During the past month, amidst the usual bombardment of cryptocurrency and Blockchain -related stories, something caught this author’s tired eyes. In the space of two weeks, four articles related to cryptocurrency point of sale (PoS) systems cropped up across the industry’s media outlets. For cryptocurrency fanboys, PoS systems will be old news. But though the technology may have been around, at least in cryptocurrency terms, for a while, it remains - globally - largely unused.

That could be about to change due to a confluence of factors. Even taking into account the recent plummet in bitcoin’s value, the cryptocurrency market is much less volatile than it was 12 months ago. That makes Payments a more viable option for both payment service providers (PSPs) and merchants. At the same time, cryptocurrency is now something most people are familiar with. True they may not hold any, but the market boom at the start of this year took cryptocurrency from being a niche industry to something the ‘average joe’ is familiar with. Finally, and on a purely pragmatic level, there are now a number of companies offering the means by which businesses can start selling their products via cryptocurrency.

Why do it?

When looking at these PSPs, the first question that comes to mind is why would any company want to accept cryptocurrency? Yes, more people have a few decimal points of bitcoin lurking in a hot wallet than they did a year ago but they probably still find it more convenient to pay in dollars, pounds or dinars when they go to buy their morning coffee. The exception to that rule would be countries that are in some sort of crisis. Venezuela is a prime example of this. With a tanking economy and inflation running at 1,000,000 percent (no that’s not a typo), the country has become a major hub for cryptocurrency payment solutions. The cryptocurrency Dash has been at forefront of this. Announcing a peer-to-peer (P2P) SMS payments solution for Venezuelans last month, the company behind the cryptocurrency said that almost 2,500 merchants in the company accept Dash as a form of payment.

[embed]https://www.youtube.com/watch?v=H1wtWzvPdc4[/embed]

Across the world in Iran, another beacon of hope and freedom, US sanctions have also sped up the adoption of cryptocurrency payments. Back in July, the Trump administration put sanctions back on Iran’s banking system and, almost immediately, companies turned to cryptocurrencies for assistance. Most notably, hotels started asking for their customers to pay deposits in cryptocurrency. The Iranian government has also started encouraging cryptocurrency miners operating in the country and has plans to form its own digital asset. Given that the US has already said its sanctions on Venezuela apply to the government’s cryptocurrency Petro, which was named as “the most horrible investment ever” by a Washington Post journalist earlier this year, it’s unlikely the Iranian government cryptocurrency is going to do well.

"A cup of coffee? That'll be BTC 0.000001 please"

Outside of countries crippled by economic mismanagement, some retailers in developed nations are also starting to accept cryptocurrency as a form of payment. At the end of November, for example, a Spanish coffee chain, Nostrum, announced that it would allow its coffee-drinking customers, across all of its 130 stores, to pay for their espressos in cryptocurrencies. In South Korea, where 35 percent of the population hold digital assets, a deal brokered in March of this year between exchange operator Bithumb and a local PSP, Korea Pay Services, means that locals can use cryptocurrency to pay in over 6,000 retail stores. As Spain and South Korea aren’t suffering from massive inflation or pervasive banking restrictions, this raises the question again - why do it? For Vini Armani, Co-Founder and Chief Technology Officer at CoinText, a peer-to-peer (P2P) cryptocurrency payments firm that is launching a merchant system next year, the answer is obvious.

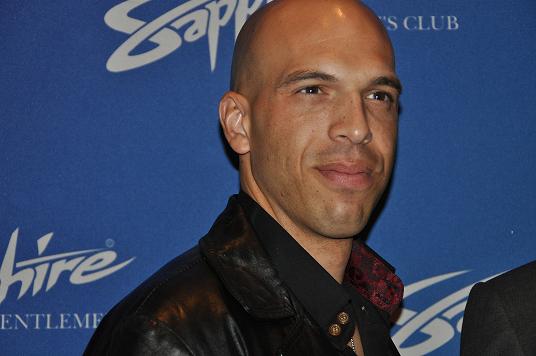

Vin Armani - CTO and Co-Founder of CoinText

“Cryptocurrency is durable, scarce, private, counterfeit resistant, nearly free to store and use, doesn't require third-parties, borderless, resistant to violence and offers deniability when traveling,” he told Finance Magnates. “No government's currency can compete with those attributes - even if they're doing ‘an ok job.’”

"When people have wealth in a certain form they like to spend it"

For others in the PoS space, that answer is valid but not the only reason for the growing adoption of cryptocurrency payment solutions. Speaking to Finance Magnates, Zac Cheah, CEO and Co-founder of PoS system operator Pundi X, said that other factors, whether it be widespread adoption of digital assets, a desire to stay ahead of the curve or traveling abroad, have impacted retailers’ decisions to start allowing customers to pay in cryptocurrencies.

“You are asking why a retailer would use a PoS system but you could say the same about crypto in general,” said Cheah. “If we assume economic crises precipitate cryptocurrency trading, few people would have traded in the markets. Yet they did. Some of our biggest markets include Singapore and Korea, neither of which is remotely affected by governance problems. When people have wealth in a certain form they like to spend it. But even if I take your point, [that a PoS system would only be useful in economic crises], as a given, Christine Lagarde last month called on other central banks to look at creating their own digital currencies. Take that into account and I think the need for a blockchain PoS system is much less marginal than even a sceptic would allow for.”

Zac Cheah, CEO and Co-founder of Pundi X, shows merchants how his company's payment system works

That may answer why a merchant would start taking cryptocurrency payments but still leaves them with a number of problems. In a corrupt country like Venezuela, performing a transaction over SMS to pay for goods probably wouldn’t be a problem. Conversely, in Spain, South Korea or the USA, the government will want to get their hands on all of the sales tax a retailer has collected. Then there are technical issues. For instance, if a client pays in bitcoin and the price fluctuates massively by the end of the day, that’s going to be a huge headache for anyone that needs - at an absolute minimum - stability in their businesses. That’s on top of worries around transaction fees, accounting systems, and compliance procedures.

Lower transaction fees

“If a transaction is for $100 worth of bitcoin, then BitPay will confirm the transaction immediately,” BitPay Chief Operating Officer Sonny Singh told Finance Magnates. “We will settle the same amount in one business day via a wireless transfer, regardless of what happens to the price of bitcoin in the meantime. The customer always pays $100 worth of bitcoin and the merchant always receives $100 USD the next business day - exactly how a Visa or Mastercard transaction is settled. Normal credit card charges range from 2 to 4 percent plus other costs, but with us you only pay 1 percent and no other costs. Credit cards also carry chargeback risks. Again, with us, there no chargebacks.”

Such a solution may put retailers’ risk-weary appetites at ease but, as noted, there are also accounting systems and tax issues to worry about. Converting a cryptocurrency into fiat currency might make that process easier but it doesn’t necessarily make retailers technological lives easier. As with BitPay, Pundi X has a number of solutions to address any potential problems in that area.

Sonny Singh, CCO of BitPay, speaks at a conference in California earlier this year

“Each device we sell is loaded with a jurisdictional GST setting allowing sales tax to be added onto any transaction - we fully comply with the laws and standards of each market in which we operate,” said Cheah. “We also have a standard backend system for merchants that integrates onto most retail accounting systems. Any shift involves some pain but retailers have their process flows down to a fine art and we’re not looking to disrupt that element of their payment systems.”

Bitcoin may have taken a beating in the past month but an overall trend towards lower volatility, and a reduction in the number of get-rich-quick traders is a positive sign that cryptocurrencies are starting to behave like regular markets and not Ponzi schemes. But if they really want to be currencies, not just a strange blend of commodity and security, they must have some practical use. PoS systems are a step in that direction. Not only will they allow existing holders of cryptocurrencies to start spending their holdings, but they will also continue to normalize the market and attract newcomers to it. On top of that, with no chargebacks and lower transaction fees, they could also offer retailers better value for money. If that’s the case, maybe we’ll start to see some infuriating ‘crypto enthusiast’ signs hung in shop windows this Christmas.