FXCM, the largest foreign exchange brokerage in the US by market share, has settled with US authorities to cease its operations in the country. The brokerage reached a $7 million settlement with the US Commodity Futures Trading Commission.

[gptAdvertisement]

Further to the settlement announcement, FXCM published a statement that details that the brokerage is selling its US client accounts to GAIN Capital. The deal is subject to regulatory approval and a final agreement between the firms.

To unlock the Asian market, register now to the iFX EXPO in Hong Kong.

Official documentation sheds light on the detailed charges that FXCM and its principles faced on Monday. The National Futures Association charged FXCM and its principals William Ahdout, Drew Niv and Ornit Niv on six counts.

According to a complaint filed by the NFA, the company and its principals on numerous occasions failed to adequately supervise FXCM and its employees. The main theme of the complaint is related to the advertisement of the broker’s ‘no dealing desk’ model as superior to the company’s competition. It was claimed to employ ‘dealing desk’ execution.

The dealing desk model was advertised as a market making model, whereby the brokerage takes the other side of client trades, while the ‘no dealing desk model’ was advertised as straight-through processing of orders via various Liquidity providers.

The largest liquidity provider

According to the NFA’s complaint, the no dealing desk model was routing orders to a ‘dealing desk’ model which was largely serviced by liquidity provider (LP) Effex Capital. The latter was presented by the firm to be an independent counterpart, however the document states that FXCM was actually supporting and controlling the LP.

Effex is said to have paid rebates to FXCM amounting to up to 70 percent of the profits of the LP. FXCM was directing the majority of its clients' trades to the unit.

The NFA states that it started an investigation into Effex in 2013, but its efforts were hampered by misleading information provided by Niv and other employees of the brokerage.

The findings of the NFA that are detailed in the regulator's complaint also show that FXCM allowed the LP to engage in ‘abusive execution tactics’.

The regulator details that the CEO of Effex, John Dittami, has been with FXCM since 2009. The document states that in the first quarter of 2010 Effex was formed as an independent company with Dittami at the helm.

FXCM is said to have provided the venture with initial financing of $2 million and a prime broking account sponsorship. The NFA’s complaint also states that Effex was operating from FXCM’s main office and was connected to the broker’s own servers via a Virtual Private Network.

The document continues - Effex had access to client order data and positions, permitting it to gather substantial amounts of information. The NFA states that FXCM was giving Effex preferential treatment over the company’s other LPs.

Due to the preferential status of the LP, Effex is said to have received more than half of FXCM’s daily order flow. The entity is said to have captured more than 50 percent of the order flow with the number reaching over 80 percent on a particular day.

The NFA states in its complaint that FXCM received close to $77 million in rebates from Effex between 2010 and 2014. The amount represents about 70% of the profits of Effex from the order flow.

By using Effex, the US regulator is asserting that FXCM has been using an execution practice that denied clients positive price improvement. Orders of the clients of the brokerage are said to have been executed at disadvantageous prices to the customers via two tactics said to have been described by employees as 'Hold Timer' and 'Previous Quote'.

“In cases where the price at the end of the hold timer had moved against Effex and in favor of the customer, Effex would reject the trade. On the other hand, of the price had moved in favor of Effex and against the customer, Effex would execute the trade and give the client negative price slippage,” the NFA’s complaint states.

The document states that FXCM not only deceived its own clients about the practices used via Effex, but also attempted to conceal some information from the NFA.

Anti-money laundering program

The NFA appears to have closely scrutinized the company in its investigations and states in the complaint that FXCM failed to implement an adequate anti-money laundering program.

The NFA review shows suspicious account activity at the brokerage which was overlooked by the company’s employees.

Price adjustments

According to the US self-regulatory organization that oversees retail foreign exchange dealers, FXCM did not treat all of its clients in the same way. The document provided by the NFA highlights a particular case when erroneous prices from Effex caused off-market price executions that cost about 100 clients 245 pips off-market.

After an initial adjustment was made, a group of clients that continually complained about the rate were compensated fully, while others were presented with only the initial adjustment.

The NFA states in the complaint that FXCM failed to make about 1,800 adjustments for $110,000 before the regulator pointed out the discrepancies to the company.

SNB capital shortfall

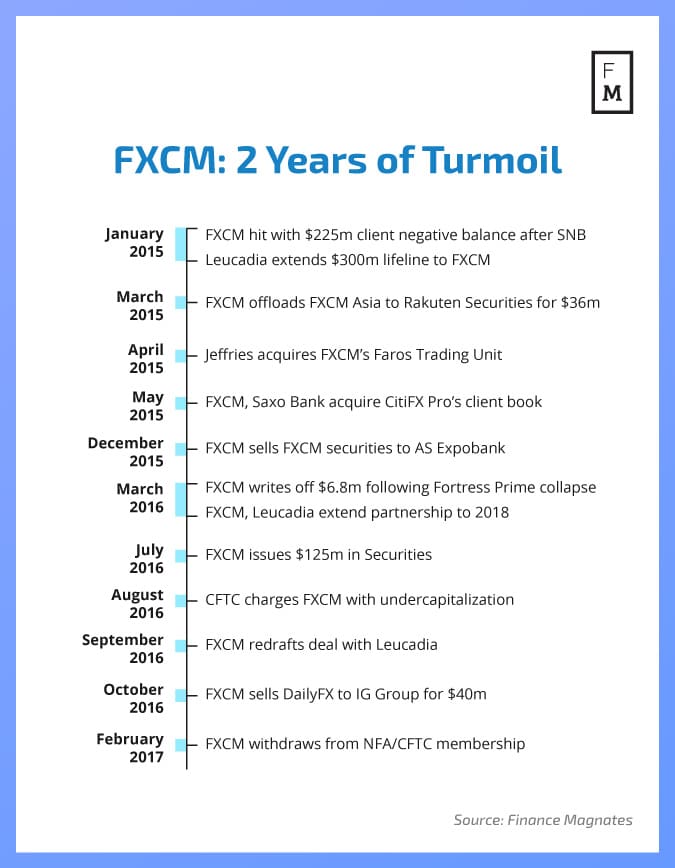

The next count in the NFA’s complaint was related to the Swiss franc debacle in January 2015. The company is said to have failed to inform the regulator about its financial state before it was specifically contacted to provide said information.

The NFA's charges have already been settled and the company has committed to selling its client accounts to GAIN Capital late on Monday.

The company commented on the charges brought forward by the NFA: “The named FXCM entities and principals neither admit nor deny the allegations associated with the settlements.”