An AI startup founder was approached by some investors, claiming to have ties with multiple billionaire families, with an offer of a massive investment. Although they were very convincing, the startup founder ended up losing about $50,000 only to realize that he was duped by an alleged organized scammer group.

According to Dr Daniel Veidlinger, a professor at California State University, Chico, and an investor in the unnamed AI startup, the scammers approached the startup’s founder with a $8 million investment proposal and then scammed the founder of about $50,000 in crypto.

The startup CEO coincidently recorded the Zoom call over which the scammers tricked him to send the cryptocurrencies. However, the startup and the founder remained anonymous.

Bait and Hook: A Sophisticated Scam

The scammers’ approach as fake investors was highly organised, Dr Veidlinger's account showed. At least four individuals were involved in the scheme.

In mid-June, one of the scammers, posing as an “International Relationship Manager” of an asset management company, contacted the startup’s CEO, expressing interest in investing in the company.

After further communication and the execution of a non-disclosure agreement (NDA), the initial scammer introduced the startup CEO to another scammer posing as the portfolio manager of the so-called asset management firm. This individual claimed to be a member of two billionaire families, one on his father’s side and the other on his mother’s side.

This second scammer held Zoom calls with the startup CEO and expressed interest in investing USD 5 million in the company. However, he abruptly withdrew from discussions, citing an unspecified “personal emergency.”

The first scammer then introduced a third individual, who presented himself as the CEO of the fake asset management company and claimed to be the “nephew” of a billionaire Swiss art dealer.

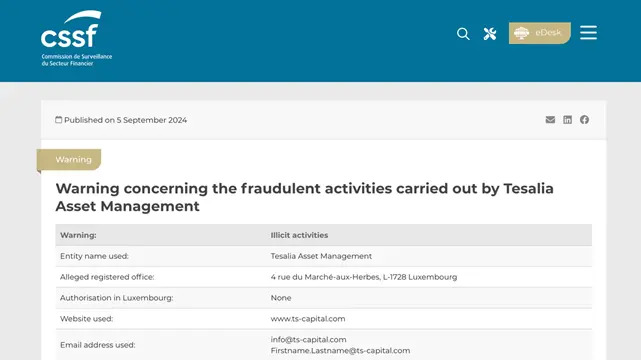

Notably, Luxembourg’s financial regulator had flagged the website of the purported asset management firm for fraudulent activity. However, the regulatory warning came after the people operating the website allegedly scammed the AI startup.

According to Dr Veidlinger, this third scammer continued to promise a USD 5 million investment in the AI startup. He claimed to hold EUR 5 million in cash that he intended to invest via a convertible debt instrument to avoid certain Swiss tax liabilities.

After negotiations over several Zoom calls, the fake investors increased their supposed investment to USD 8 million. The startup CEO even engaged a corporate law firm to draft an investment agreement, which the scammers approved.

A week after receiving the agreement, the scammer posing as the CEO claimed that his CFO had advised him to set aside USD 1.2 million—the total interest on the USD 8 million convertible debt investment—in a cryptocurrency wallet for three months for regulatory compliance. He further stated that this amount would be drawn from his initial investment, presenting this as part of the investment process.

Catch: Fiat Investment to Crypto Wallet Request

The scammers then moved to the “catch” stage, making an unusual request. They asked the startup CEO to create a cryptocurrency wallet and deposit at least USD 400,000 into it to prove the startup’s financial capability, Dr Veidlinger pointed out.

The startup CEO, unable to use company funds, offered to deposit USD 50,000 of his personal funds. At this stage, Dr Veidlinger, an investor in the startup, was asked to assist in setting up the wallet.

Dr Veidlinger initially created a Coinbase wallet, deposited approximately USD 51,000 in USDT, and shared the wallet details with the scammers. However, the scammers claimed the wallet could not be verified on the blockchain and asked for the funds to be transferred to a Trust Wallet address.

Although Dr Veidlinger complied and the funds were verified on Trust Wallet, the scammers then requested the funds be stored on Atomic Wallet. Despite finding this unusual, Dr Veidlinger agreed.

During a subsequent Zoom call, the scammer posing as the CEO introduced another individual, referred to as his nephew, who asked to verify the funds on Atomic Wallet. Although the funds had already been verified on Etherscan, the startup CEO complied.

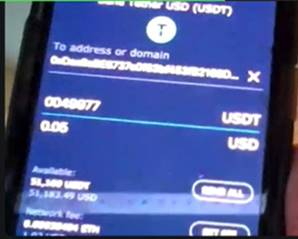

The scammers then requested a live transaction during the Zoom call, as per Dr Veidlinger. They instructed the startup CEO to send USD 5 in USDT from his wallet to theirs, asking him to manually input the amount and scan a QR code. However, the QR code embedded the transaction amount, overriding the manually entered amount. As a result, the startup CEO inadvertently sent nearly USD 50,000 in USDT.

The scammers exploited a basic vulnerability in Atomic Wallet interface. Although the startup CEO manually entered USD 5, the QR code embedded a higher transfer amount, which appeared as USD 5 on the confirmation screen but sent USD 50,000 in reality.

The startup CEO confronted the scammers, who refused to return the funds and subsequently cut off all communication.

“The day of the theft—August 23, 2024—would have been the last time startup CEO's ever communicated with the scammers,” Dr Veidlinger told Finance Magnates. “They did their best to first deny the theft and then to pressure him (the startup founder) not to public with the details and recordings... When scammers realized they could not dissuade startup's CEO from going public, they broke off all contact.”

Dr Veidlinger confirmed to Finance Magnates that the stolen funds could not be recovered. The funds were moved in small amounts to over a dozen destinations and cashed out on two exchanges: Bitget and Binance. Dr Veidlinger, who managed the crypto wallet, and the startup also filed complaints with the law enforcements in North America and Europe, however, none of them receive any update on the actions. They also reported the interface vulnerability to Atomic Wallet, only to receive a scripted message from the support team.

“Even though the startup has engaged a law firm, it has been advised that probability of funds recovery is practically zero given multiple jurisdictions involved. Never mind the difficulty of bringing litigation against people whose identity and domicile we do not know,” Dr Veidlinger.

Finance Magnates reached out to Atomic Wallet to know about the vulnerability and also Tesalia Asset Management, the platform Dr Veidlinger accused to be operated by the scammers, but did not receive any reply from either.