Following the implementation of the European MiFID (Markets in Financial Instruments Directive) regulations, Forex and CFDs providers were introduced to the option of obtaining a license in any EU member state and offering their products through the passporting scheme. Shortly after, binary options was officially allowed to join following the EU Commission stating that binary options is a financial instrument under MIFID and as such, those seeking to offer these products can apply for an investment firm license.

The MIFID framework does not address each and every aspect of importance to forex and binary options providers

As is widely known to everybody in the industry, Cyprus seized the occasion and was the first to grant investment firm licenses to binary options providers. Cyprus rapidly became the beacon of the industry, attracting many providers of both binary options and forex to set up their operations and obtain their licenses from the local regulator (CySEC ), thus turning Cyprus into the uncontested hub of the forex and binary options industry within the EU.

The race to Cyprus despite CySEC’s changing attitude towards the industry is still going on, as many providers are reportedly on CYSEC’s waiting list for their investment firm license. This has taken away the industry’s attention from other potential jurisdictions which are likely to fit the needs of the industry.

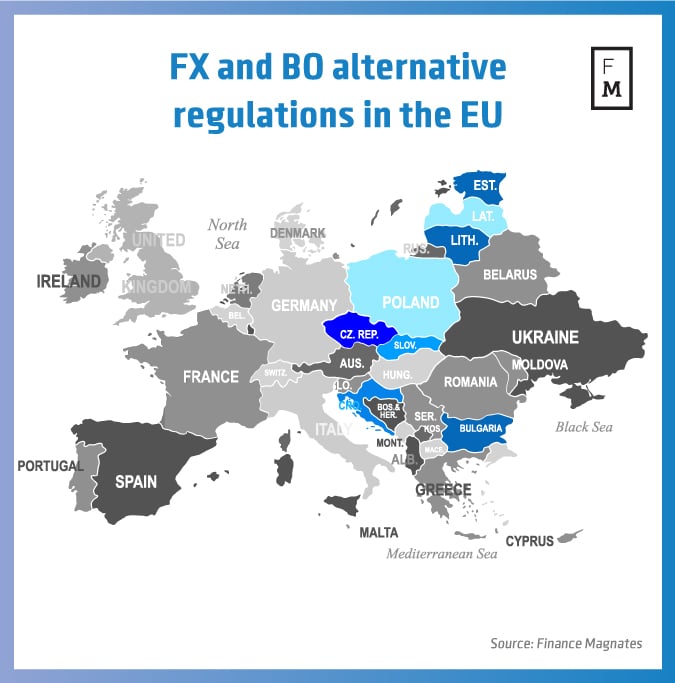

Central and Eastern Europe Lucrative Countries

As is known to all, MiFID provides a regulatory framework for the licensing and supervision of all investment firms providing investment services for all types of financial products. This framework includes standardized minimal requirements such as own funds / capital requirements, the need to establish a substantive physical presence in the country granting you your license, reporting duties to regulator and clients, and many obligations we can summarize as proper business conduct.

Nonetheless, the MIFID framework does not address each and every aspect of importance to forex and binary options providers. Some of these aspects include, for example, taxation, especially corporate income tax, setup costs and ongoing maintenance costs (offices, employees), quality and competence of the local work force, the size and aptitude of the local banking and financial system, the local regulator’s attitude towards the industry and its experience licensing and overseeing it, to name a few.

The EU, especially amongst its members in Central and Eastern Europe, includes many jurisdictions worthy of the industry’s attention. Namely, these are Estonia, Latvia, Lithuania, Bulgaria, Croatia, Slovakia, Poland and the Czech Republic.

Estonia - the Financial Supervision Commission of Estonia has issued several forex broker licenses to local providers. Estonia enjoys many advantages such as a developed financial sector, a transparent regulatory environment, highly skilled employees (despite having only 1.3 million inhabitants) including many English speakers. Additionally, Estonia benefits from a favorable tax system as the corporate income tax is 0% (20% when distributing dividends).

Latvia - the FCMC has issued several IBS licenses to forex providers. Latvia enjoys many advantages such as a developed financial sector, a transparent regulatory environment, highly skilled employees, including many English speakers.

Lithuania - the Bank of Lithuania has issued several financial broker licenses and is willing to issue such licenses to forex providers as well. Lithuania enjoys many advantages such as a developed financial sector, a transparent regulatory environment, highly skilled employees, including many English speakers. Additionally, the requirement for the domiciling of directors is relatively flexible as in some cases directors may not be required to be based in Lithuania.

Bulgaria - the Financial Supervision Commission of Bulgaria has issued several investment intermediary licenses to local binary options providers. Bulgaria enjoys many advantages such as a regulator experienced in supervising forex providers, highly skilled employees, including many English speakers. Additionally, Bulgaria benefits from a favorable tax system as the corporate income tax is only 10% and attractive setup and legal costs compared to other EU jurisdictions.

Croatia - HANFA has issued several brokerage houses licenses to local forex providers. Croatia enjoys many advantages such as a regulator experienced in supervising forex providers, highly skilled employees, including many English speakers, and its proximity to Western Europe. Additionally, Croatia benefits from attractive setup and legal costs.

David Woliner

Slovakia - the national Bank of Slovakia (NBS) has issued several securities trader licenses and is willing to issue such licenses to forex providers as well. Slovakia enjoys several advantages such as prime location in Central Europe and competitive set up and legal costs. Additionally, the requirement for the domiciling of directors is relatively flexible as in some cases directors are not required to be based in Slovakia.

Poland - the Polish FSA has issued several brokerage houses licenses to local forex providers. Poland enjoys many advantages such as a regulator experienced in supervising forex providers, highly skilled employees, including many English speakers, a highly developed banking and financial sector (Poland is ranked 4th in the EU in numbers of total financial institutions, credit institutions and payment services providers established in the country) and a prime location between Eastern and Western Europe.

The Czech Republic - the Czech National Bank has issued several investment firm licenses to local forex providers. The Czech Republic enjoys many advantages such as a regulator experienced in supervising forex providers, highly skilled employees, including many English speakers, a highly-developed banking and financial sector and a prime location on between Eastern and Western Europe.

All the above mentioned jurisdictions may be considered uncharted waters, at least to some extent. Then again, so was Cyprus a few years ago. Therefore, if you are looking to set up an forex or binary options business in the EU, the eight jurisdictions named above are noteworthy jurisdictions you should consider alongside Cyprus.

This article was written by David Woliner, Head of Financial Regulation at Ben Basat, Porat & Co Law Firm.