Following our post about Alpari’s sponsorship of English Premier League West Ham United, we received tremendous comment feedback and it was one of our most popular articles for February. The post created triggered a discussion on the effects of sports sponsorships and costs.

For a more in-depth look, today we have a guest post from Stephen Pearson, Founder and CEO of Sports Media Gaming (SMG), a sports and gaming media consulting firm. As a Marketing professional, Pearson has worked on both sides of the industry; working with the UEFA and Premier League in the past and now representing sponsors.

FX Trading and Sports Sponsorship

If FX companies were ranked according to the size of investment into sports sponsorship then the top two companies would definitely be FXpro, followed closely by AlpariFX.

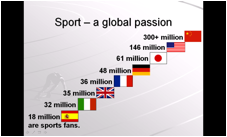

There has been no sign of any let up in the investment by FX companies into sports sponsorship and it’s easy to understand why. Sports sponsorship provides a series of benefits to FX companies:

- Global brand awareness through a “one stop shop”

- A predominantly male demograph in line with the core make up of FX traders.

- Sport offers “big brand status” where the FX company sits aside more established blue chip global sponsors

- A combination of offline and online media elements enhance the marketing mix and opportunity for ROI

Source: WPP

Sports Media Gaming also see a strong parallel between the FX trading market and the online betting sector where brands like BWIN, 888.com, Betfair, and a host of others have used sport to create standout and target key markets. Both sectors are comparatively new to market when compared to more established brands in sports sponsorship, target the same demograph and both sectors have become quickly saturated, requiring brands to find unique ways to create standout.

Of course one of the key benefits of sports sponsorship, is to circumvent any national advertising regulations by sponsorship of non domicile rights that happen to be broadcast back into the territory. This is one reason that Premier League Football has proved to be so popular with Asian bookies like and the enormous exposure the League gets into markets like Asia.

Who is Doing What in Sports Sponsorship ?

Football and Formula1 have proved to be the key drivers when it comes to sports sponsorship, followed by sailing and rugby. These are all natural sports to target the male demograph and achieve global exposure.

Additionally there is a very good synergy in the case of Formula1 as FX promotes its core values of speed and technical superior products with high performance cars. The provision of high quality hospitality facilities permits high value promotional opportunities to generate new sign ups.

Until the start of last season the top three teams on the grid were all sponsored by FX brands. Red Bull & FXDD, Mercedes & MIG Bank, McClaren & XTB

The English Premier League currently has two teams bearing FX trading company logos for the start of the 2013/14 season with Fulham & FXPro and now West Ham United & Alpari. It is worth noting that FX companies can only be involved with Premier League teams as the main shirt sponsor and at no lower level. This is because Barclays Bank who sponsor the League (The Barclays Premier League) to the tune of £48million per season have wide ranging exclusive rights. The average shirt sponsorship at this level in the Premier League is approximately £3million per annum, whilst a team like Manchester United or Liverpool are currently commanding over £20million per annum.

A typical Formula1 sponsorship which includes branding on the car will be in the region of £2.5-£4million for one of the leading cars on the grid.

FXPro

The clear leaders in sports investment, we estimate are investing approximately $20mill per year and have presently in their portfolio the following:

Main shirt sponsor of Premier League team Fulham FC

Official partner of the Asian Champions League Football

Naming Rights partner to Australian Super Rugby

(plus previously sponsors of Virgin F1 team, Sauber F1 , Aston Villa FC and World Rally Championships)

AlpariFX

Have also recently invested heavily into sports sponsorship and have in their portfolio the following:

Naming sponsor of sailing’s World Match Racing Tour

Main shirt sponsor of Premier League team West Ham United

Official Partner of the New York Knicks, New York Rangers and Madison Square Garden

FXDD

They are formerly sponsors of the Red Bull Racing Formula 1 team

Current sponsors of Malta Football Association and Maltese Referees

Aim Autosport Team FXDD competing in Rolex Sports Cars Series, the Star Mazda Series and the USF2000 Series . The company which has a mandate to identify, train and manage emerging motorsport talent.

XTB

They are current sponsors of the McClaren Formula 1 team

MIG Bank

They are current sponsors of the Mercedes Formula 1 team

AFX Capital

Title Sponsors of the AFX Capital Sailing Team

A range of other FX companies such as Instaforex and FXPrimus have become involved in sponsorship on a local level in key markets like Asia.

FX Trading companies are currently leading the way in the Online Trading sector in sports sponsorship, however we fully expect to start seeing Binary Option Trading firms and financial spread betting firms starting to use sports as a high profile media platform.

At present the market is very competitive, it is very much a buyers market in sports as there are so many rights available concurrently on the market. These include F1 teams, football teams in leading leagues like England, Spain and Italy, high profile sailing, international rugby and sports that FX companies have not yet aligned with which still remain highly relevant such as tennis and golf.

About Sports Media Gaming Ltd

Sports Media Gaming Ltd is a leading independent sports marketing agency, headquartered in London and operating internationally. The Founder and CEO, Stephen Pearson has a background spanning over 25 years in international sports marketing, including Board level roles at organisations like UEFA Champions League and the FA Premier League. He has acted for a wide range of brands in sport such as PlayStation, Coca-Cola, McDonalds, Visa, Electronic Arts, TUI Group, JVC and many more.