredited investors would be crossing any legal lines.

In the meantime, “Everything that we’re doing today is working towards either educating individual investors, or pushing forward to a new paradigm of money: toward living in a world that is asset-backed instead of living in a world that’s liability-backed.”

The Future of Bitcoin

What are Russell’s thoughts on the future of Bitcoin? “I see Bitcoin becoming a world reserve asset that governments will use,” he said. “I have one reason for this: do you think that China wants to use the USD to settle its transactions? Do you think that the United Nations would use the yuan instead of the dollar?”

Therefore, “the easiest settlement layer for all of the countries in the world would be a neutral third-party,” he said. “It would be something that no single country controls, but that all of them agree on. That is Bitcoin today.”

“The most logical step would be for the governments of the world to say, the dollar is toxic because we don’t control it, the US Federal Reserve does, and we can’t really trust them. China’s throwing a fit, Russia’s throwing a fit, the US is throwing a fit, so let’s pick a neutral third-party that no one can control.”

“That’s decades away. I don’t see that happening anytime soon,” Russell added. “But, if that happens, you’ll see a $50 trillion or $100 trillion-dollar market cap on Bitcoin; you’ll have BTC at $10 million apiece. That’s my price target. It’s on sale today for $50K-60K apiece.”

This is an excerpt that has been edited for clarity and length. To hear Finance Magnates’ full interview with Tantra Labs’ Russell Lacour, visit us on Soundcloud or Youtube. This is a sponsored piece.